Insights

Welcome to the 2020’s – its going to be full of volatility

Definition

- The MOVE Index calculates the future volatility in U.S. Treasury yields.

- The VIX measures the expected volatility of the US stock market.

- The 30-day Bitcoin Volatility Index is referred to as the BVOL Index.

Quick Take

- The MOVE index has moved to its highest since 2009.

- While the VIX hit 30 during yesterday’s trading session, which was a YTD high.

- BVOL index also surged to highs last seen since May 2022 during the Luna collapse.

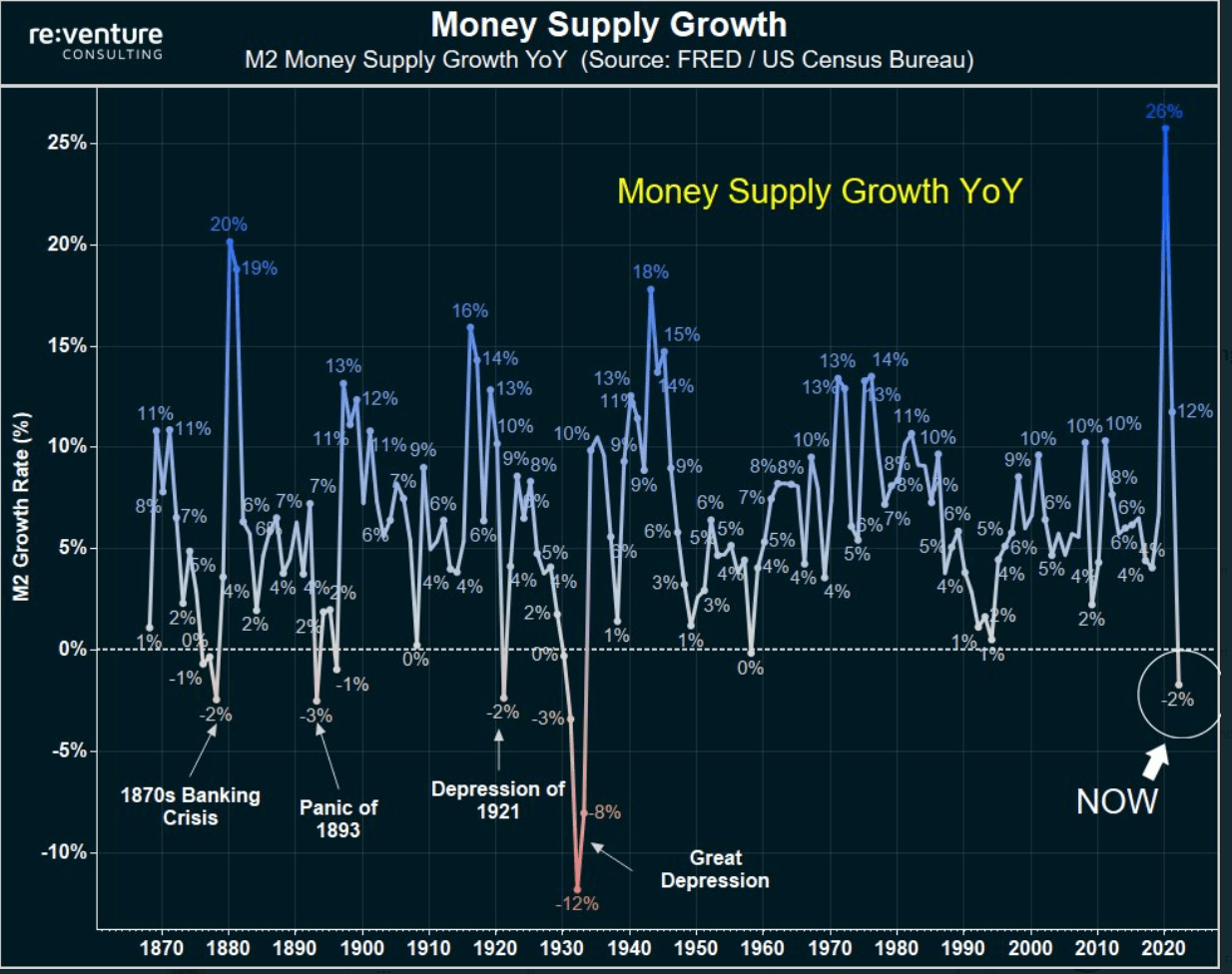

- The federal reserve has raised rates at the fastest pace ever while the money supply contracts and is negative YOY.

- These moves in the money supply will only increase volatility in both traditional and crypto markets.