Surge in Bitcoin fees short-lived as Runes transactions dip

Quick Take

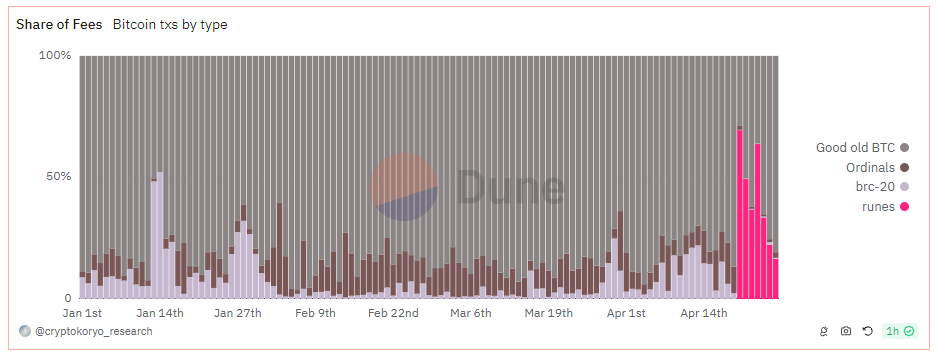

The Bitcoin halving on April 20 catalyzed a surge in miner fees, largely due to the highly anticipated introduction of Runes. Initially, Runes dominated transaction volumes, reaching over 750,000 transactions, approximately 73% of the total transactions on April 23. However, according to Dune Analytics data, subsequent days witnessed a gradual decline in transaction volumes.

By April 25, Bitcoin on-chain transactions, approximately 265,000 transactions, contributed 75% of transaction fees, while Runes only accounted for around 22%.

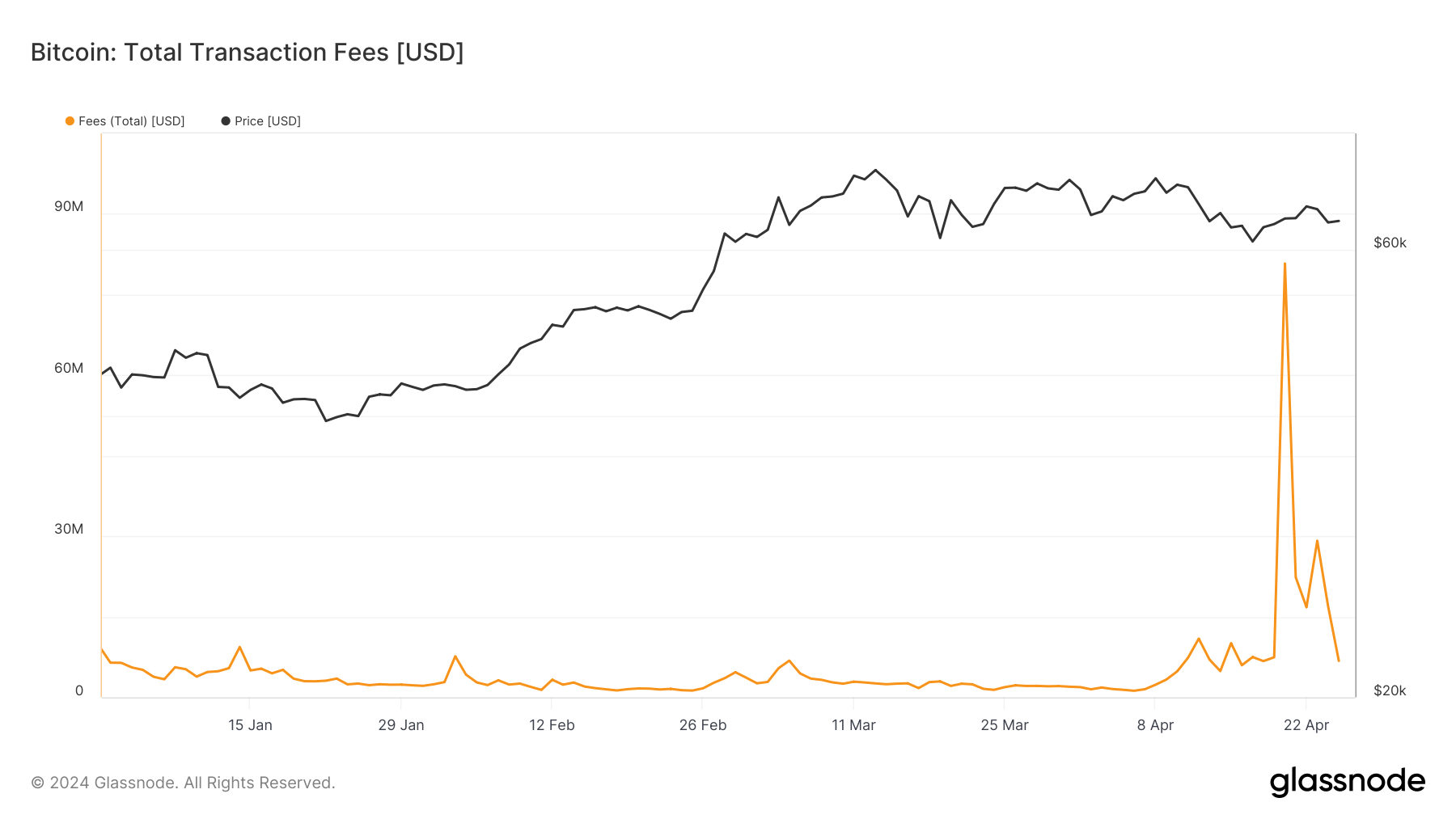

Glassnode data shows that fees have regressed to pre-halving levels, signaling a potential shift in Runes’ significance in fee distribution, with April 25 seeing Bitcoin network fees at roughly $6.7 million, mirroring pre-halving levels and indicating waning interest.

Previous CryptoSlate analysis found a notable drop in transactions involving inscriptions since its 2023 launch, suggesting a similar trend for Runes.

Another factor contributing to the decline in fees after the halving is the ongoing Bitcoin difficulty epoch, with the current difficulty adjustment showing a positive rate of around 1%. Despite diminishing fees, the question remains whether the hash rate will continue to rise.

Glassnode

Glassnode