Fidelity’s FBTC ETF hits $4 billion mark amid Bitcoin ETF boom

Quick Take

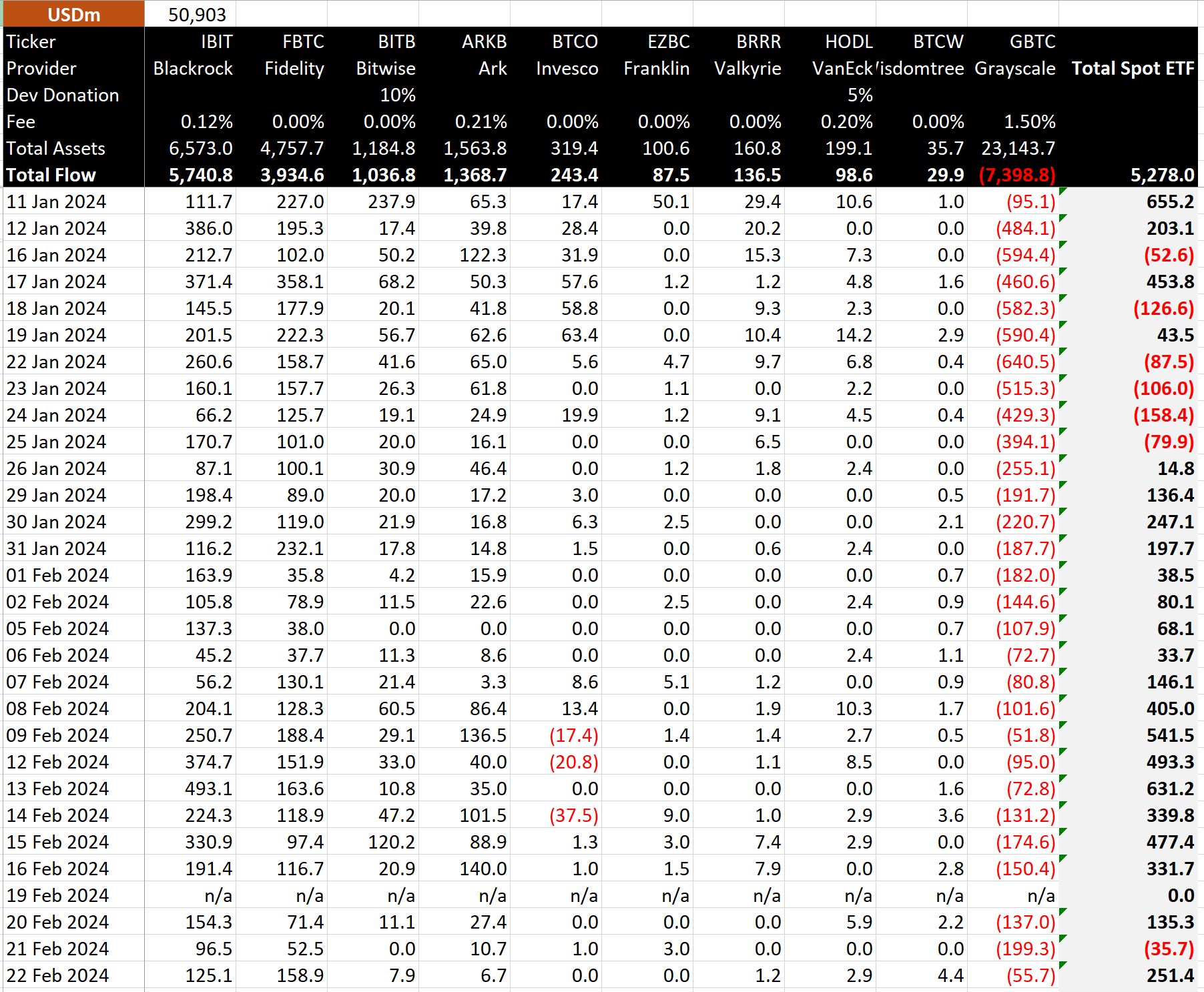

The landscape of Bitcoin ETFs witnessed significant activity on Feb. 22, according to BitMEX data, with a robust inflow of $251 million, the equivalent of 4,900 BTC.

BitMEX data shows that the spotlight was on Fidelity’s FBTC ETF, which reported a substantial inflow of $159 million, pushing its total inflows to the $4 billion mark. BlackRock’s IBIT was not far behind, absorbing $125 million to bring its total net inflow to an impressive $5.7 billion.

