Over $5.8 billion in Bitcoin and Ethereum options set to expire, market volatility anticipated

Quick Take

Tomorrow, Jan. 26, is the expiration of a staggering $5.82 billion worth of Bitcoin and Ethereum options, a potentially influential event for both Bitcoin (BTC) and Ethereum (ETH) markets.

The options, divided into $3.75 billion for BTC and $2.08 billion for ETH, depict an interesting dynamic for both leading digital assets. For BTC, with a put/call ratio of 0.52 and a defined ‘max pain point’ at $41,000, there lies significant open interest of over $360 million at a strike price of $50,000.

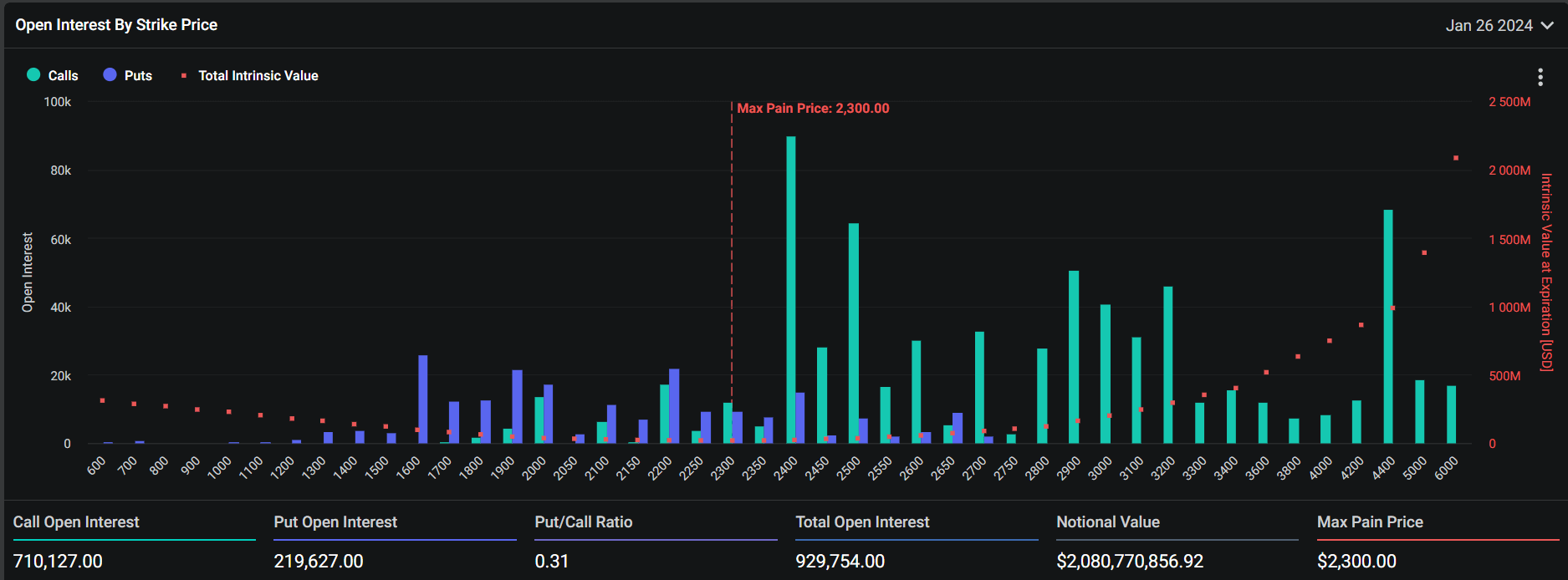

The ETH options highlight a different scenario, evidenced by a lower put/call ratio of 0.31 and a ‘max pain point of $2,300. There is also significant open interest of around $200 million at the price of $2400.

Such figures foretell potential fluctuation in the digital asset market following the options expiration at 8:00 AM UTC, Jan. 26.

Deribit

Deribit