The pivotal role of stablecoins in Bitcoin’s recent surge

Quick Take

Over the past three months, there has been a significant rise in the aggregate market cap of the top five stablecoins: USDT, USDC, BUSD, DAI, and TUSD.

This value has jumped by a remarkable 10 billion from its previous low of 119 billion in October 2023, in addition to a 3.2% increase in the past 30 days.

The lion’s share of this growth is attributed to USDT tether, boasting a whopping 96 billion in supply of the 129 billion total, while the USDC supply has also witnessed notable growth, now valued at 26.1 billion, up from a low of 24 billion.

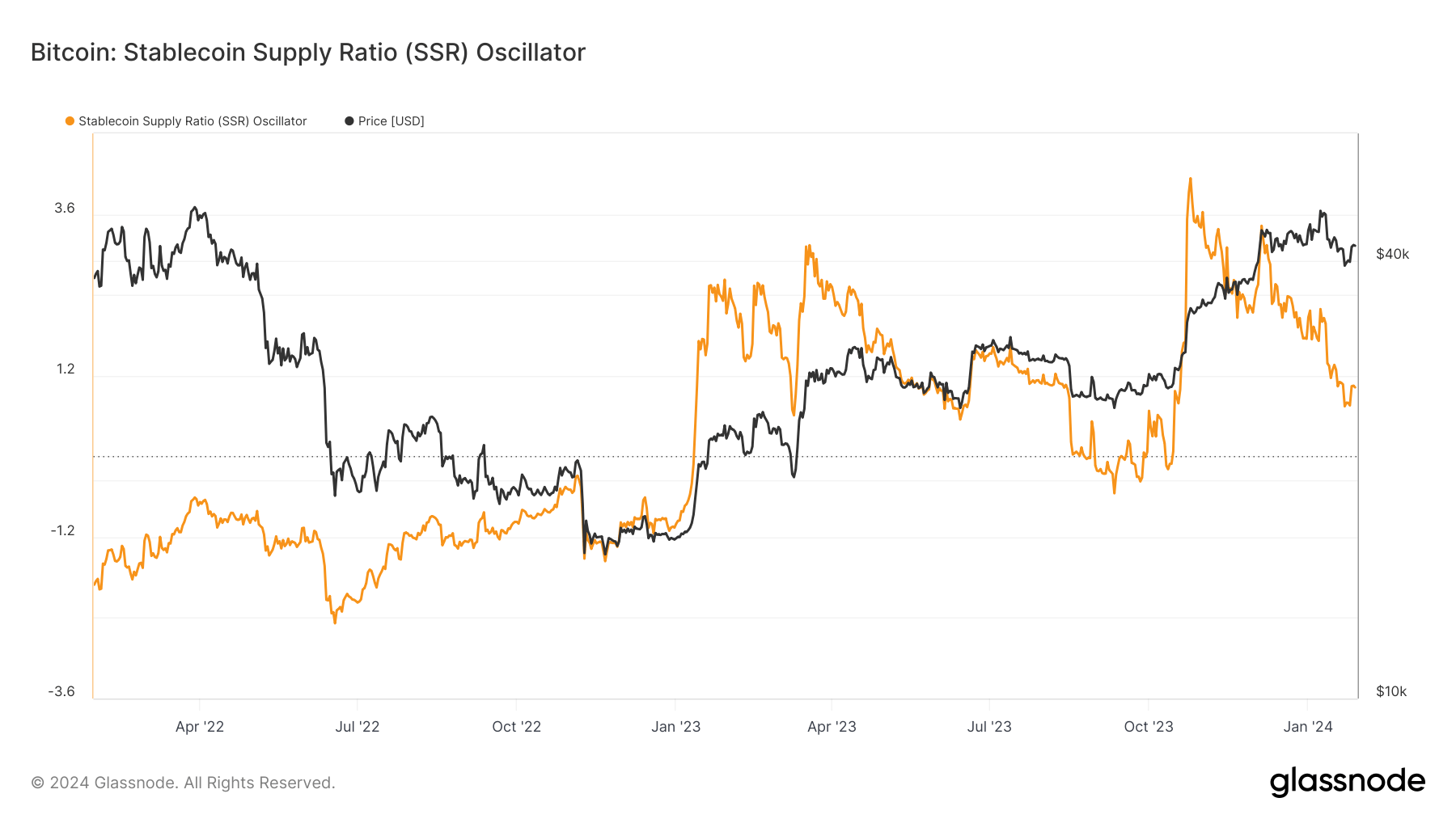

This influx in stablecoin supply appears to resonate with the recent surge of Bitcoin to $42,000. This correlation can be dissected using the Stablecoin Supply Ratio (SSR), a measure of the Bitcoin supply against the supply of stablecoins denoted in Bitcoin. A low SSR signifies that the current stablecoin supply has increased “buying power” to purchase Bitcoin.

The SSR has demonstrated a subtle elevation, moving up from 0.74 to 1.04 – a slight uptick indicative of the increased “buying power” of stablecoins. This pattern is particularly evident in the context of Bitcoin’s significant market movement in October 2023. During this period, Bitcoin soared from $25,000 to $45,000, paralleled by a dramatic shift in the SSR ratio, which rocketed from -0.11 to 4.13.

Glassnode

Glassnode