Record low speculation reveals Bitcoin market maturing in silence

Quick Take

CryptoSlate’s previous analysis revealed a significant divergence between long-term holders (those who have held Bitcoin for more than 155 days) and short-term holders (those who have held Bitcoin for less than 155 days).

Taking this analysis one step further, a striking revelation around speculative Bitcoin purchases emerges using the HODL waves metric, which classifies Bitcoin’s active supply into different age bands.

The 24-hour investors, likely to trade or speculate within a 24-hour timeframe, represent only 0.78% of the Bitcoin supply. This percentage is lower than any previously recorded during bear markets, indicating a record-low level of speculation around Bitcoin and suggesting an unprecedented quiet in the market chatter surrounding the leading cryptocurrency.

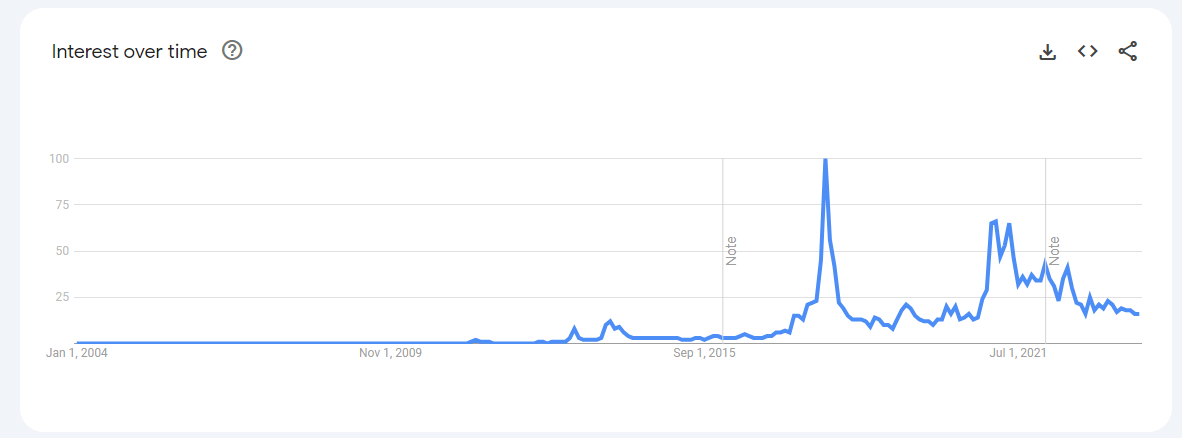

In addition, data from Google search trends paints a similar picture. The interest level in Bitcoin is currently ranked at 16, one of the lowest levels in this cycle. Interestingly, the last time Bitcoin ranked 16 was at the end of 2020, shortly before the massive bull run that took place into 2021.

Glassnode

Glassnode