MicroStrategy’s leverage scenarios show potential for astronomical returns on Bitcoin investments

Quick Take

In its Q4 earnings report, MicroStrategy disclosed its substantial Bitcoin investment in Q4 2023 of $1.25 billion, which is now worth a staggering $8 billion. The firm holds 190,000 BTC in its corporate treasury.

MicroStrategy’s Q4 2023 Earnings Presentation shows that this strategic decision has paid dividends, as its stock has surged by 305% since it started investing in Bitcoin in August 2020. For comparison, Bitcoin itself saw an increase of 260% during the same period, while more traditional assets lagged behind, with the S&P 500 and gold only increasing by 48% and 1%, respectively, according to MicroStrategy data.

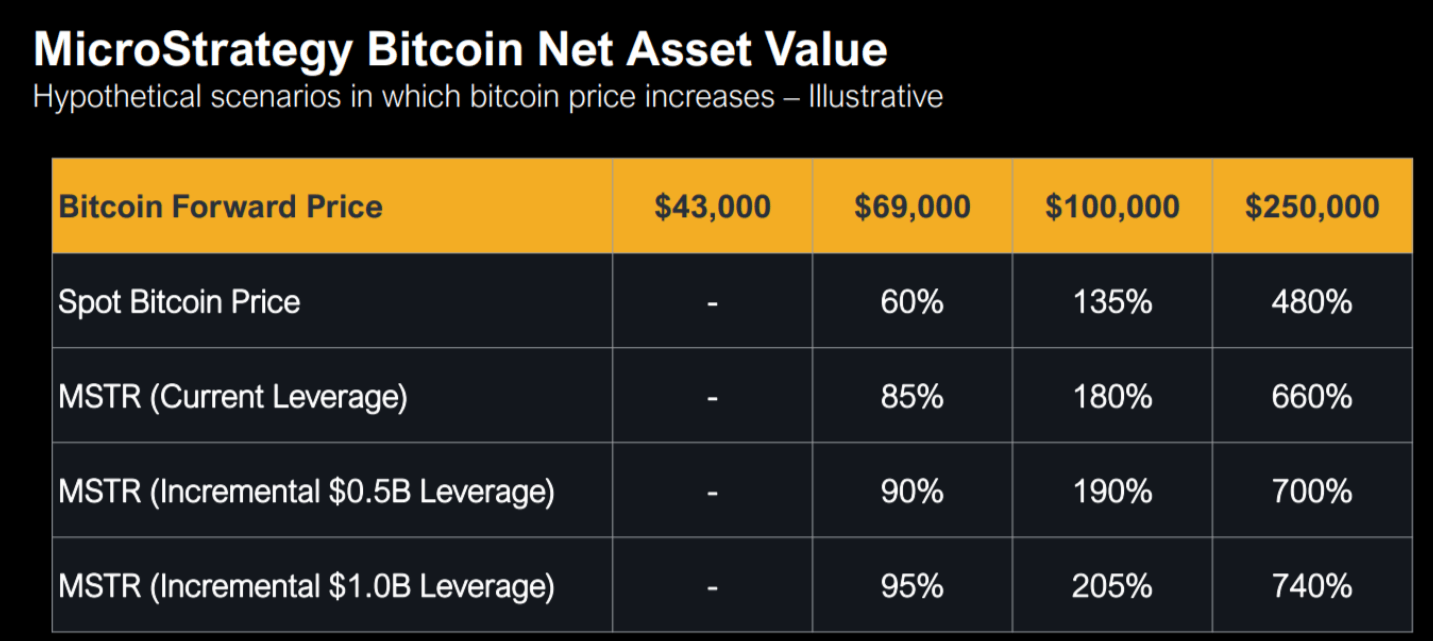

Furthermore, MicroStrategy presented hypothetical scenarios in the earnings presentation based on their net asset value, calculated as their Bitcoin holdings market value minus total outstanding debt.

These scenarios considered varying Bitcoin spot prices and the effect of adding leverage. For instance, if Bitcoin’s price rose from $43,000 to $69,000, this would result in a 60% increase, scaling up to a 135% increase if Bitcoin hit $100k and a whopping 480% surge if Bitcoin reached $250k, MicroStrategy data shows.

As MicroStrategy reported, adding the company’s existing leverage would further enhance returns, potentially by 85% at a Bitcoin price of $69,000 and up to 660% if Bitcoin soared to $250k. An additional scenario illustrated how a further $0.5B of leverage could substantially augment these returns.