Market shift in favor of Bitcoin as key technical indicators suggest a bullish phase

Quick Take

Bitcoin has recently reasserted its position above the $36,000 benchmark, triggering a wave of short liquidations. In the past four hours alone, Bitcoin shorts worth $13 million have been liquidated, contributing to the total crypto market liquidations of $30 million. This development indicates the shifting market dynamics as traders adapt to the evolving landscape.

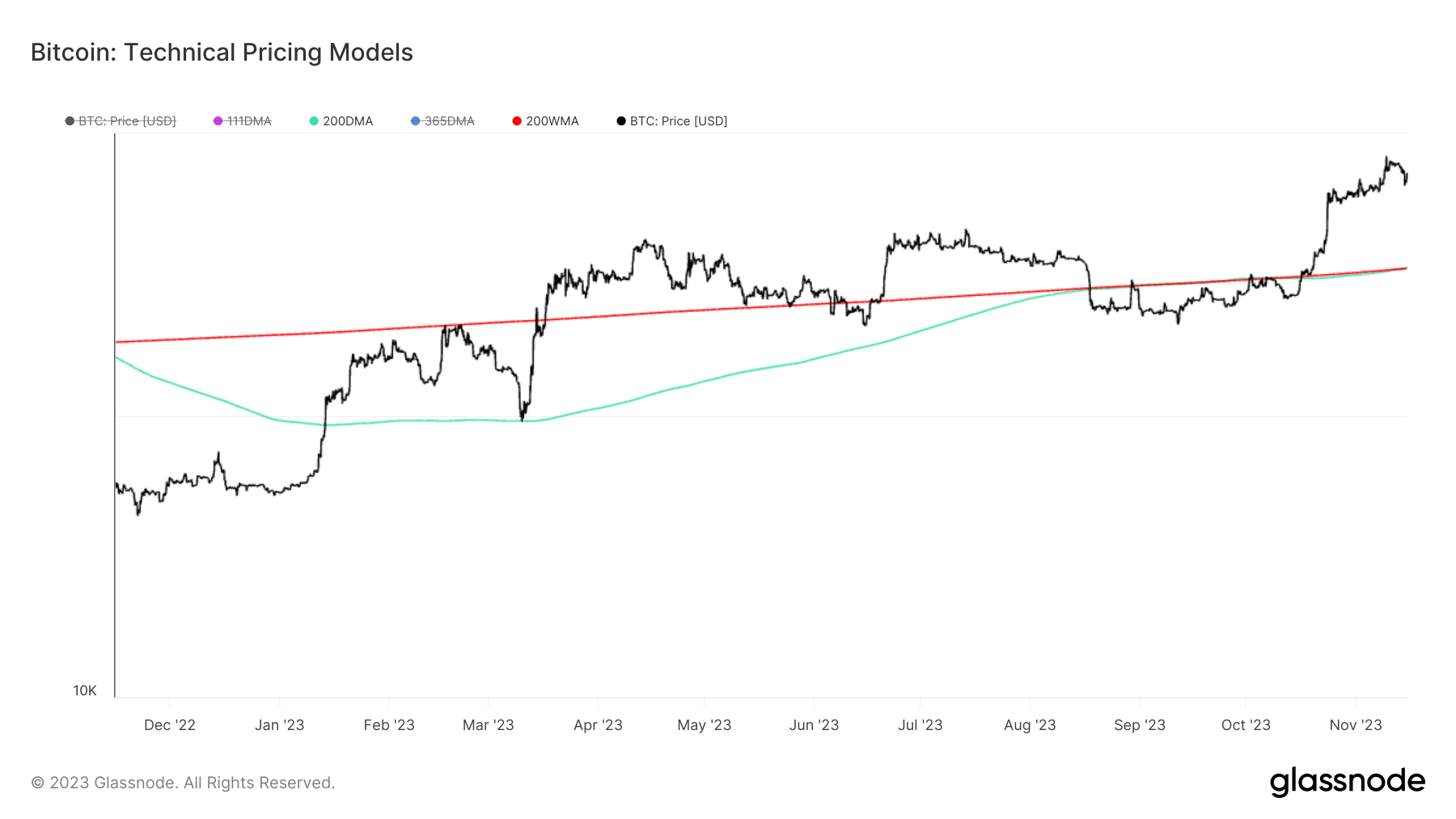

However, a significant milestone drawing attention is the 200-day Simple Moving Average (SMA) of $28,749, surpassing the 200-week Moving Average (WMA) of $28,694 for the first time. As a well-regarded tool in Technical Analysis, the 200-day SMA is often linked with the transition between Bull and Bear markets. Meanwhile, the 200-week SMA captures the inherent momentum of Bitcoin’s typical 4-year cycle.

Echoing the previous week’s trend, where the realized price outpaced the short-term holder’s realized price, this flip in the moving averages projects a bullish outlook for Bitcoin’s momentum in the near term.

CoinGlass

CoinGlass