Heightened Bitcoin volatility post-halving reflects speculative trading trends

Onchain Highlights

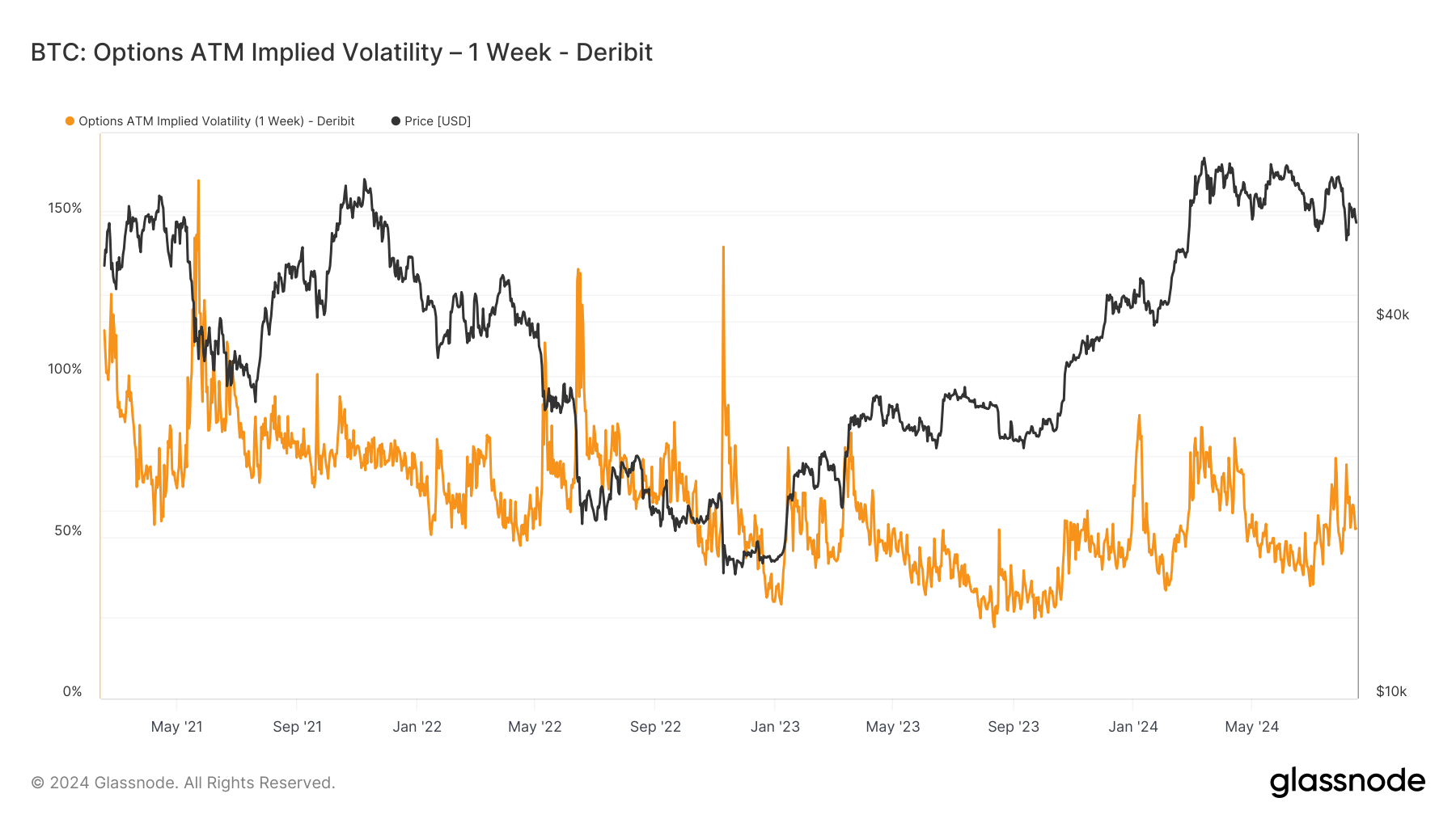

DEFINITION: Implied Volatility is the market’s expectation of volatility. Given the price of an option, we can solve for the expected volatility of the underlying asset. Formally, implied volatility (IV) is the one standard deviation range of the expected movement of an asset’s price over the course of a year. Viewing At-The-Money (ATM) IV over time gives a normalized view of volatility expectations, which will often rise and fall with realized volatility and market sentiment. This metric shows the ATM implied volatility for options contracts that expire 1 week from today.

BTC’s 1-week implied volatility has seen notable fluctuations throughout 2024. The metric, a key indicator of market sentiment, remained relatively stable at around 50% in the early part of the year after a brief spike in early January and mid-February.

However, as Bitcoin approached its halving in April, volatility spiked, peaking above 80% as traders anticipated potential market turbulence. Despite a brief decline post-halving, volatility resurfaced in mid-year, driven by increased uncertainty in the market, possibly tied to regulatory developments and macroeconomic conditions.

Comparing the current volatility levels to the broader historical context, 2024 shows a trend of heightened volatility compared to the more subdued environment of 2023. The persistent spikes suggest that traders are increasingly factoring in short-term market risks, underscoring a more speculative trading environment post-halving.

This trend could continue as market participants navigate the evolving regulatory landscape and global economic shifts that influence Bitcoin’s price trends.

Glassnode

Glassnode