Insights

S&P 500 index, Bitcoin show further signs of decoupling as tech stocks prop up index

Quick Take

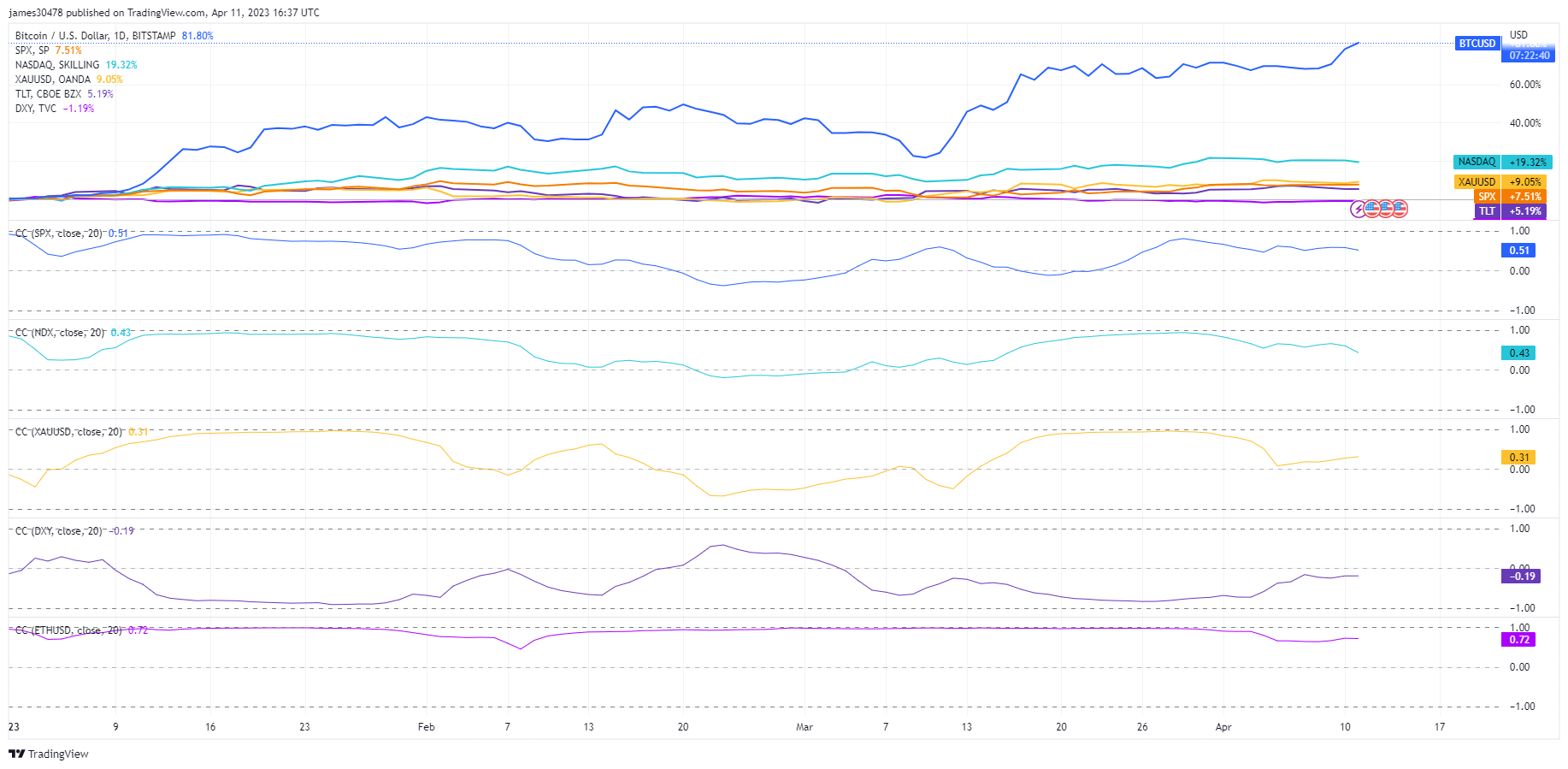

S&P 500 faces headwinds

- The S&P is roughly up 7% in 2023, but most of the gains have come from seven tech stocks, which coincidentally have the largest market cap in the index.

- While these stocks have incredibly elevated PE ratios, high rates and a lack of stimulus will provide headwinds for these stocks and S&P 500 as an index. As Q1 earnings season approaches.

