Insights

Options 25 Delta Skew suggests bearish sentiment ahead of CPI

Definition

Skew is the relative richness of put vs. call options, expressed in Implied Volatility (IV). For options with a specific expiry, 25 Delta Skew refers to puts with a delta of -25% and calls with a delta of 25% to demonstrate this difference in the market’s perception of implied volatility.

25 Delta Skew is calculated as the difference between a 25-delta put’s implied volatility and a 25-delta call’s implied volatility — normalized by the ATM Implied Volatility.

While Implied Volatility is the market’s expectation of volatility.

Quick Take

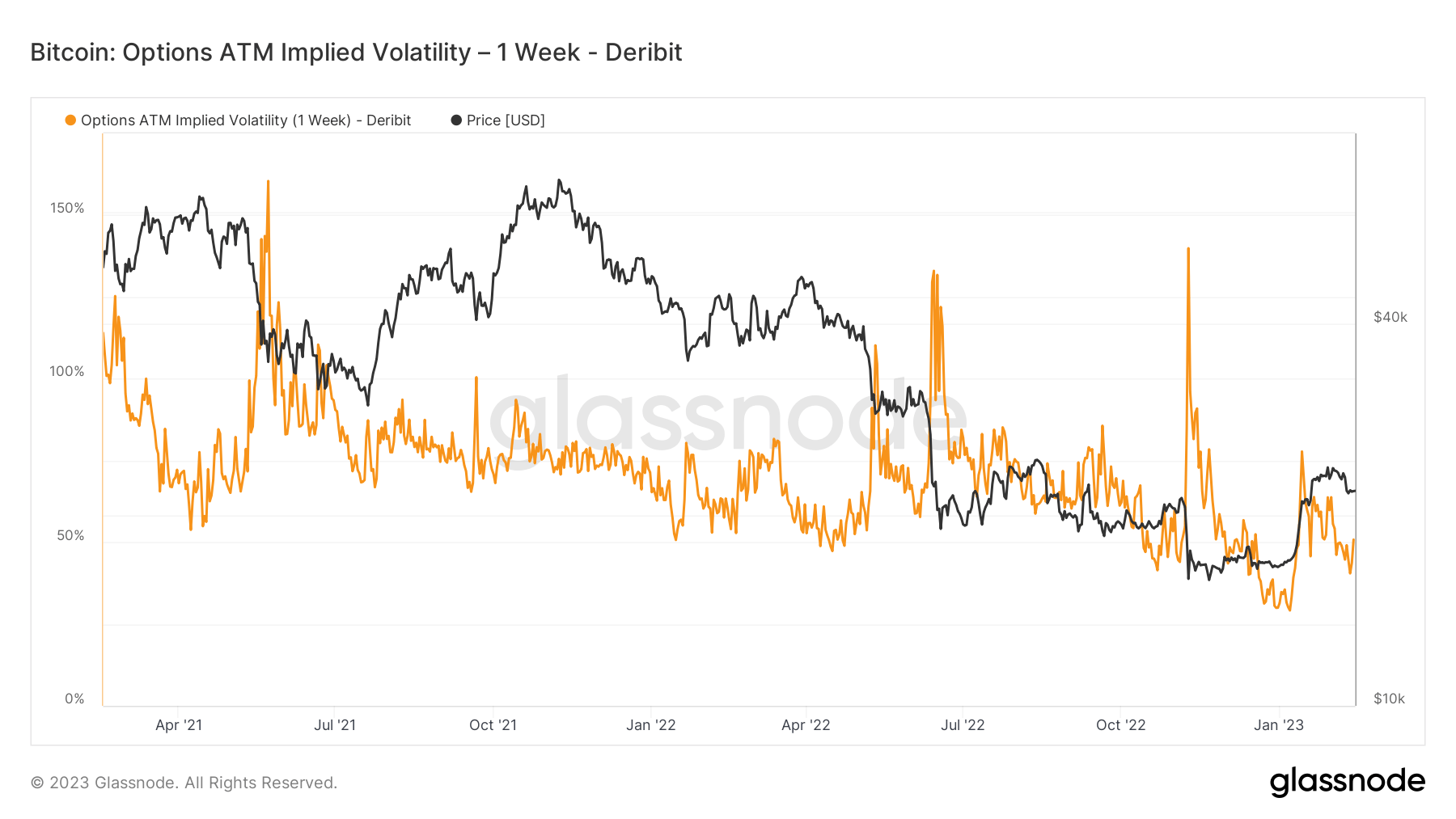

- Options 25 Delta Skew suggests puts are more expensive than calls — indicating bearish sentiment ahead of the CPI announcement today.

- For the past two years, calls have become more expensive each time than puts highlighted in the black box. Bitcoin has rallied in price — potentially indicating a bear market rally.

- Implied volatility has come down meaningfully since the FTX collapse, currently at 50% — as opposed to 140%.

- 25 Delta Skew and implied volatility focus on options contracts expiring in one week from today.