With Bitcoin’s rally, derivatives market indicators signal changing tides

Quick Take

Bitcoin is gaining momentum, exhibiting a surge of roughly 20% in the past month. This has subsequently led to a stir in the Bitcoin derivatives market.

Intriguingly, at the start of January, just before the Bitcoin ETF launch, the annualized funding rate was approximately 13.87%, grounded on a daily rate of 0.038%. This funding rate is representative of the average rate set by exchanges for perpetual futures contracts. When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is negative, short positions periodically pay long positions.

A sharp decline is observed in the recently annualized funding rate, which now stands at roughly 3.285%, based on a current daily rate of 0.009%. Although this demonstrates a substantial plunge from the peak of 14%, it coincided with when Bitcoin fell 20% from $49,000 to below $40,000. However, in recent days, it has indicated an upward trend that warrants attention.

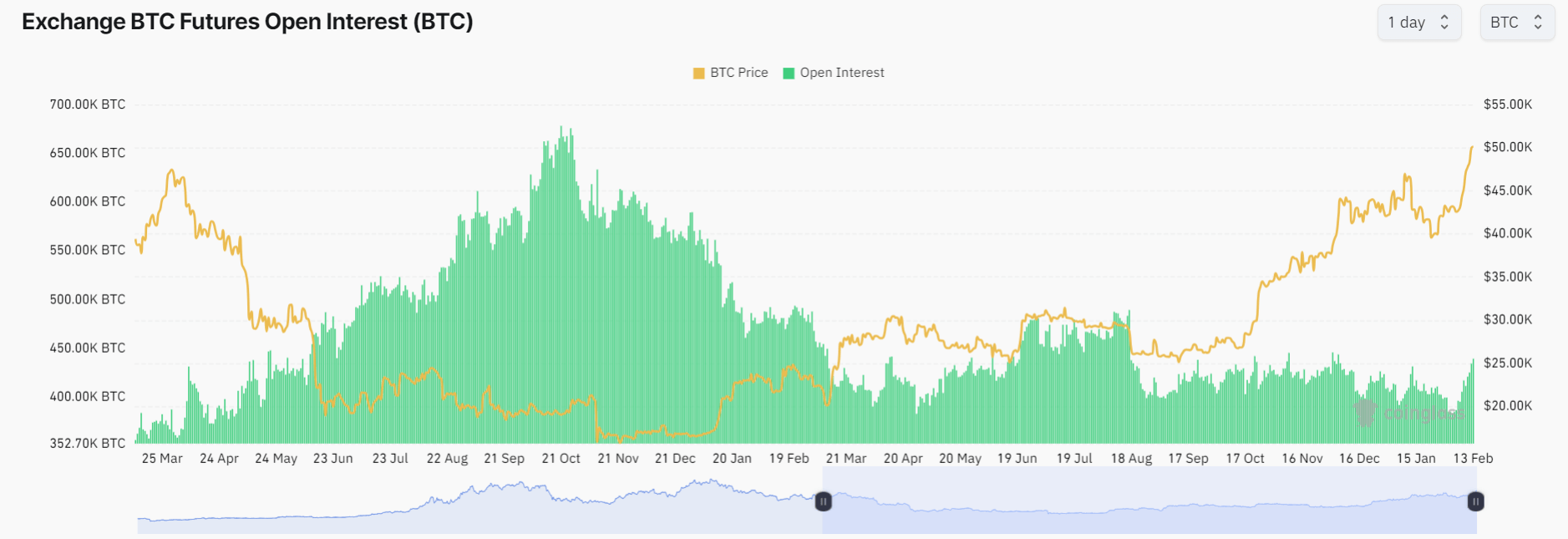

In the sphere of open interest—representing the total USD value allocated in open futures contracts—approximately 440,000 Bitcoin are now committed to OI contracts, according to Coinglass.

Data from Coinglass shows that this reflects a 13% uptick from the February low. The past day has witnessed both CME and Binance exchanges registering an approximate 7% swell in OI, with CME reclaiming its pole position in OI leadership.

While open interest hasn’t presented a significant increase over the past year, its current trajectory suggests potential changes in the market forces.

Glassnode

Glassnode