Over $850 million in realized losses, with short-term holders bearing the brunt

Quick Take

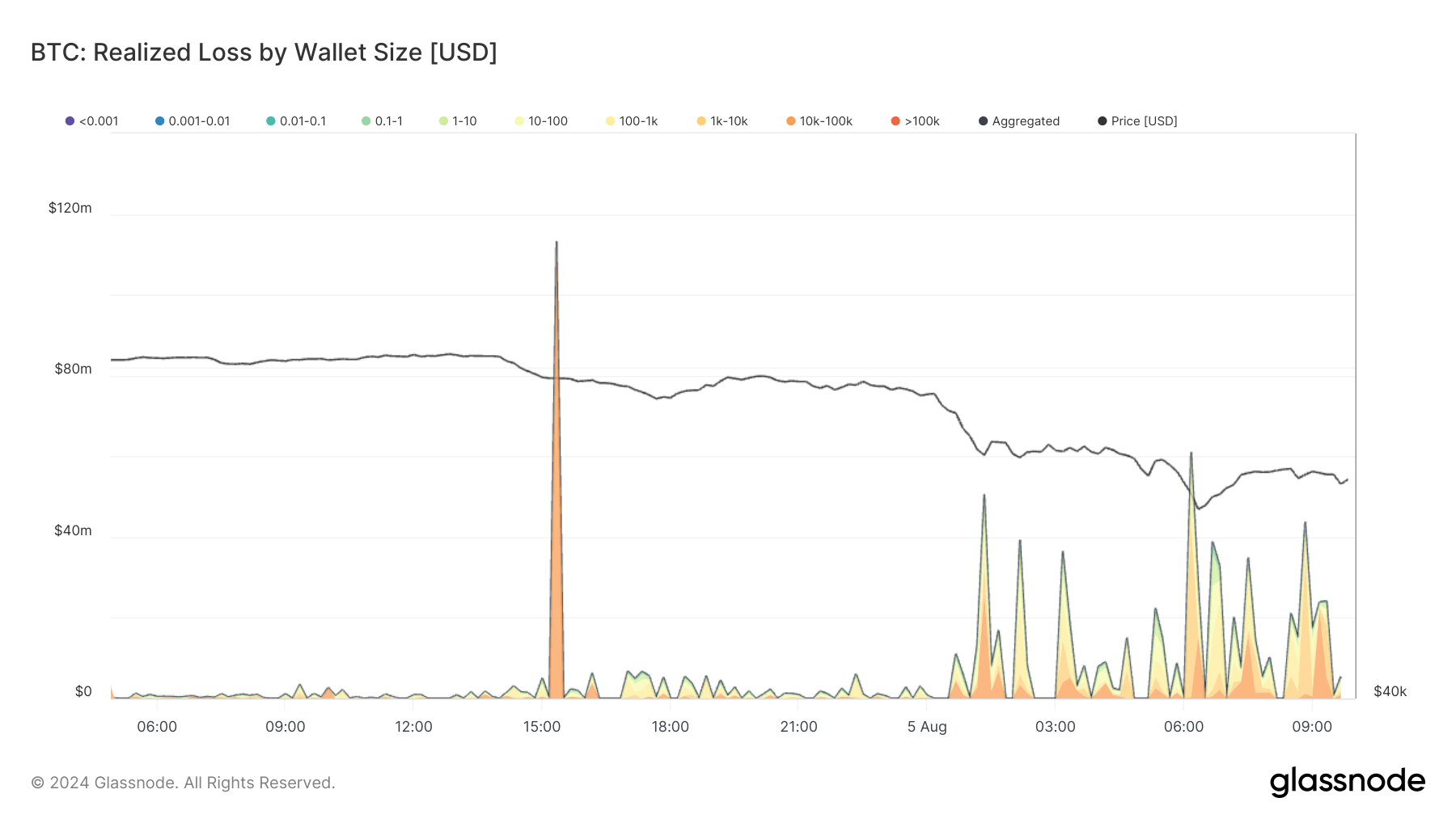

On Aug. 2, Bitcoin (BTC) was trading around $65,000, but by Aug. 5, it had plummeted to a low of $49,000 before recovering to about $51,000. This drastic fluctuation has led to substantial realized losses, particularly among short-term holders (STHs).

Since Aug. 4, over $850 million in realized losses have been recorded, with the bulk of these losses attributed to STHs, who have held Bitcoin for less than 155 days. In contrast, long-term holders (LTHs) have only realized about $600,000 in losses, highlighting that the recent market downturn has primarily impacted newer investors.

| Time | Value |

|---|---|

| 24h | $101,547,395 |

| 1d_1w | $394,421,018 |

| 1w_1m | $175,281,805 |

| 1m_3m | $101,741,897 |

| 3m_6m | $94,699,637 |

| 6m_12m | $101,737 |

| 1y_2y | $2,497 |

| 2y_3y | $295,917 |

| 3y_5y | $292,370 |

| 5y_7y | – |

| 7y_10y | – |

| more_10y | – |

| aggregated | $868,384,273 |

Analyzing the losses by size, it is evident that the losses span across different investor cohorts, from those holding approximately 1 BTC to those holding up to 100,000 BTC. Notably, there was a significant spike on Aug. 4, when a whale with a balance of 10k-100k BTC sold over $100 million in realized losses.

Glassnode

Glassnode