Ethereum ETF filing triggers spike in open interest as Bitcoin steadies

Quick Take

On Nov. 9, the crypto market saw significant turmoil, with over $400 million in liquidations. There was a notable change in open interest, especially for Bitcoin and Ethereum.

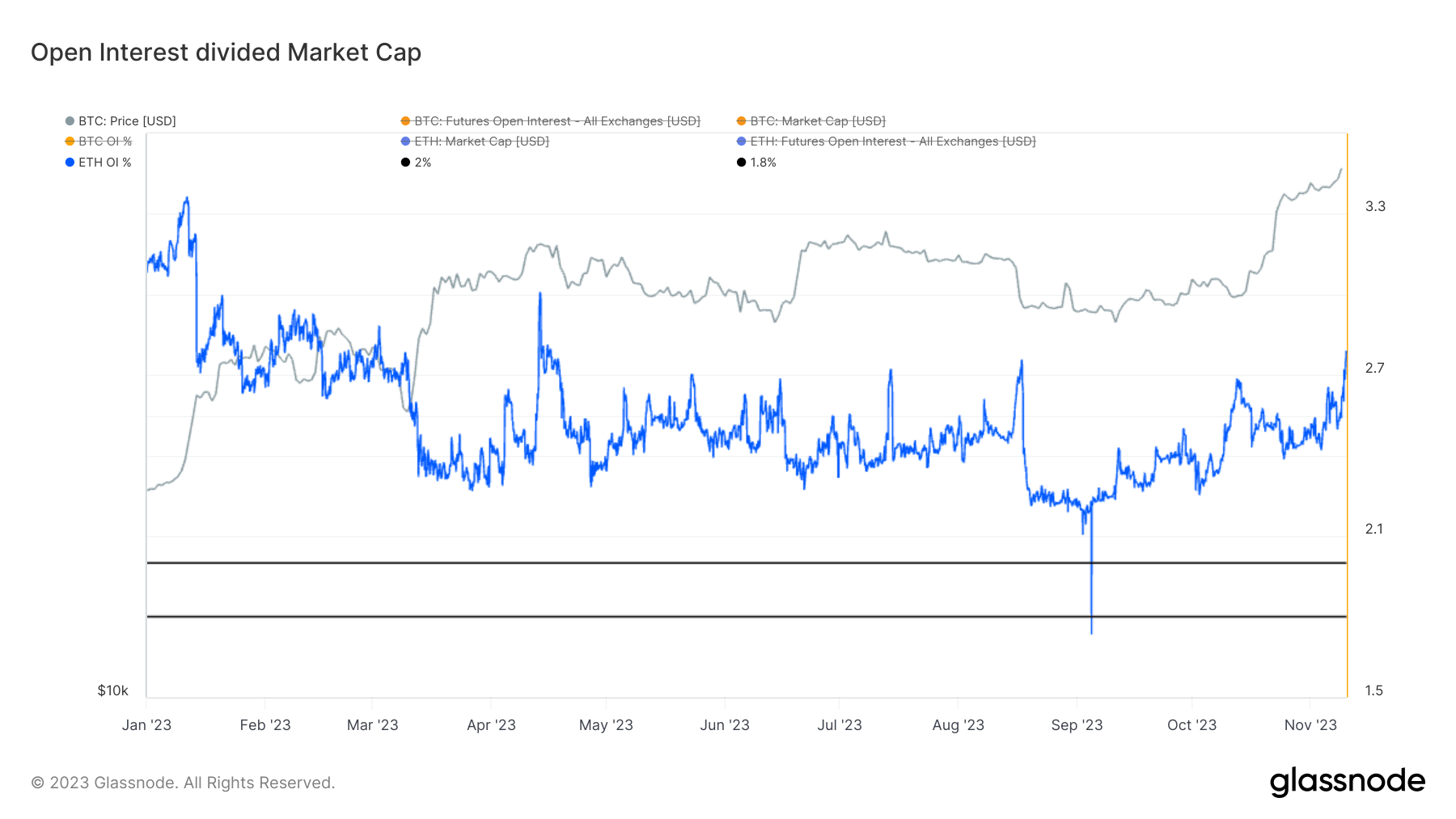

The majority of Bitcoin’s open interest now sits in the U.S. capital markets, with the Chicago Mercantile Exchange (CME) playing a dominant role. This open interest represents just 2% of Bitcoin’s total market cap, which has remained mostly unchanged since August. Despite the steadiness in open interest, Bitcoin’s price has surged from $26,000 to $36,500 since then, indicating a substantial increase.

In contrast, Ethereum witnessed a notable surge in open interest following the news of BlackRock’s spot Ethereum ETF filing. This resulted in a more than 17% increase in 24 hours, equal to around $8 billion in notional value. Consequently, Ethereum’s open interest as a percentage of its market cap surpassed 2.65% – one of the highest levels witnessed this year.