EU inflation outpaces expectations, energy prices hold key to potential rate hikes

Quick Take

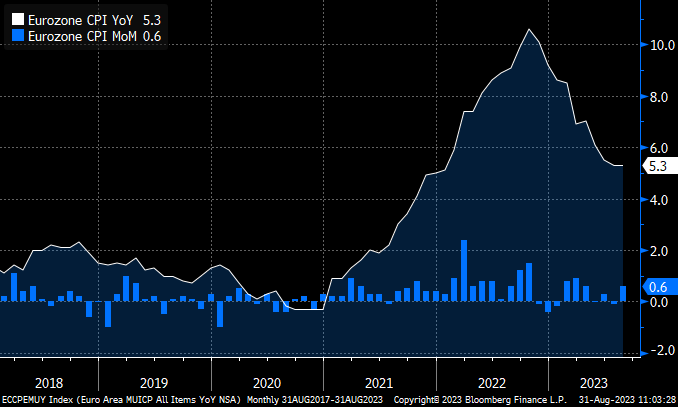

The latest EU inflation data highlights a persistent trend of inflationary pressure. Year over year inflation rates are stubbornly high, reported at 5.3%, exceeding the consensus by 0.2%. Moreover, with a positive month over month figure and a year over year core inflation still at 5.3%, the situation suggests a potential for the Consumer Price Index (CPI) to re-accelerate.

A key point made by analyst Fabian Wintersberger is the role of energy in shaping the inflation picture. Currently, energy stands at -3.3% year over year, but without this negative impact, the Eurozone CPI would have been reported at 6.3%. Its importance becomes even more evident when considering a potential scenario where if energy prices were to turn positive, the Eurozone could face a significantly higher CPI, further increasing the likelihood of more rate hikes.

Inflationary trends, therefore, continue to be a major force in European economic policy, with potential implications for monetary policy decisions and, by extension, the financial markets.