Resilient Bitcoin defies interest rate pressures and technical resistance

Quick Take

In a striking reversal from the start of the week, CryptoSlate reports a resurgence of Bitcoin, which was grappling beneath key technical levels but has since ascended above them.

This recovery is significant, given the substantial resistance observed near $28,000, a level influenced by the 200-week, 200-day, and 111-day moving averages and the short-term holder’s realized price.

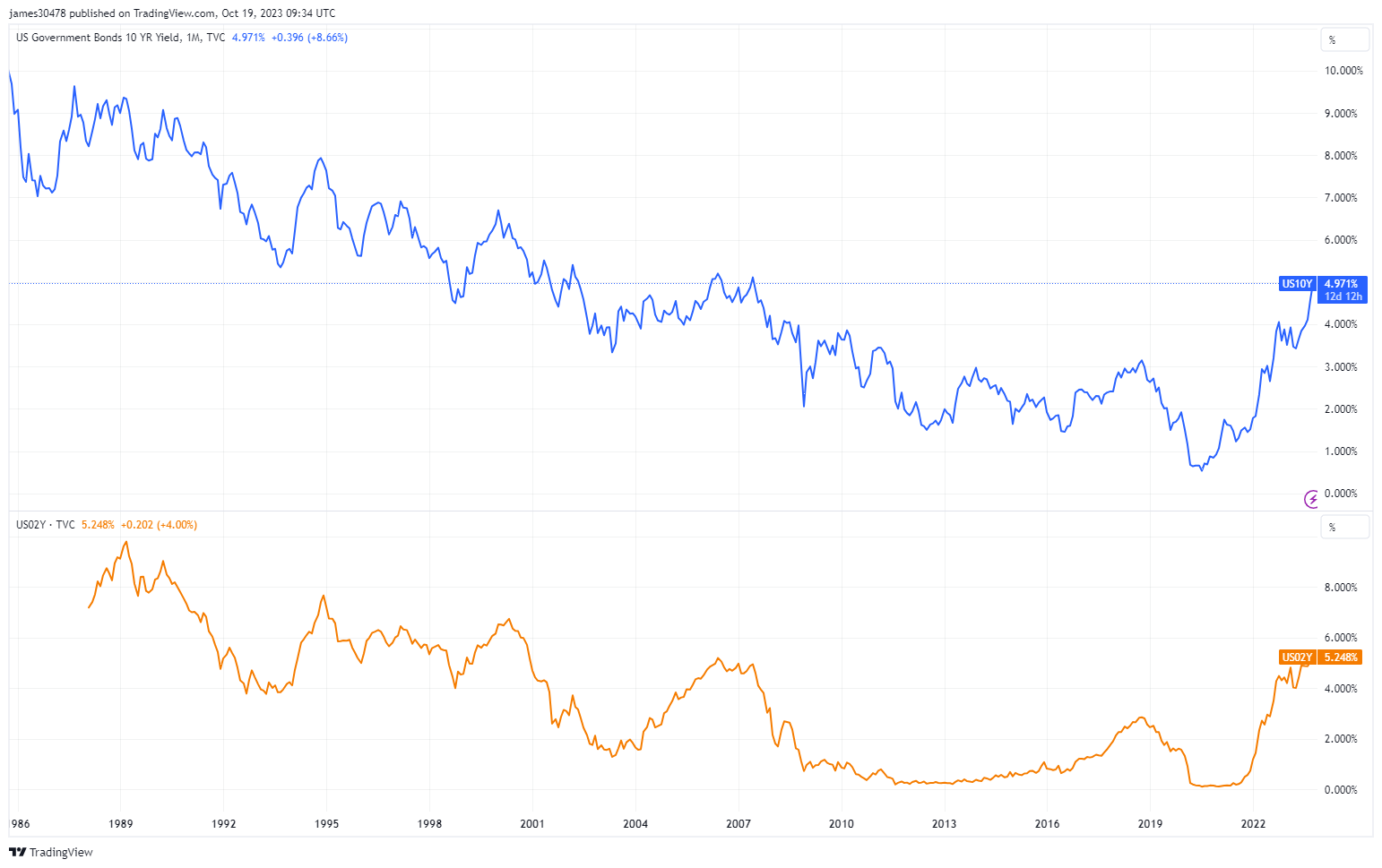

The rebound is even more noteworthy considering the imminent 5% benchmark of the US10Y, a critical yield that sets the global interest rate benchmark. This key indicator is gearing up to hit levels unseen since before the 2007 financial crisis, entailing a tightening economic environment and adding pressure on risk assets like Bitcoin.

Amplifying these developments is the US02Y yield, which has cleared the 2006 peak at 5.253% and recorded its highest level since 2000.

Glassnode

Glassnode