Insights

Policymakers struggle to rein in sticky core inflation

Quick Take

- Core inflation is the change in the cost of goods and services that do not include sectors such as energy and food.

- They are dismissed due to volatile prices or can fluctuate wildly.

- Core inflation in the U.S. has only declined 1% point from the peak in March 2021 — while they have a significantly tight labor market.

- U.S. core inflation is at 5.54% compared to 6.41% last year.

- In Europe, core inflation doesn’t slow; it continues to rise as wages grow and services remain elevated.

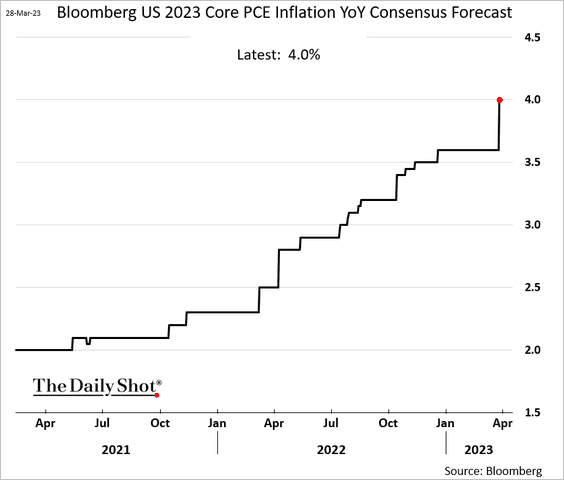

- Economists have raised their projections for U.S. core inflation.

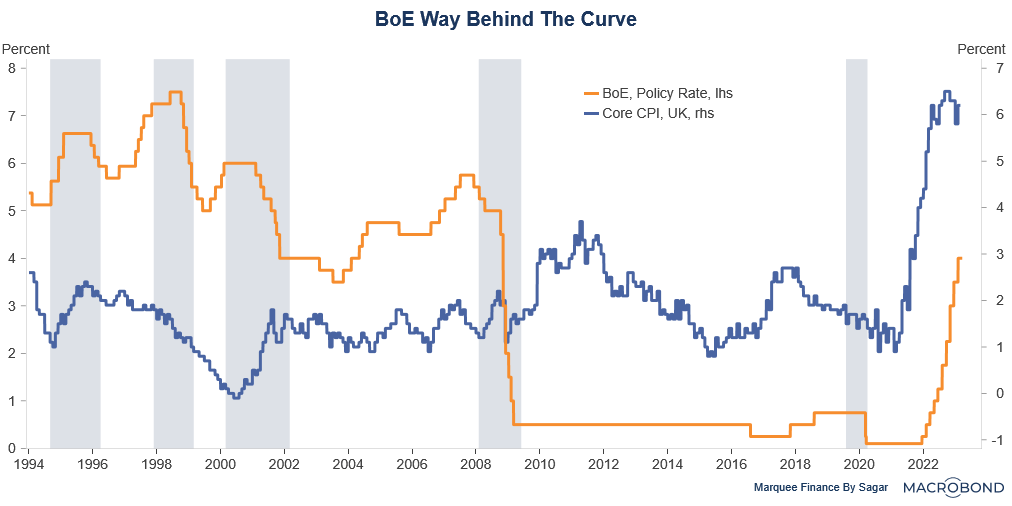

- The same is true for the U.K., as core inflation accelerated to more than 6% from 5.7%.

- The best way to fight core inflation is with positive real rates — which hasn’t happened for almost a decade.

- Will they bring the economy down to combat inflation?