Grayscale GBTC records lowest outflows since February at $75 million

Quick Take

On April 3, Bitcoin (BTC) exchange-traded funds (ETFs) experienced a notable increase in net inflows, reaching $113.5 million, marking the most substantial daily net inflow since March 28. This surge was primarily fueled by Fidelity’s FBTC, which saw its highest net inflow since March 26, totaling $116.7 million. Consequently, FBTC’s total net inflows surged to an impressive $7.7 billion, according to Farside data.

Farside data reports that Bitwise’s BITB also contributed positively, attracting $23.0 million in net inflows, which has been strongest since March 28, with total net inflows reaching $1.6 billion.

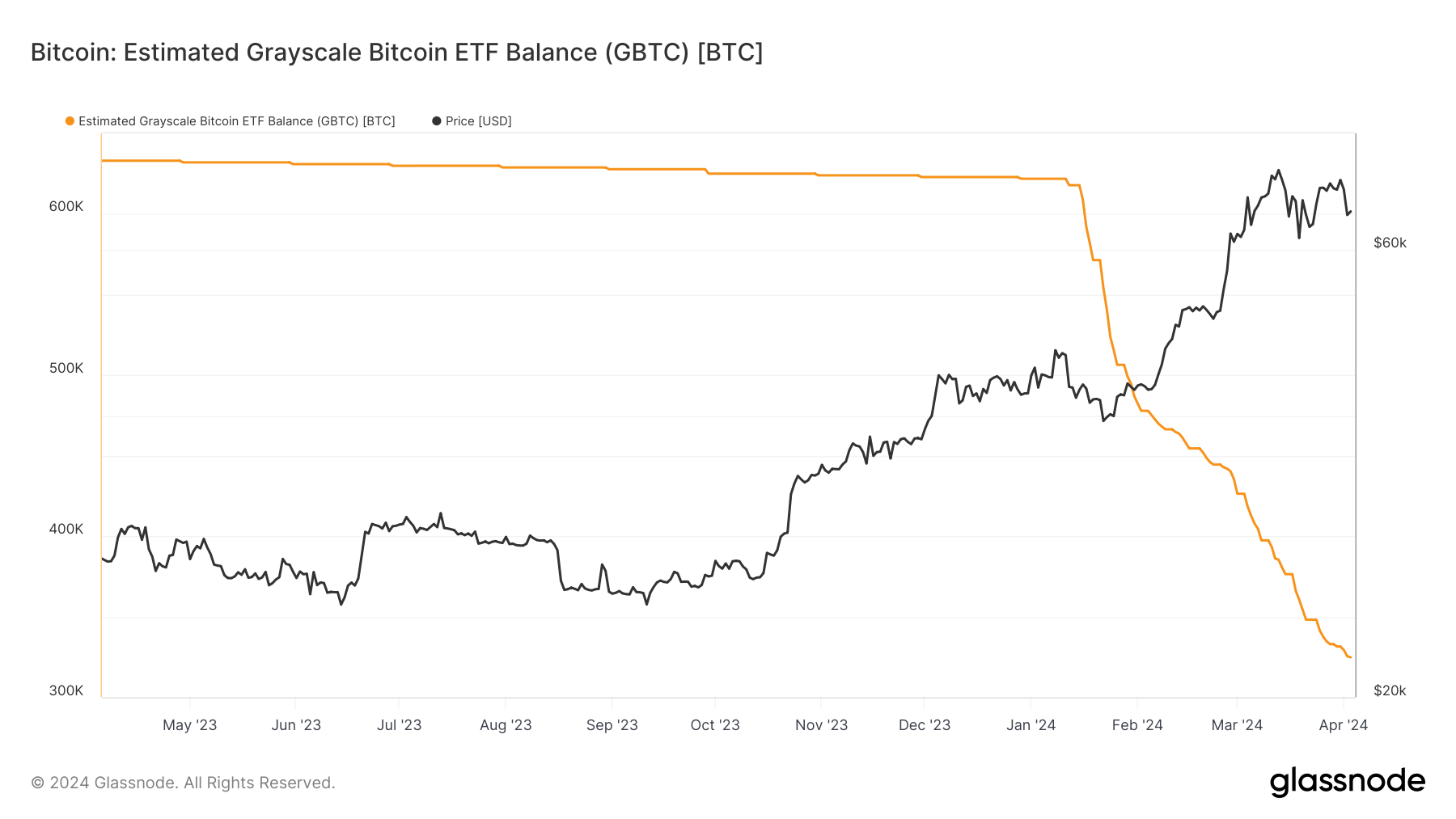

Grayscale’s GBTC experienced outflows of $75.1 million, though lower than the previous day and the lowest since February 26. Despite the outflows, GBTC’s total outflows have now amounted to a significant $15.2 billion, with its BTC holdings decreasing to approximately 325,000 BTC from 621,000 BTC before the ETF launch on January 11, as per Glassnode data.

According to Farside data, total net inflows for Bitcoin ETFs have surged impressively to $12.1 billion, signaling sustained interest and demand for Bitcoin investment products.

Farside Investors

Farside Investors