Power-law model suggests Bitcoin’s maturity post-2024 halving

Onchain Highlights

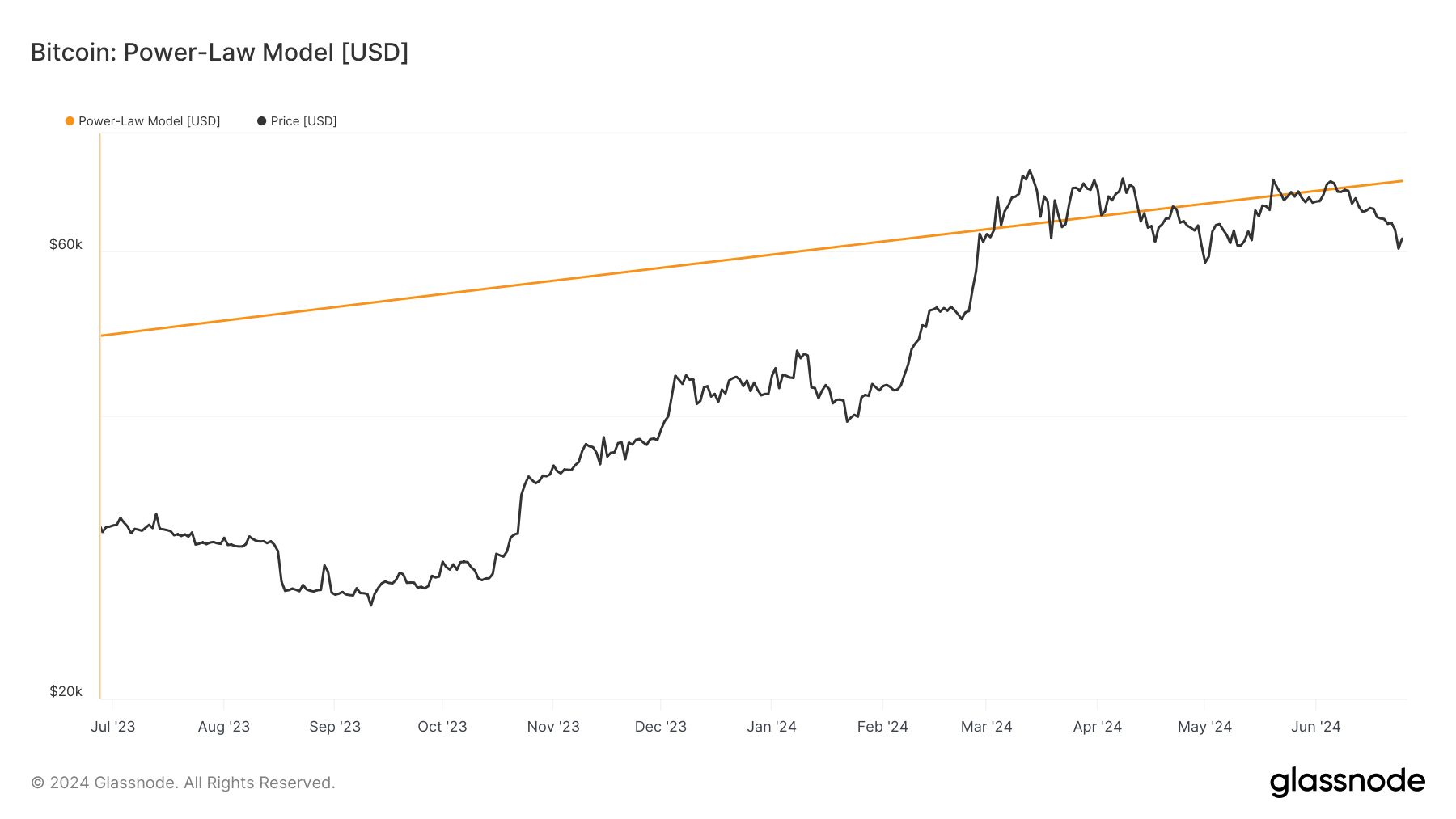

DEFINITION: The Bitcoin Power-Law Model provides a mathematical description of Bitcoin’s historical price trends, revealing a power-law distribution on a log-log scale. This analysis suggests a correlation between time and price. However, the model’s foundation on historical data and the issue of non-independent sequential price points raise questions about its broader applicability.

Bitcoin’s price movement over the past decade has followed a power-law distribution, as depicted by the. The chart reveals a consistent upward trend, correlating Bitcoin’s historical price trends with time. This model indicates Bitcoin’s potential long-term growth trajectory by illustrating its periodic price surges and corrections.

Since 2011, Bitcoin’s price has experienced exponential growth, punctuated by significant volatility, which was particularly noticeable in the 2013 and 2017 bull runs. A retracement follows each peak, yet the overall trend aligns with the power-law model’s projections.

As the model extends into 2024, it suggests a stabilizing pattern, reflecting the market’s maturity post the April 2024 halving. The current price aligns closely with the model’s expected value, indicating market behavior in line with historical trends. However, the model’s reliance on historical data and sequential price points necessitates cautious interpretation regarding future predictions.

Glassnode

Glassnode