Two Bitcoin funds hit top 10 ETF inflows across all categories in January

Quick Take

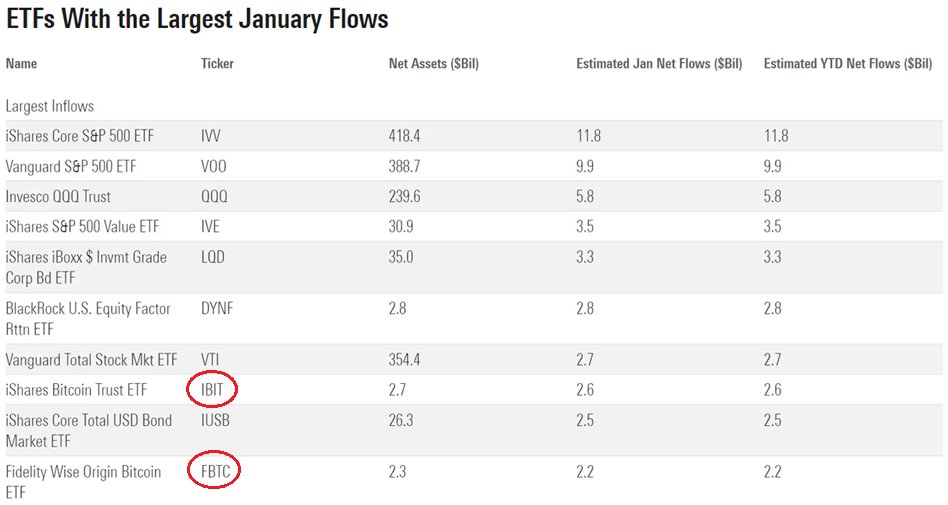

January ETF flows demonstrated a new trend in the investment landscape. Although the iShares Core S&P 500 ETF ($11.8 billion) and the Vanguard S&P 500 ETF ($9.9 billion) led the month, two Bitcoin-focused ETFs carved out a notable place on the leaderboard, according to Geraci.

Despite having a fraction of the net assets, the iShares Bitcoin Trust ETF (IBIT) and the Fidelity Wise Origin Bitcoin ETF (FBTC) had an impressive $2.6 billion and $2.2 billion in net assets, respectively, according to Geraci. In comparison, Vanguard’s Total Stock Mkt ETF (VTI) recorded only marginally higher inflows at $2.7 billion.

This demonstrates a burgeoning investor interest in incorporating Bitcoin into their portfolios, even amid a decline in Bitcoin’s price from $49,000 to approximately $39,000 within the month.

Considering the fact that there were around 3,109 ETFs active in the United States as of December 2023, according to Y Charts, the notable performance of these two Bitcoin ETFs is a significant indication of the evolving investment trends.

While the market dominance of traditional equity ETFs remains unchallenged, the impressive debut of Bitcoin ETFs suggests a steady acceptance of digital assets in the mainstream finance sector, marking a new phase in the digital asset investment era. At the same time, the digital assets industry is waiting on potential approval from the SEC on an Ethereum ETF.