Fidelity’s Bitcoin ETF records its largest single-day inflow, attracting $405 million

Quick Take

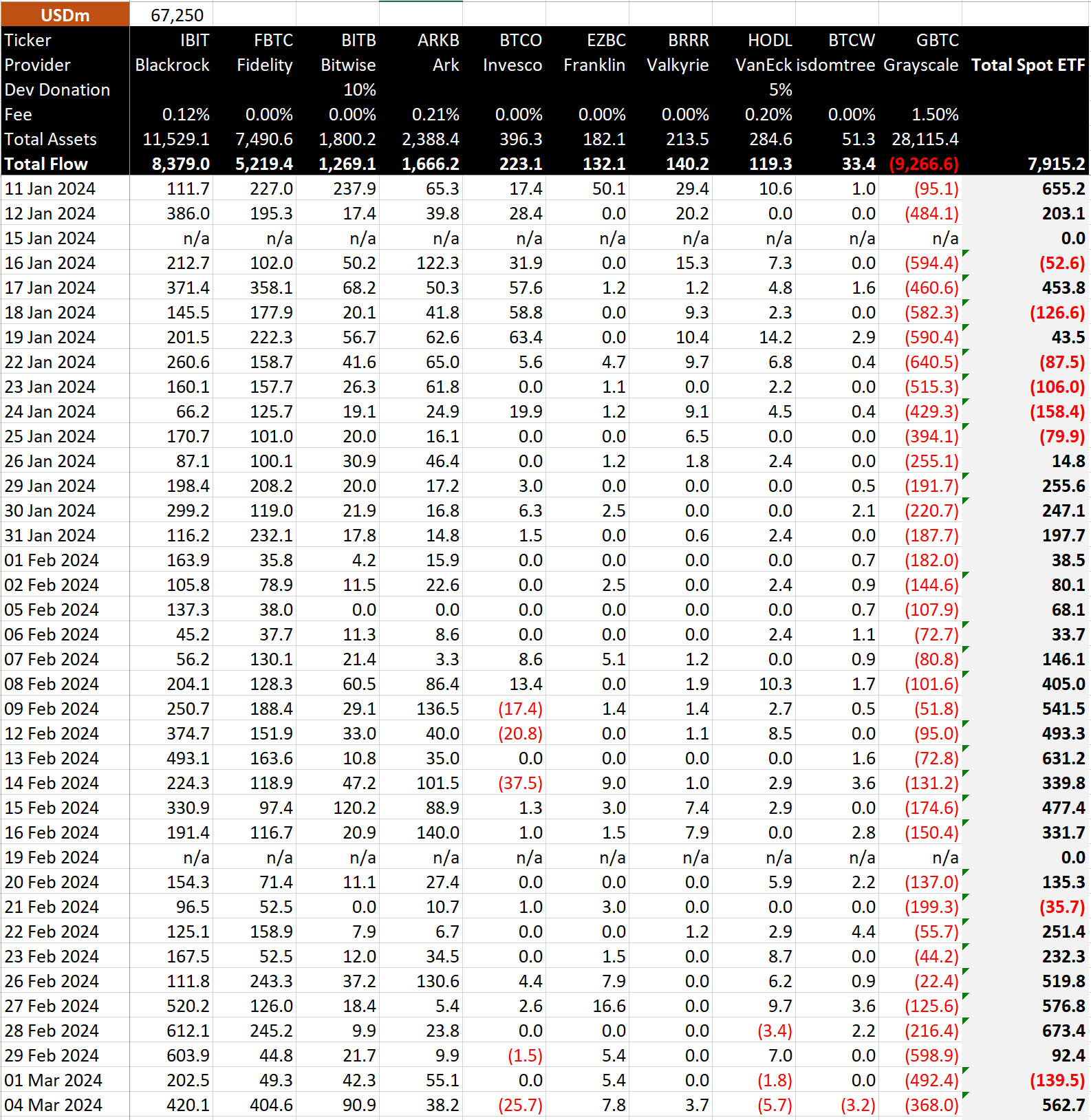

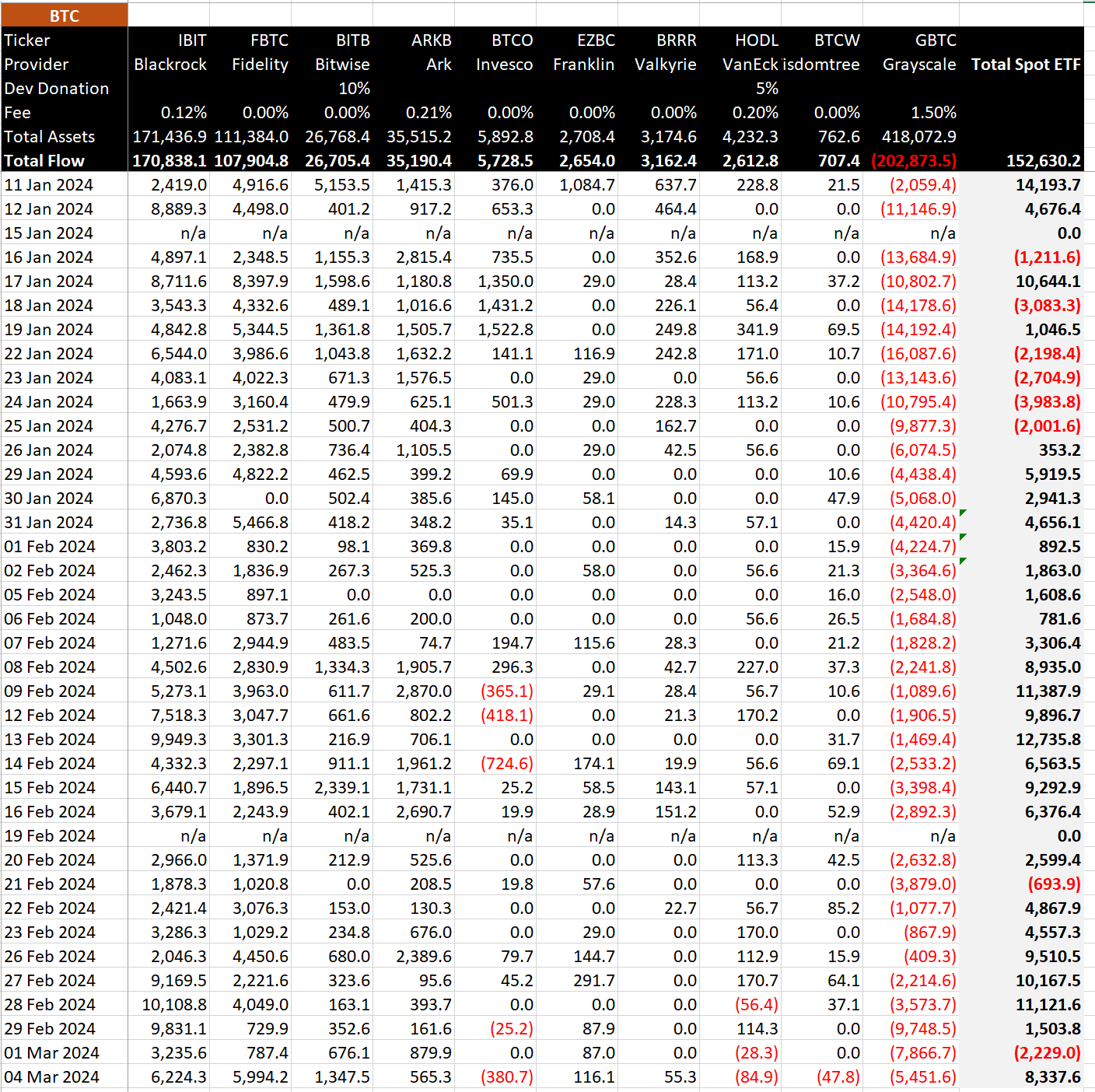

As Bitcoin hovers just below the all-time high of $69,000, the ETF sector demonstrates substantial activity, reflecting wider market sentiment and significant institutional interest. According to BitMEX, recent inflows into Bitcoin ETFs reached a striking total of $563 million on March 4, equivalent to roughly 8,338 Bitcoins.

Data from BitMEX shows that renowned investment firm BlackRock’s IBIT saw an additional inflow of $420 million, increasing their total net flow to an impressive $8.4 billion and holding a staggering 170,838 Bitcoin. Similarly, Fidelity’s FBTC recorded a massive inflow of $405 million, marking the strongest net inflow day since its inception and bringing its total net inflow to $5.2 billion, currently holding 107,905 Bitcoin.

Meanwhile, Bitwise’s BITB reported a significant net inflow of approximately $91 million – their third-highest net inflow day, raising their total net inflow to $1.3 billion.

On the contrary, GBTC recorded another considerable day of outflows amounting to $368 million. However, there’s a silver lining as the outflows from the last three trading days have begun to diminish, though GBTC’s total outflows remain substantial at $9.3 billion, according to BitMEX.

Besides GBTC, three ETF issuers experienced outflows: Invesco’s BTCO saw a $26 million outflow, Van Eck’s HODL encountered a $6 million outflow, indicating consecutive losses, and WisdomTree’s BTCW had a $3.2 million outflow.

The total inflows for the ETFs have reached $7.9 billion, equivalent to 152,630 BTC.

BitMEX

BitMEX