Will Ethereum NFTs Make a Comeback?

Onchain Highlights

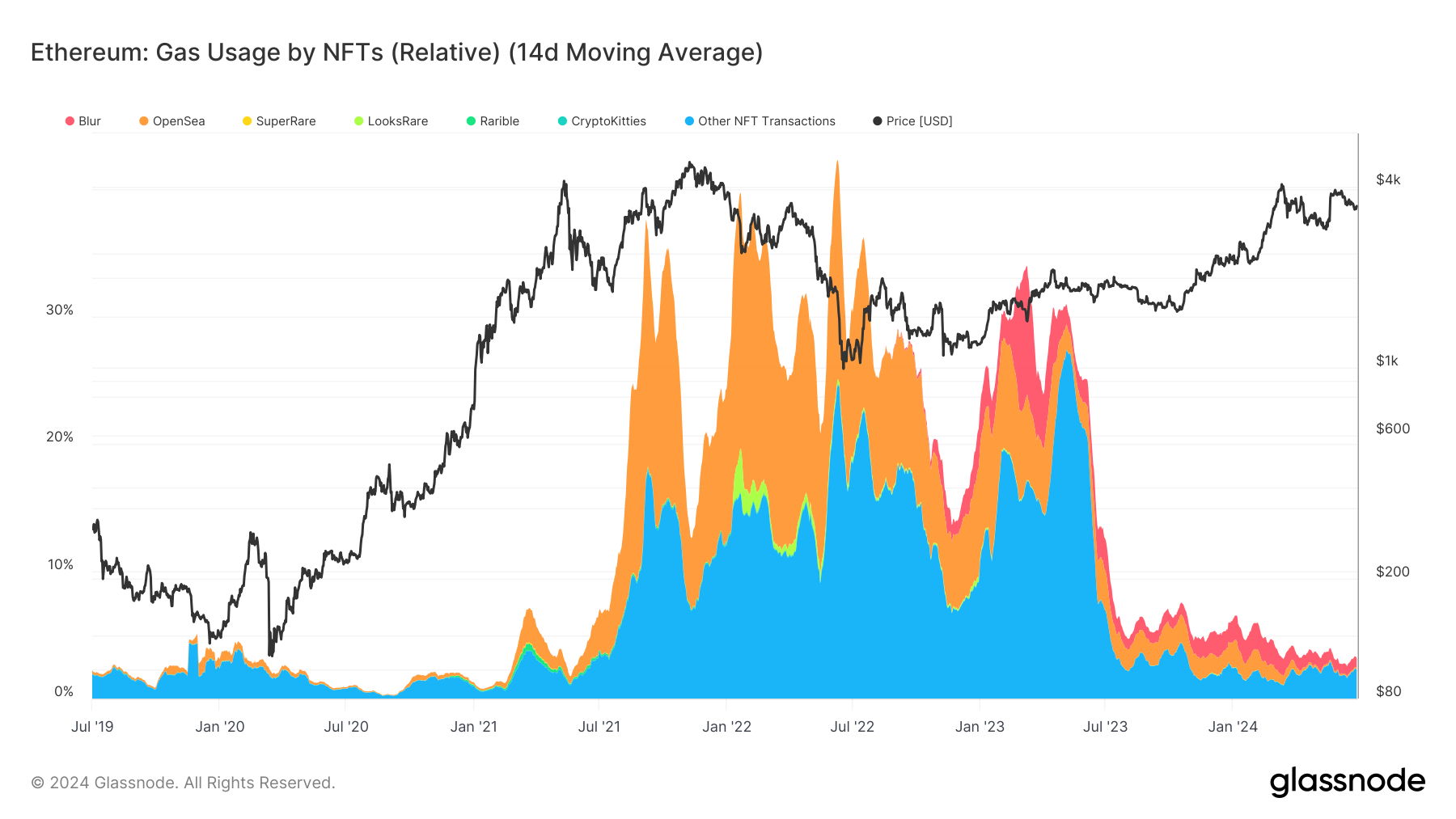

DEFINITION: The relative amount (share) of gas consumed by the Ethereum network by transactions interacting with non-fungible tokens. This category includes token contract standards (ERC721, ERC1155) and NFT marketplaces (OpenSea, Blur, LooksRare, Rarible, SuperRare) for trading those.

Ethereum’s gas usage by NFTs has exhibited significant shifts over the past few years, mainly as different platforms have gained and lost prominence. Recent data indicates that Blur and OpenSea have consistently dominated gas consumption since early 2024.

This reflects the increasing activity on these platforms as traders and collectors continue to engage in the NFT market. In contrast, platforms like Rarible and SuperRare show relatively lower gas usage, highlighting their smaller user bases or less frequent transactions.

Historically, significant spikes in gas usage by NFT transactions correlate with broader trends in Ethereum’s price movements. For instance, the surge in early 2021 coincided with a considerable bull run in the crypto market, driving more transactions and higher gas fees. As Ethereum’s price stabilized in mid-2023, NFT-related gas usage also normalized, illustrating the interconnectedness of these metrics.

The current landscape suggests that while new NFT marketplaces emerge, established platforms like Blur and OpenSea maintain relative dominance, continually influencing Ethereum’s overall gas consumption patterns. This dynamic plays a crucial role in understanding the operational costs and transaction efficiency of the Ethereum network.

While relative usage may be compatible with past cycles, overall NFT gas usage has plummeted since January 2023 as a percentage of overall network activity. At its peak, gas usage broke 40%, with a consistent level above 30%. Current levels are below 4%, partly due to the increasing popularity of layer-2s like Base and side chains like Polygon and an overall downtrend in the NFT market.

Glassnode

Glassnode