Insights

Vix hits highest level since Jan 6; DXY breaks 104

Definition

- The VIX Index is a calculation designed to measure the U.S. stock market’s constant, 30-day expected volatility, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.

Quick Take

- The VIX touched 23, the highest since the beginning of January

- The DXY is breaching 104, as Bitcoin retreats to $24,400.

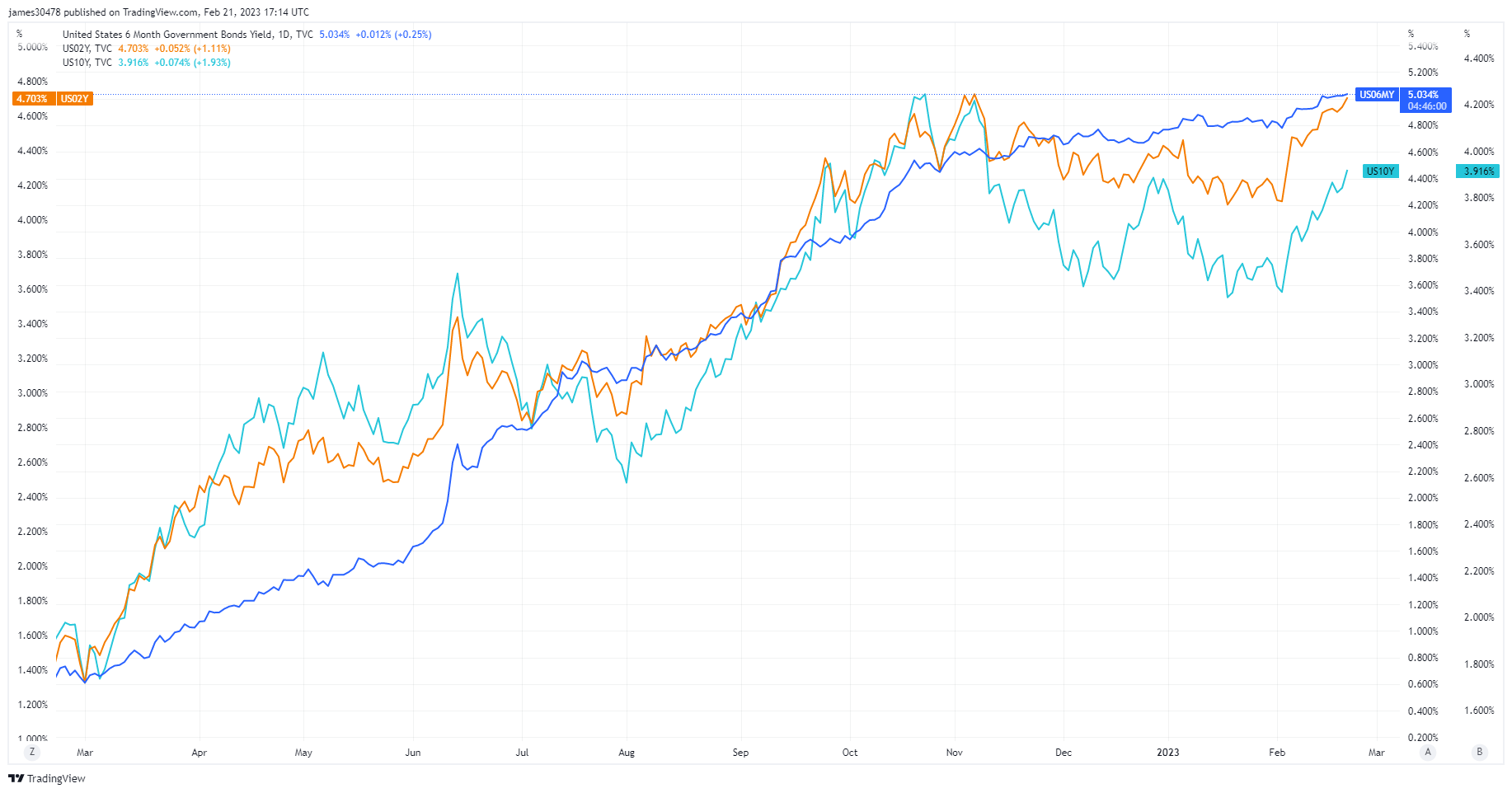

- U.S. treasury yields are soaring to YTD highs.

– US 06M: 5.034%

– US 02Y: 4.703%

– US 10Y: 3.914%