Watch for movements: Bitcoin’s static supply gears up for significant changes

Quick Take

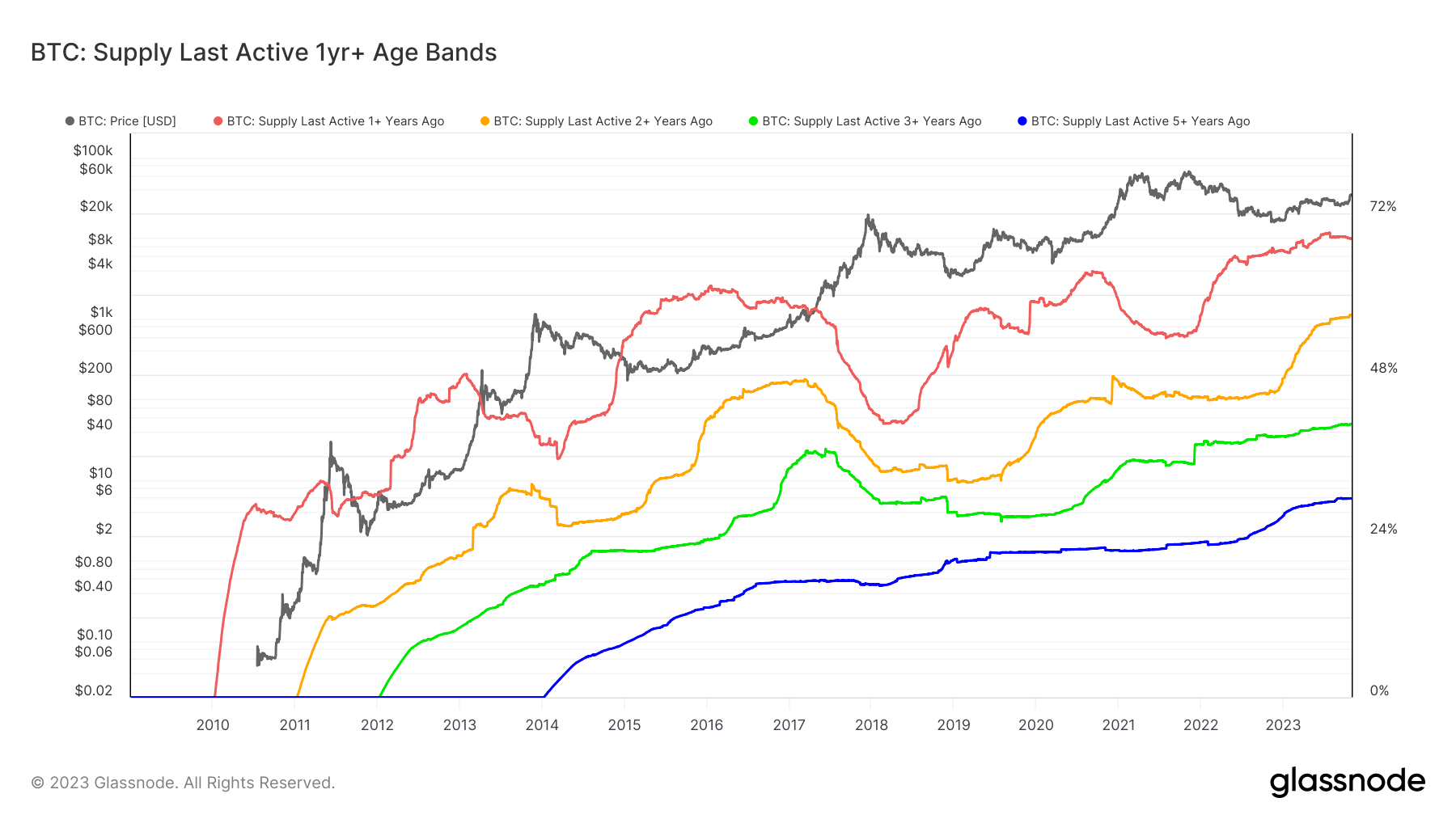

The next several weeks are poised for significant movement in the categories of Bitcoin’s Supply Last Active (SLA), which indicates the percentage of circulating Bitcoin supply that has remained static for at least 1, 2, 3, or 5 years.

SLA for 1+ years currently stands around 68.3%, a slight drop from its July high of 69%. This shift coincides with the impending anniversary of the FTX collapse that precipitated Bitcoin’s drop from nearly $20,000 to around $15,500. The expected increase in the SLA of 1+ years may potentially reveal those who capitalized on this dip.

| Supply Last Active | % |

|---|---|

| Supply Last Active 1 + Years Ago | 68.31% |

| Supply Last Active 2 + Years Ago | 57.01% |

| Supply Last Active 3 + Years Ago | 40.72% |

| Supply Last Active 5 + Years Ago | 29.61% |

In a historical context, the peak of the last cycle in November 2021, where Bitcoin hit approximately $69,000, is beginning to influence the upward trend in SLA 2+ years ago, reflected in its all-time high of 57%.

Moreover, as Bitcoin began its bull run in September 2020, the SLA 3+ years ago also achieved an all-time high, sitting at 41%. As we move forward, this cohort is anticipated to increase further.

Lastly, the 5+ year SLA cohort, currently at 29.6%, is expected to trend higher. This prediction is based on the Bitcoin price in December 2018, when it dropped from around $6,300 to bottom out at $3,200. It will be intriguing to observe how this cohort, who may have bought during this bottom, responds to a potential price drop.

Glassnode

Glassnode