Ethereum’s funding rates and price decline point to bearish shift

Onchain Highlights

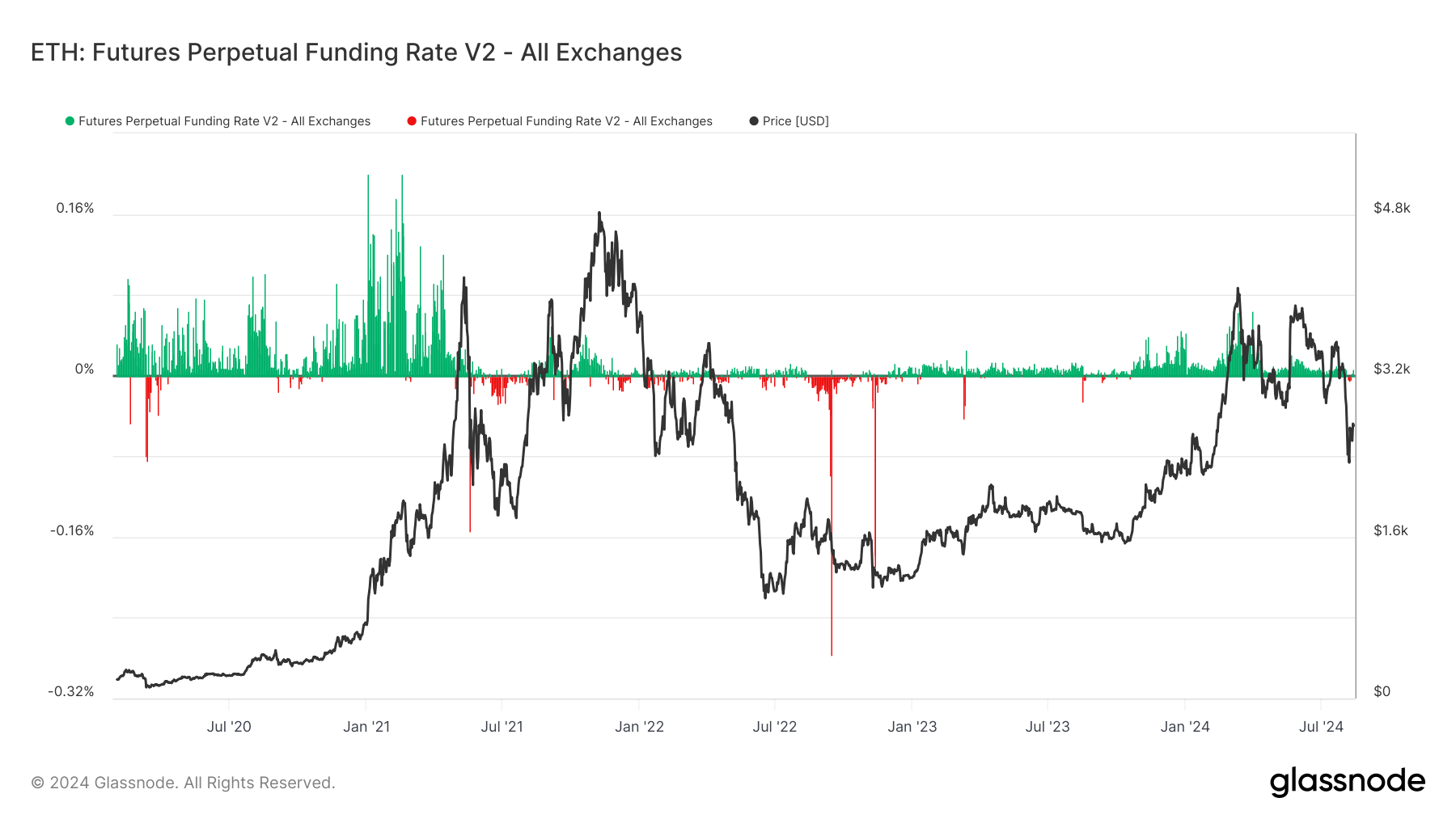

DEFINITION:The average funding rate (in %) set by exchanges for perpetual futures contracts. When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is negative, short positions periodically pay long positions.

Ethereum’s perpetual futures funding rate has recently dipped off its bullish premium. This trend is evident in both short-term and long-term views, reflecting increasing bearish sentiment among traders.

Historically, negative funding rates indicate that short positions are paying long positions, suggesting a prevalence of bearish bets. The charts highlight that despite Ethereum’s price volatility since the start of 2024, funding rates have often been positive, signaling bullish expectations. However, the recent decline in both funding rates and prices below the $2,700 level highlights a shift in market sentiment.

Over the past few years, Ethereum’s perpetual futures funding rate has exhibited significant fluctuations, closely mirroring broader market trends. In periods of strong market optimism, such as during the 2021 bull run, funding rates surged into positive territory, indicating a dominance of long positions as traders bet on continued price increases.

However, during market downturns, notably in mid-2022 and at several points in 2023, funding rates turned negative, reflecting a shift toward bearish sentiment. These oscillations highlight how funding rates have historically served as a barometer for trader sentiment, often foreshadowing major price movements in the underlying asset.

Glassnode

Glassnode