Ethereum and Bitcoin futures open interest near record highs in notional value

Quick Take

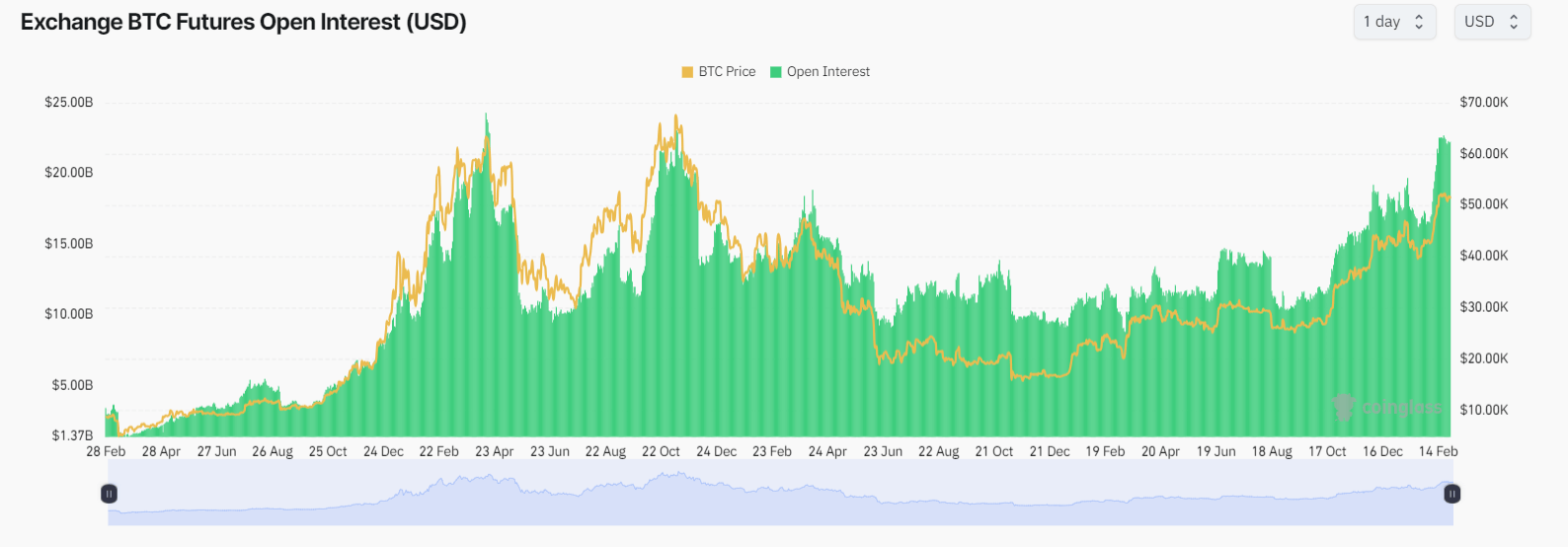

The total amount of funds allocated in open futures contracts or “futures open interest” is nearing an all-time high for Ethereum and Bitcoin in terms of notional value.

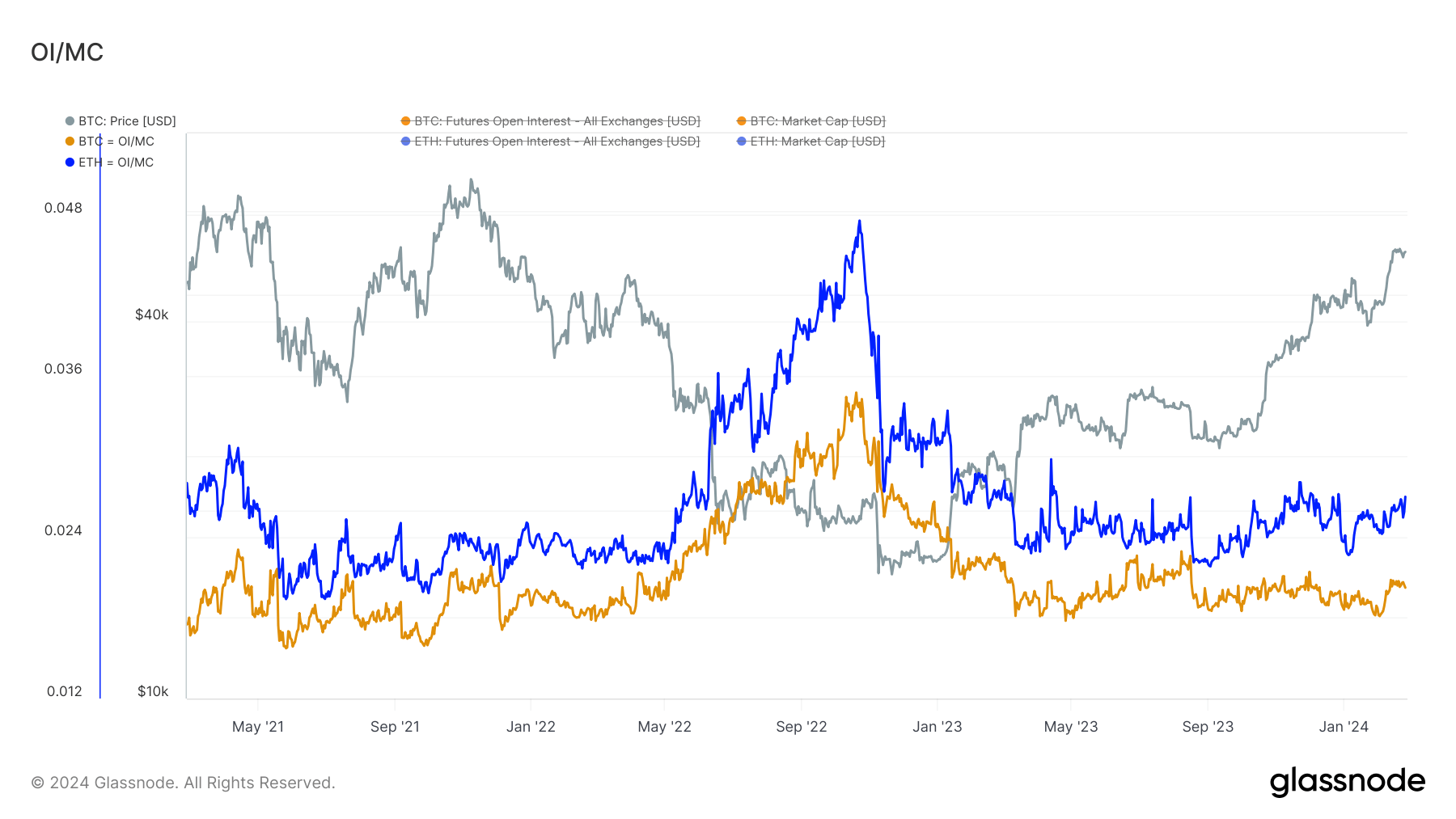

Ethereum’s open interest currently stands at $10.5 billion, aligning with it crossing the significant price threshold of $3,000.

This is particularly noteworthy as its current level mirrors that of November 2021, Ethereum’s peak at $11 billion, when the price of ETH was approximately $4,700.

Similarly, the notional value of Bitcoin is also approaching all-time highs, with roughly $22.5 billion corresponding to the same levels observed in May and November 2021, when Bitcoin traded over $60,000.

For Bitcoin, the open interest represents about 2.25% of its market cap. For Ethereum, the open interest accounts for approximately 2.77% of its market cap. Both have seen increases in the past weeks, but they are historically at an average level.

CoinGlass

CoinGlass