Insights

GBTC discount narrows during SEC hearing, yield curve inversion deepens; 60% probability for 50bps hike

Quick Take

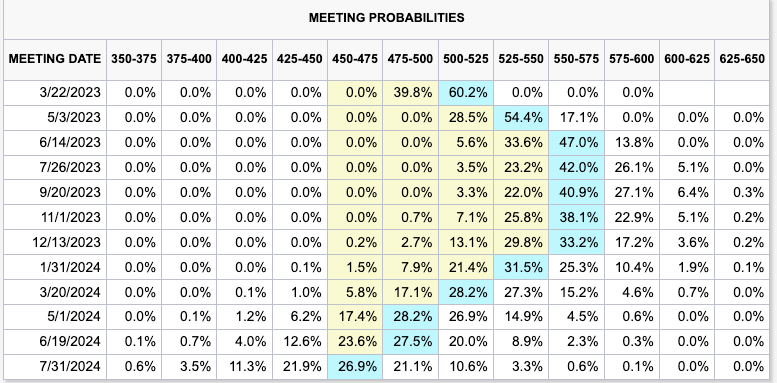

Result of Powell Speaking

- The US 10-year minus 02 years has reached -100 bps inversion.

- The forward growth outlook is a full percentage point lower than the expected policy rate.

- Levels of policy error not achieved since February 1980.

- Inversion points to a recession, but a larger inversion doesn’t not mean a faster or deeper recession.

- While the terminal rate is now forecasted at 5.6% for October 2023 and a 60% probability of a 50bps rate hike during the March FOMC meeting.

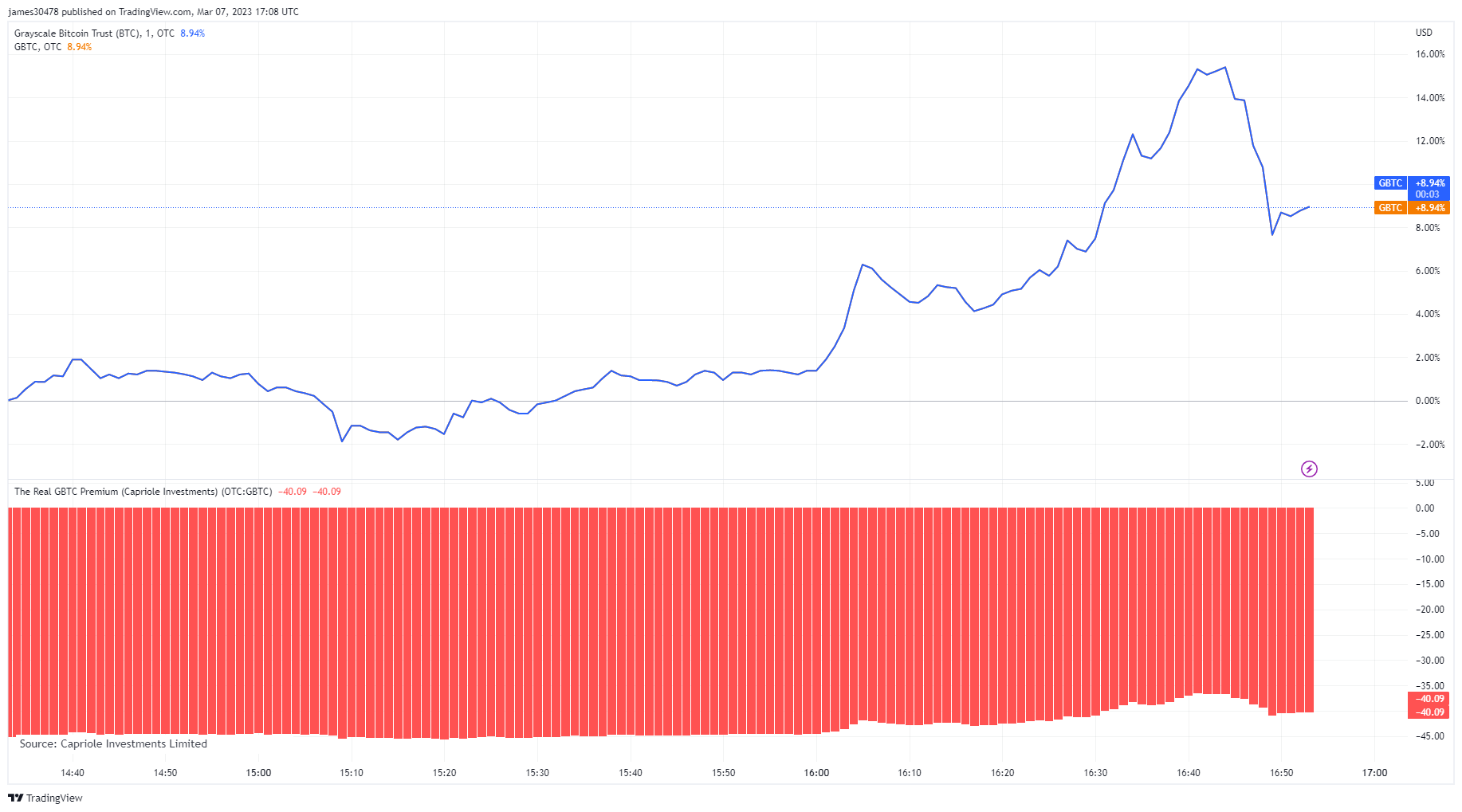

Result of Grayscale vs. SEC hearing

- So far, GBTC is up roughly 9% today due to the current hearing, Grayscale vs. SEC.

- The discount to NAV is roughly 40%, which assumes Grayscale’s chances of a spot ETF have increased.

- The gap was as narrow as -35%.

- GBTC would have a pathway to convert to NAV.

- BTC remains roughly flat for the day at $22,300