Unfazed Bitcoin breaks $30,000 mark, causing market liquidations

Quick Take

As Bitcoin confidently surged past the $29,000 mark earlier today, the crypto market witnessed a flurry of liquidations close to $100 million in the past 24 hours. The majority of this sum, around $72 million, was induced by short positions, of which Bitcoin constituted approximately $40 million. This movement signals the market’s reaction to Bitcoin’s price hike, leading to a quick closure of positions that bet against the digital currency’s rise.

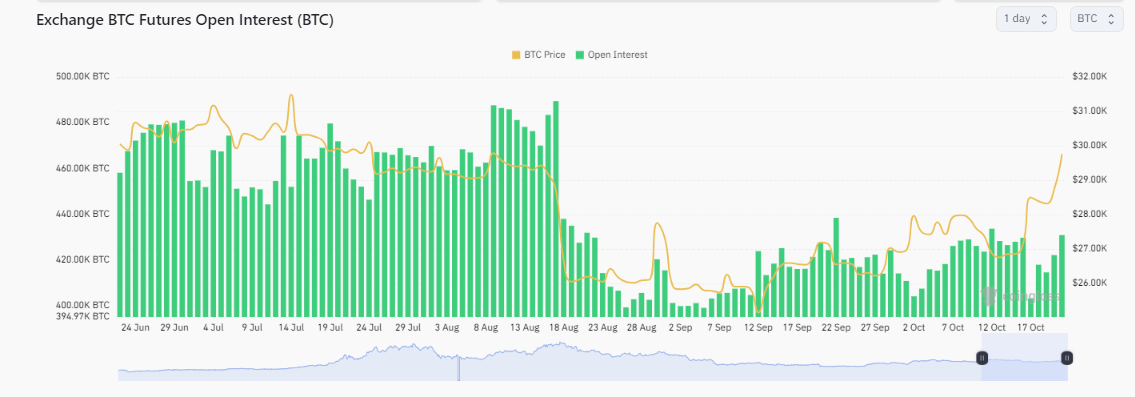

Simultaneously, an uptick in open interest is observable. Data from Coinglass reveals an estimated 430,000 Bitcoin currently tied up in futures open interest contracts. This is one of the highest levels since August, showcasing a growing interest from traders in the futures market.

Since the closure of the U.S. stock market, the price of Bitcoin has witnessed an increase of over 3.5%. In contrast, the S&P 500 futures market is currently experiencing a dip, showing a decline of 0.27%.