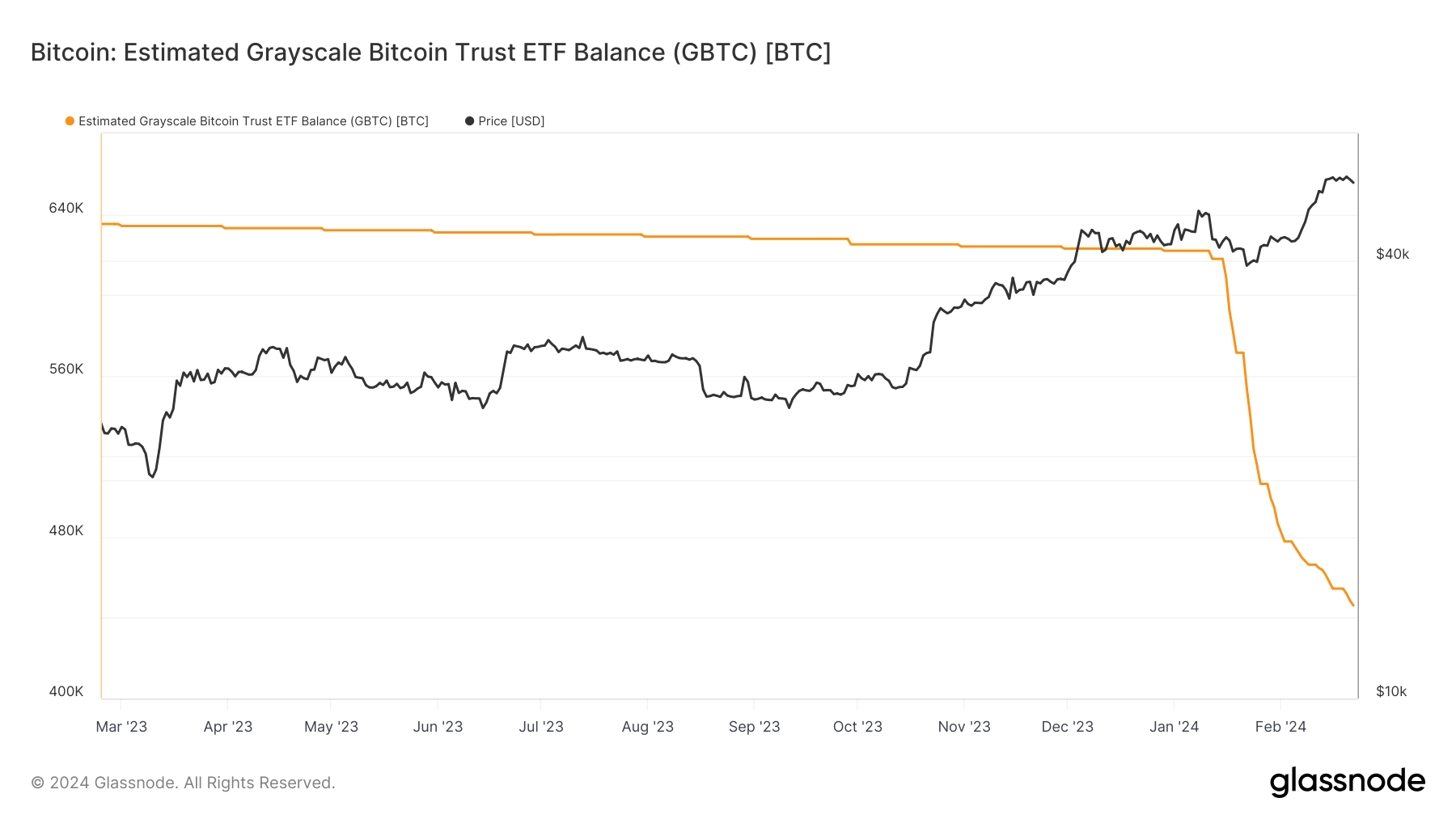

As BitMEX reported, on the opposite side of the spectrum, GBTC experienced more outflows, but they were subdued. The ETF recorded a $56 million outflow, albeit less than the $199 million outflow observed the previous day, Feb. 21; with an aggregate outflow of $7.4 billion to date, GBTC has witnessed a 33% departure from their total Bitcoin holdings, since the Bitcoin ETFs’ commencement on Jan. 11, according to Glassnode.

This surge reaffirmed the overall strength of the Bitcoin ETF market, taking the total net inflow for all Bitcoin ETFs to $5.3 billion, or the equivalent of 110k Bitcoin.

BitMEX

BitMEX