- While the S&P 500 is starting to de-correlate further from Bitcoin, roughly at a 50% correlation. At the same time, the Nasdaq is down to a 42% correlation with Bitcoin.

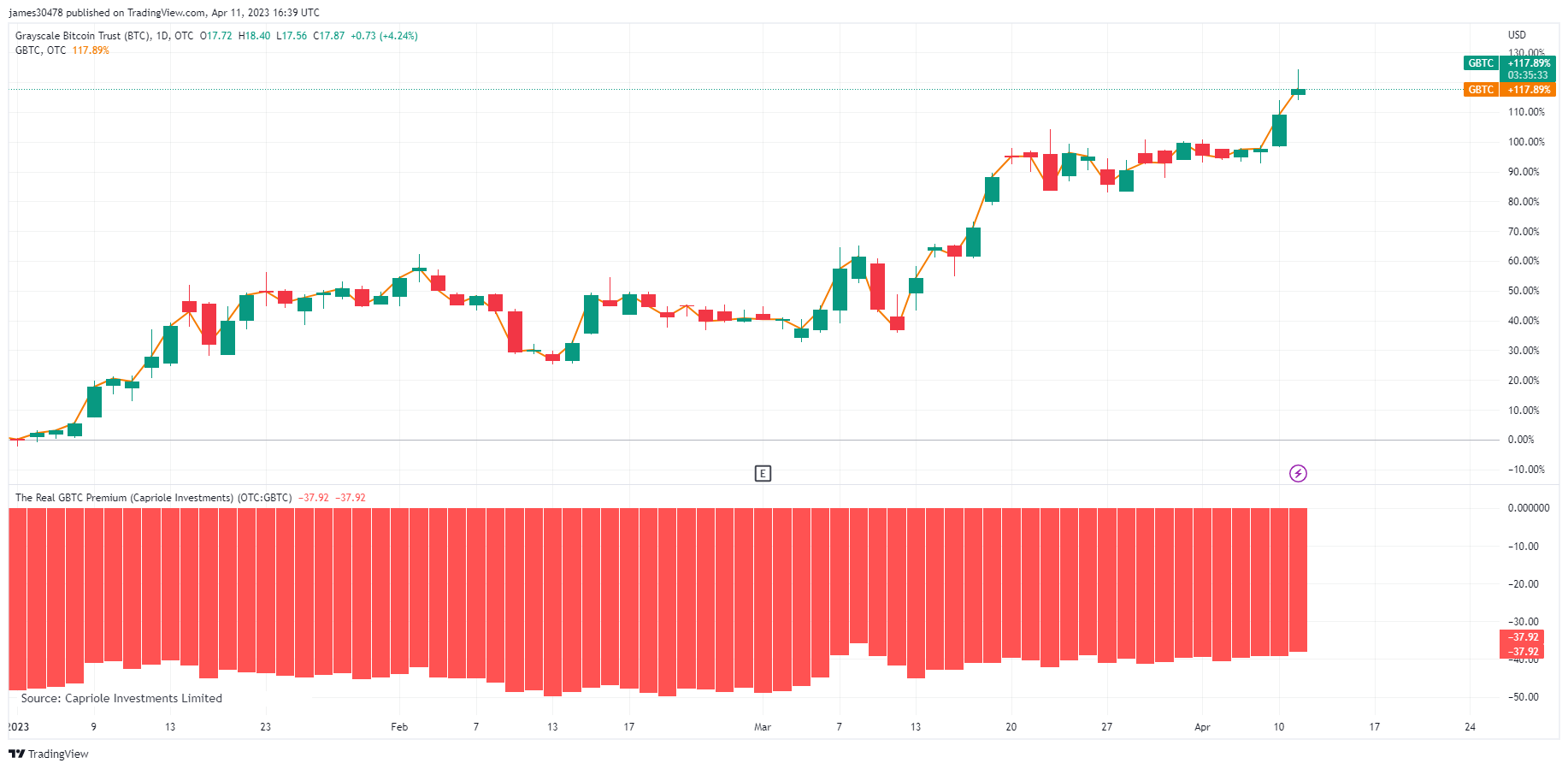

GBTC

- The GBTC discount continues to narrow, as the discount to NAV is below 38%, while it was as high as 50% in Q4 of 2022.

- GBTC is up 117% year to date, outperforming Bitcoin, which has just surpassed $30,000.

- CryptoSlate did an extensive market report on the GBTC trade that had further implications for the crypto industry.