Insights

This isn’t the inflation wave to be worried about – it’s the next one

Quick Take

- U.S. CPI inflation matched forecasts by most measures, but we are nowhere near done yet.

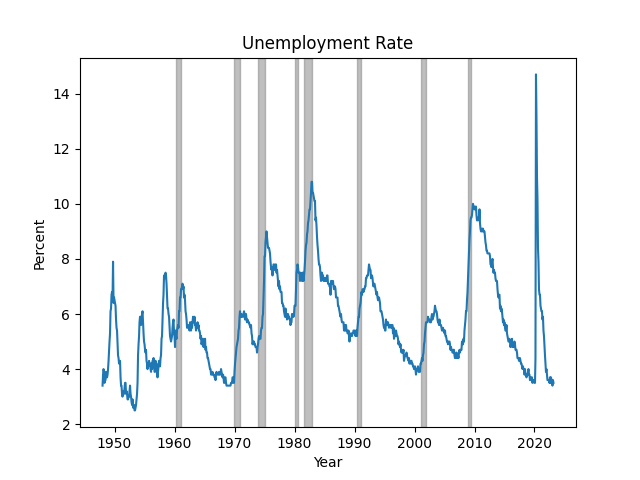

- Contrarian views have done well this cycle, a recession hasn’t occurred, and we are most likely facing the possibility of stagflation.

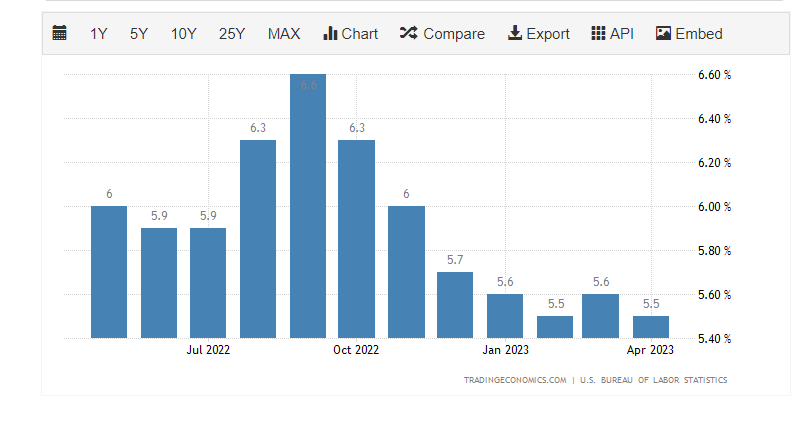

- The Fed has gone on the most aggressive tightening cycle in the past forty years, and core inflation is still around 5.5% — which has not budged for an entire year, slightly down from 6%.

- Core goods price inflation increased from 1.6% to 2.1%, while the monthly increase in core services CPI less shelter was up 0.3%.

- Unemployment is still at historic lows at 3.4% — which is not what the Fed wants to see. This will complicate their job in getting inflation to the 2% target.

- A similar pattern this decade may likely be the 70s, where we had high inflation and elevated interest rates.