Insights

Looming June FOMC meeting roils Bitcoin market

Quick Take

- The Federal Reserve’s actions, specifically its interest rate decisions, serve as an external catalyst that influences Bitcoin’s price movements, as noted by Swissblock.

- The recent Nasdaq and NVIDIA rallies have not significantly affected the cryptocurrency market, but Swissblock has observed that the fluctuating likelihood of interest rate hikes has impacted Bitcoin’s price movements.

- Recent events related to the U.S. debt ceiling debate have resulted in a higher-than-anticipated target range for interest rates at the upcoming June FOMC meeting.

- However, once the debt ceiling was completed, the likelihood of the 25-basis point rate hike decreased from over 50% to 24%, according to Swissblock.

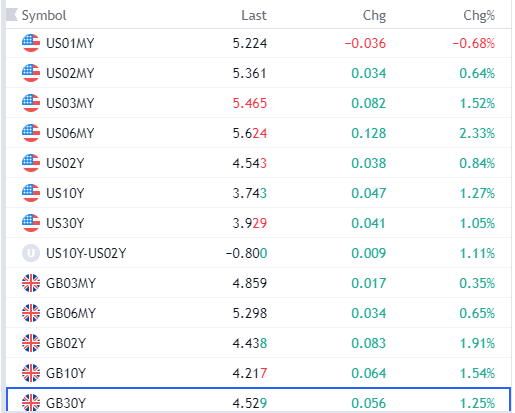

- With just under ten days to go until the next FOMC meeting, yields on the front end of the curve continue to increase, suggesting further rate hikes.

- The Consumer Price Index (CPI) report, scheduled for release on June 13, could have a significant impact on the FOMC meeting’s rate decision the following day.

Swissblock

Swissblock