Insights

Wall Street is now pricing in a terminal rate of 5.25-5.50, after hot PCE data, BTC down over 3%

Quick Take

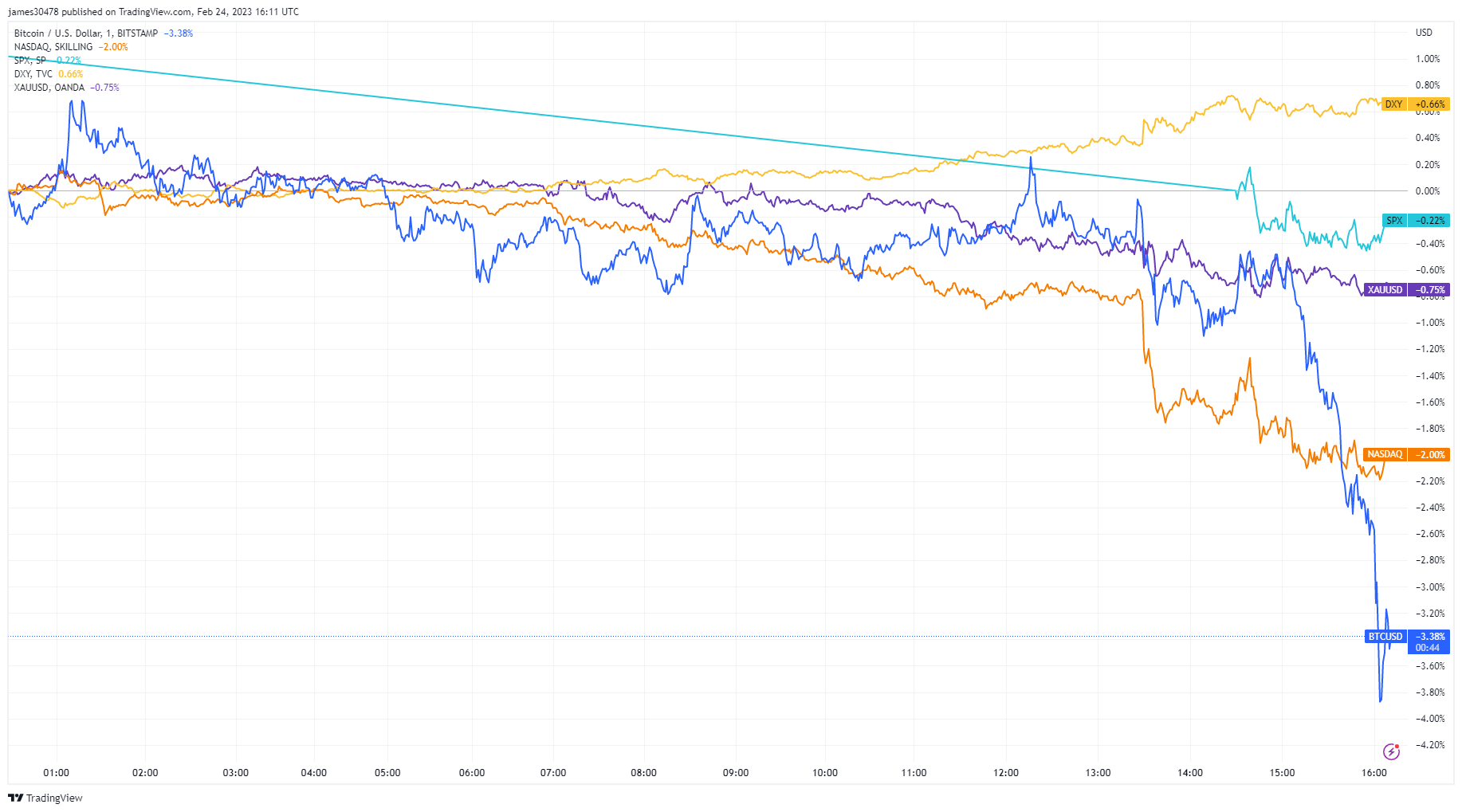

- Bitcoin is down -3.31% on Feb. 24 due to a hotter than expected PCE data.

- Traditional assets are also down on the day, which includes SPX (-0.22%), XAUUSD (-0.75%), and Nasdaq (-2.00%).

- Wall Street is now pricing another 25 bps hike, in addition to the 50 bps remaining, due to today’s PCE.

- This would take the federal funds rate to 5.25 – 5.50% for the end of 2023, a total of 75 bps remaining.