Insights

Signature Bank plummets in share price pre-market, after news of Silvergate halting operations

Quick Take

- As of March 9, Silvergate will halt operations and undergo liquidation.

- Silvergate saw a 70% drop in deposits in Q4, followed by a 90% drop two days later, which coincided with the worst bond performance in over 200 years.

- This equated to roughly $13 billion in demand deposits being withdrawn in minutes with only $1.4B cash.

- Silvergate Capital shares are down 44.6% pre-market.

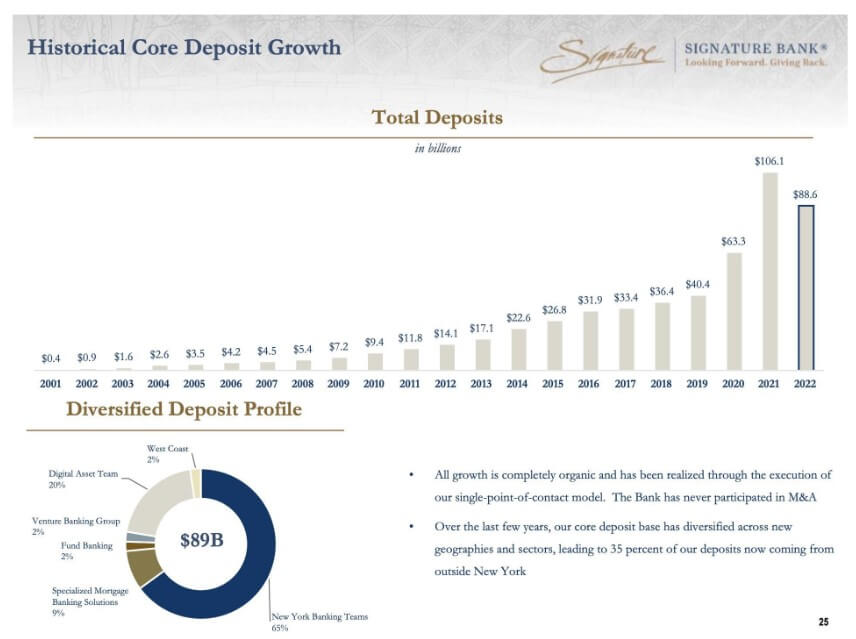

- The Signature Bank is currently 7% down pre-market and 9% down year-to-date.

- While Signature Bank deposits are less liquid than Silvergate were, they also saw deposits decrease YOY for the first time.