Major institutions signal growing interest in Bitcoin ETFs

Quick Take

The market for Bitcoin ETFs is witnessing an uptick in interest from institutional investors.

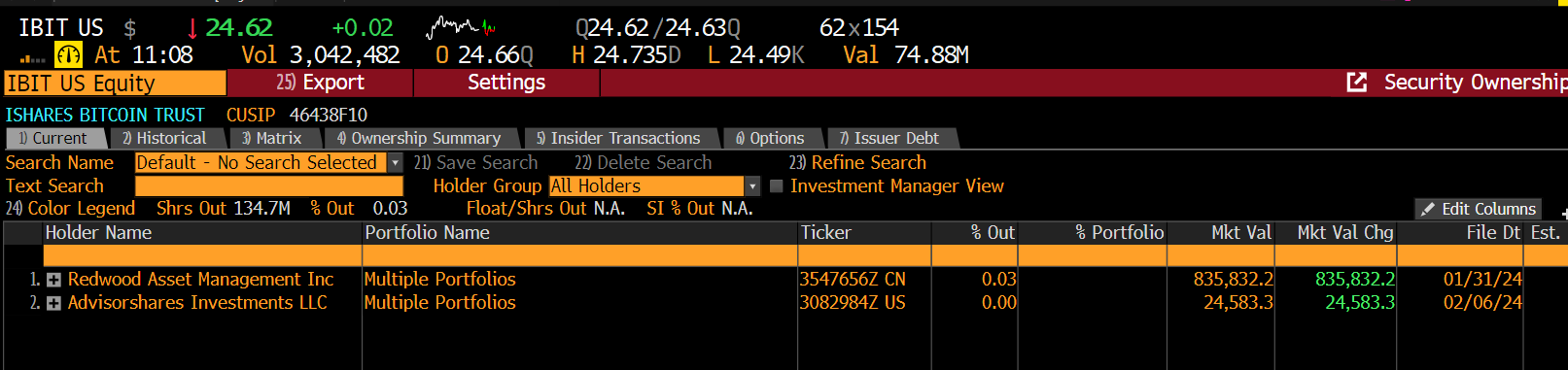

BlackRock recently noticed an expansion in the holder list of its ETF, IBIT. The new entrants include Redwood Asset Management Inc. and Advisorshares Investments LLC, according to ETF Bloomberg analyst Eric Balchunas.

This could potentially serve as a precursor for increased institutional acceptance of Bitcoin ETFs as a new asset class.

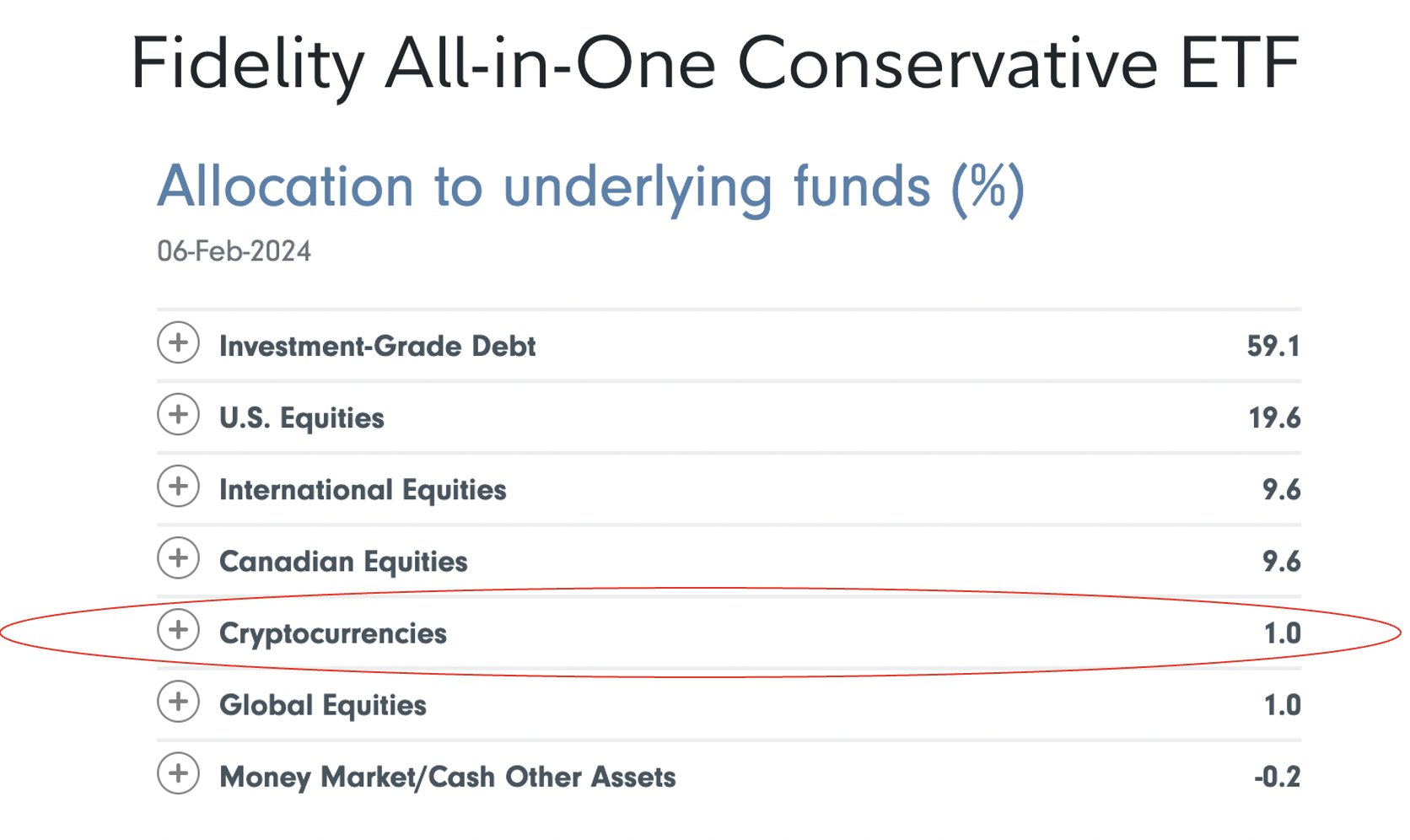

In a parallel development, Fidelity Canada has incorporated a percentage of Bitcoin allocation in their “All-in-One” asset allocation funds, utilizing spot Bitcoin ETFs.

According to Bitwise Invest CIO Matt Hougan, these allocations range from a modest 1% in their conservative portfolio to a more assertive 3.1% in the aggressive portfolio.

These developments highlight the burgeoning interest of institutions in Bitcoin ETFs, and it is anticipated that this trend will continue to evolve.