Fidelity’s Bitcoin ETF faces 7th consecutive outflow as Ethereum ETFs continue inflows

Quick Take

Bitcoin

On Aug. 6, Farside data shows that Bitcoin (BTC) exchange-traded funds (ETFs) experienced $148.6 million in outflows, marking the third consecutive trading day of such trends, though each outflow has progressively decreased. No inflows were reported. Fidelity’s FBTC led the outflows with $64.5 million, marking its seventh consecutive trading day of outflows. Ark’s ARKB saw a $28.9 million outflow, Franklin Templeton’s EZBC experienced a $23.0 million outflow, and Grayscale’s GBTC had a $32.2 million outflow. Notably, BlackRock’s IBIT reported no activity, with zero inflows or outflows. Despite the outflows, total BTC ETF inflows stand at $17.2 billion.

Ethereum

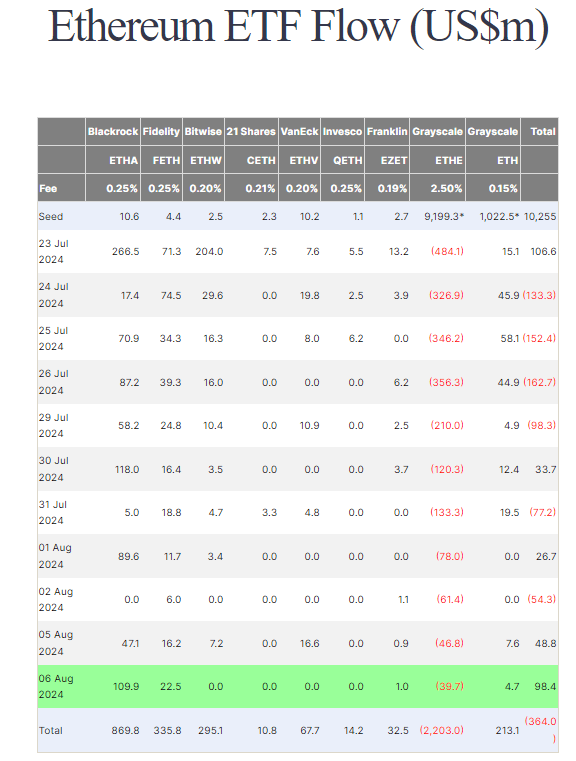

Meanwhile, Ethereum ETFs showed a contrasting trend with inflows. ETH ETFs saw a $98.4 million inflow, bolstered by BlackRock’s ETHA contributing $109.9 million, bringing its total net inflow to $869.8 million. Grayscale’s ETHE continued its pattern of reduced outflows, registering just $39.7 million, pushing total outflows of all ETFs to $364.0 million, according to Farside data.

Farside Investors

Farside Investors