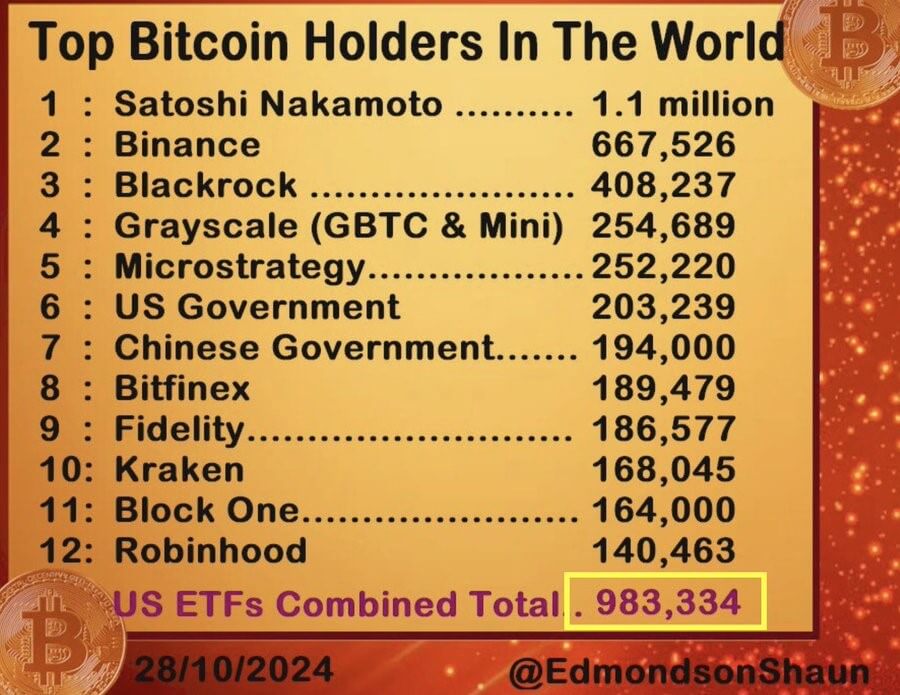

Spot Bitcoin ETFs on track to overtak Satoshi Nakamoto’s BTC holdings by year-end

Bloomberg ETF analyst Eric Balchunas predicted that by December, US spot Bitcoin exchange-traded funds (ETFs) BTC holdings could eclipse those of Satoshi Nakamoto.

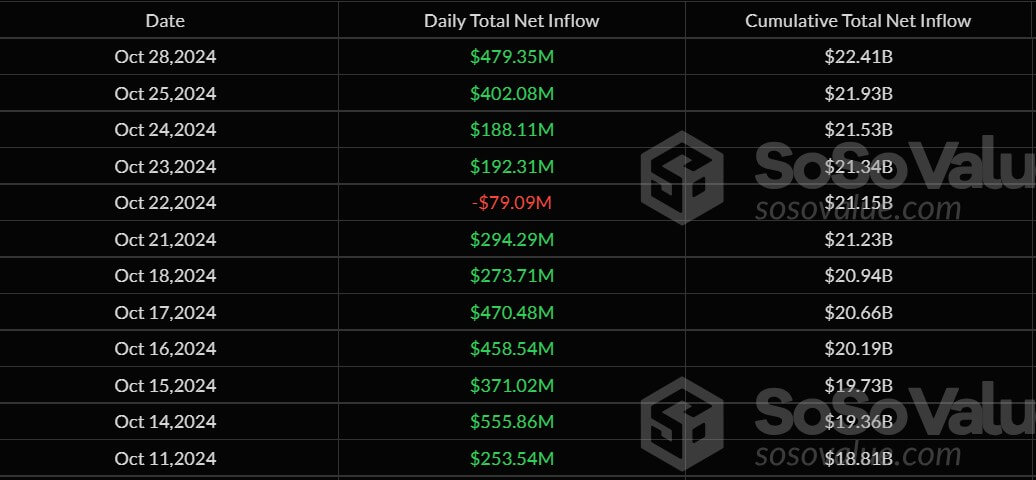

Balchunas suggested that at their current accumulation pace — roughly 17,000 BTC weekly — the ETFs may surpass 1 million BTC next week. This puts them on track to outpace Nakamoto’s holdings, estimated to be around 1.1 million BTC, as early as December.

The recent inflow into spot BTC ETFs adds weight to this forecast. Over the past 12 trading days, these ETFs have attracted close to $4 billion, with BlackRock’s iShares Bitcoin Trust ETF (IBIT) alone pulling in around $2.6 billion.

Despite the impressive moves, Balchunas noted that the unpredictability in the crypto market could impact the timeline. He added that despite the possibility of unexpected events, like a selloff, resulting in delays, the funds’ growth remains on an upward trajectory.

He stated:

“Anything can happen, e.g., a violent selloff, and all this is delayed albeit still inevitable. On the flip, if prices keep going up, Trump wins, we could see FOMO could kick in, and it all happens faster.”