Insights

No more rate hikes: Markets believe the Fed rate pause is nigh

Quick Take

- Chances of any more rate hikes seem to have disappeared after the recently reported weak U.S. macro data.

- A pause is now the firm favorite for the next two meetings, with roughly 75bps rate cuts throughout the year.

- The market believes the US rates will end the year at 4-4.25%.

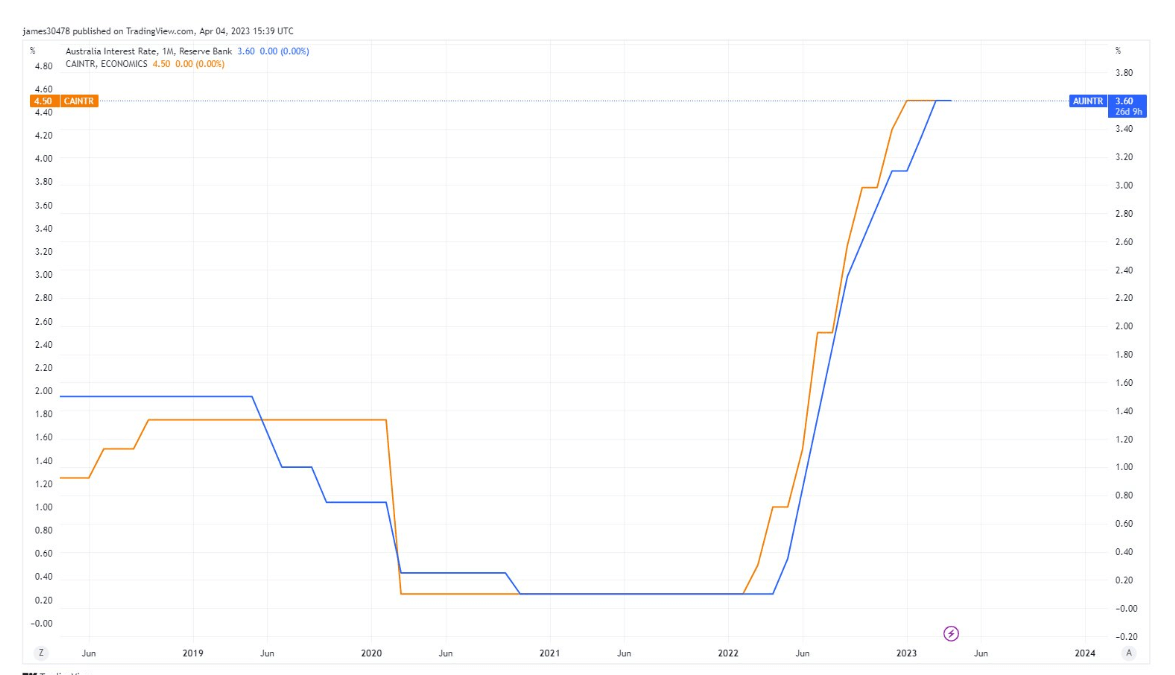

- Australia’s Central Bank joined Canada in “pausing” interest rates.

- Liquidity is drying up; banks are reluctant to lend while the economy slows down. These could be the biggest headwinds that Bitcoin would face.