Insights

Investors adopt risk-off approach as Bitcoin futures OI plummets to YTD low

Definition

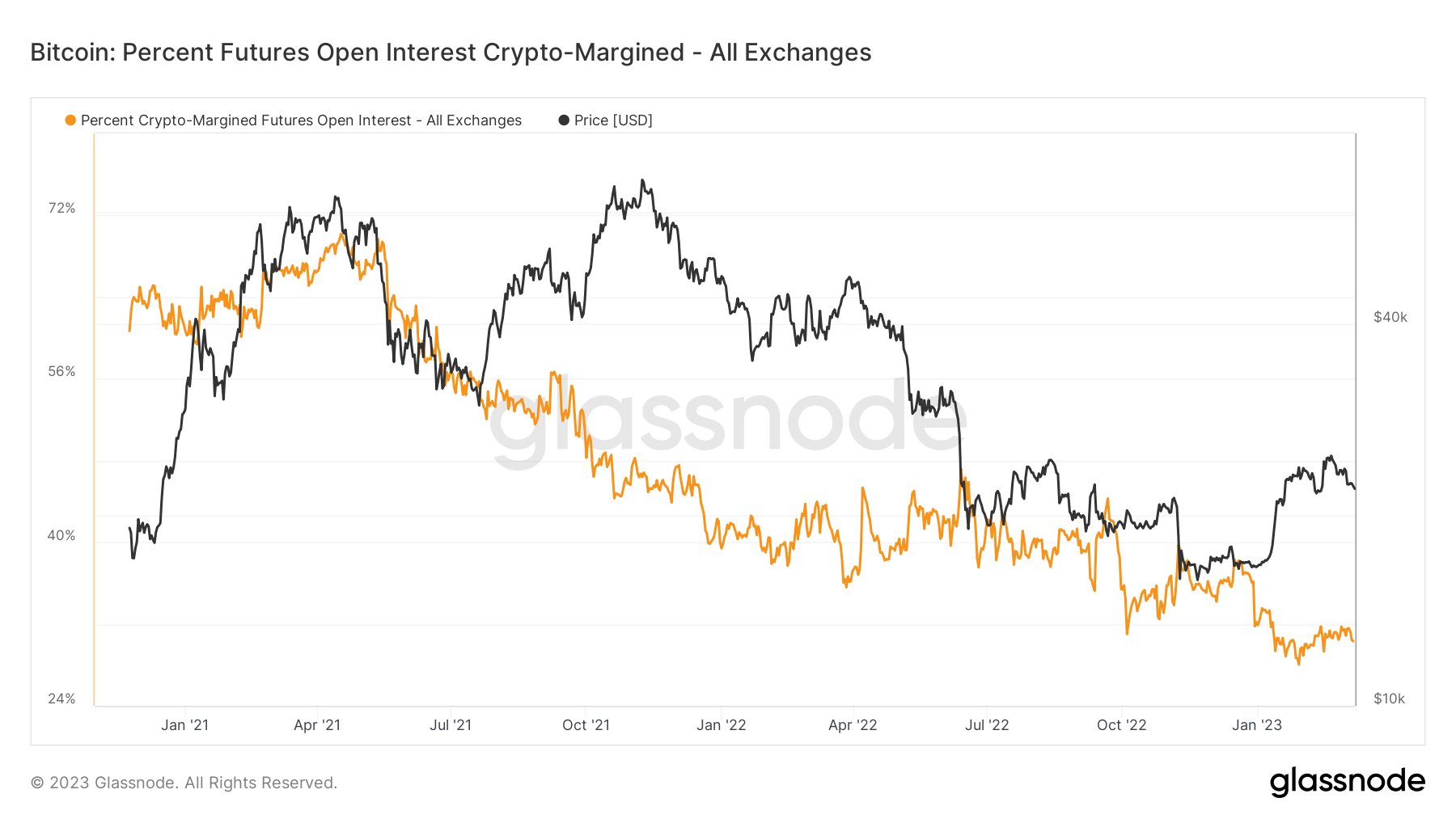

The total amount of funds (USD Value) allocated in open futures contracts. While crypto backed-margin is the percentage of futures contracts’ open interest that is margined in the native coin (e.g. BTC) and not in USD or a USD-pegged stablecoin.

Quick Take

- Roughly 400,000 Bitcoin are currently allocated into futures open interest.

- This is the lowest amount year-to-date, whilst almost 250,000 BTC less than November 2022.

- The allocation of open interest is primarily in stablecoins or USD, roughly 70% of the allocation (277,000 BTC).

- Crypto-backed margin is heading to all-time lows at roughly 30% allocation, indicative of a risk-off environment.

- As the underlying asset of Bitcoin is volatile compared to a stablecoin or the dollar, this would take away a considerable amount of volatility.