Insights

Rate cuts are now the expectation as fed balance sheet grows

Quick Take

- The outlook from markets has completely changed in the past few weeks due to banking failures in the US and EU.

- The market is now pricing in no more rate hikes but substantial cuts, ending 2023 around 3.75-4%.

- Four cuts are priced into the rest of the year, while the market suggests a greater than 90% chance the Fed is done raising rates.

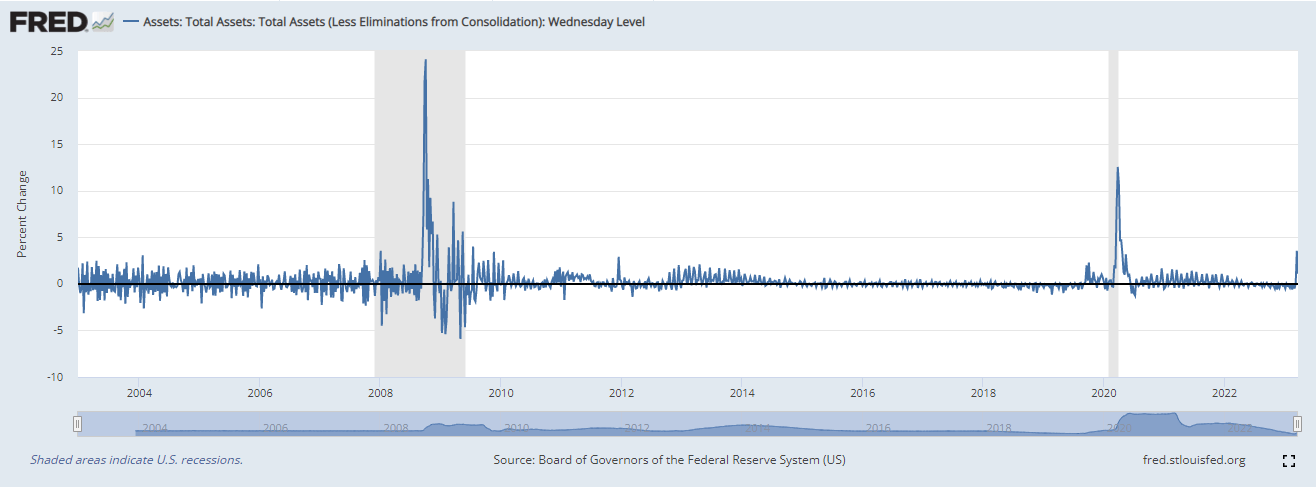

- The fed balance sheet has grown for the past two consecutive weeks; roughly $100 billion was added to the balance sheet this week.

- While two-thirds of quantitative tightening have been undone in a matter of weeks.

- This is the third biggest percent change to the fed balance sheet, only being beaten by covid and 2008.