Ethereum 2.0 deposit contract continue to rise amid centralization concerns

Quick Take

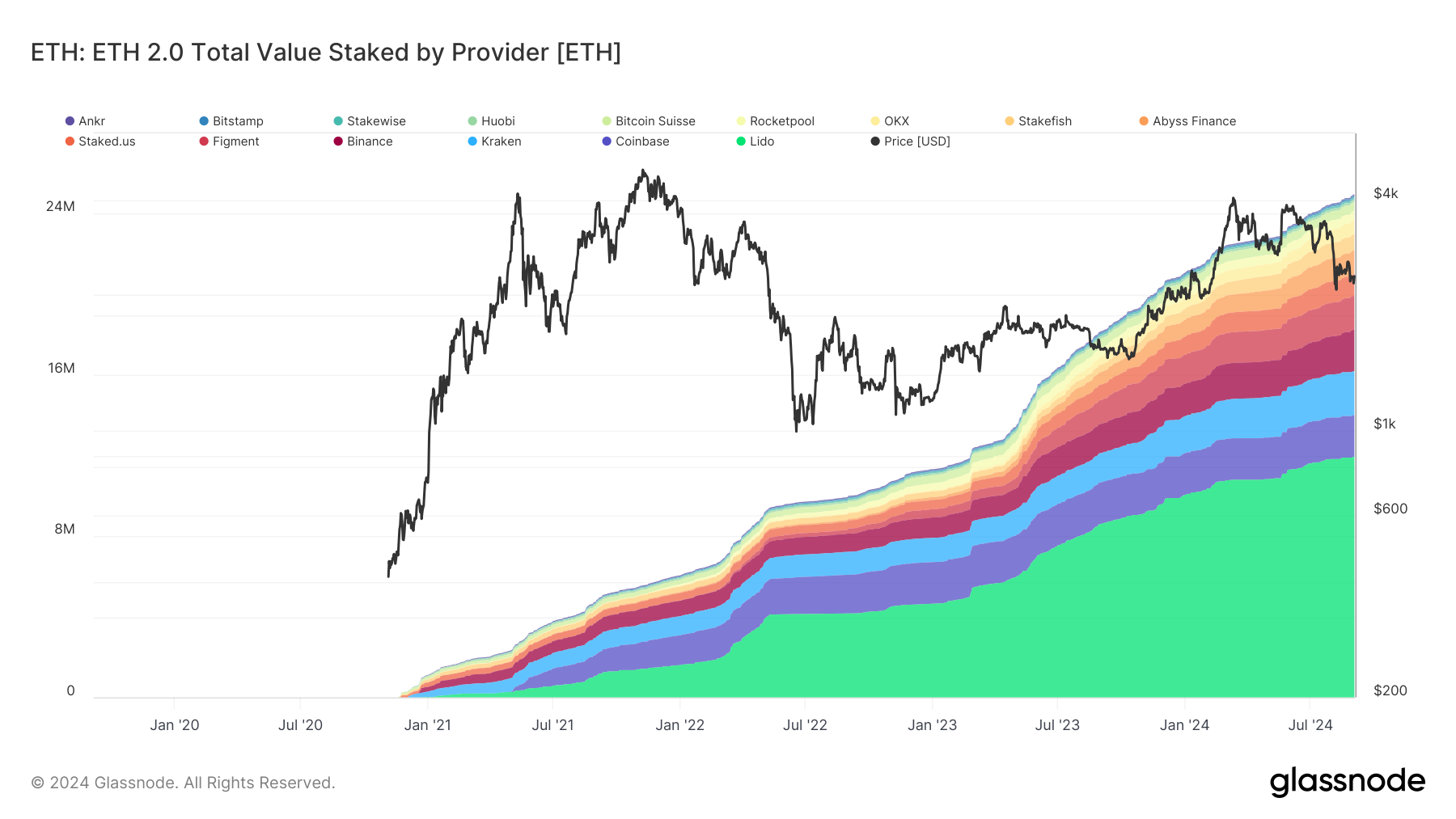

The Ethereum 2.0 deposit contract has reached a significant milestone, with its balance surpassing 50 million ETH in USD value, according to Glassnode. As Glassnode only tracks inflows, on-chain data suggests it is closer to 34 million ETH when unstaking is added to the formula.

Of this, almost 48%—is controlled by the top 11 staking providers. I believe this highlights a trend towards centralization. The top four providers—Binance, Kraken, Coinbase, and Lido—hold a combined 36% of the total staked. Notably, Lido alone manages a significant 24% share.

[Editor’s Note: By comparison, 97% of Bitcoin’s hash rate is managed by the top 11 mining pools. The top four pools manage 78% of the hash rate, also highlighting centralization concerns in Bitcoin’s proof-of-work network.]

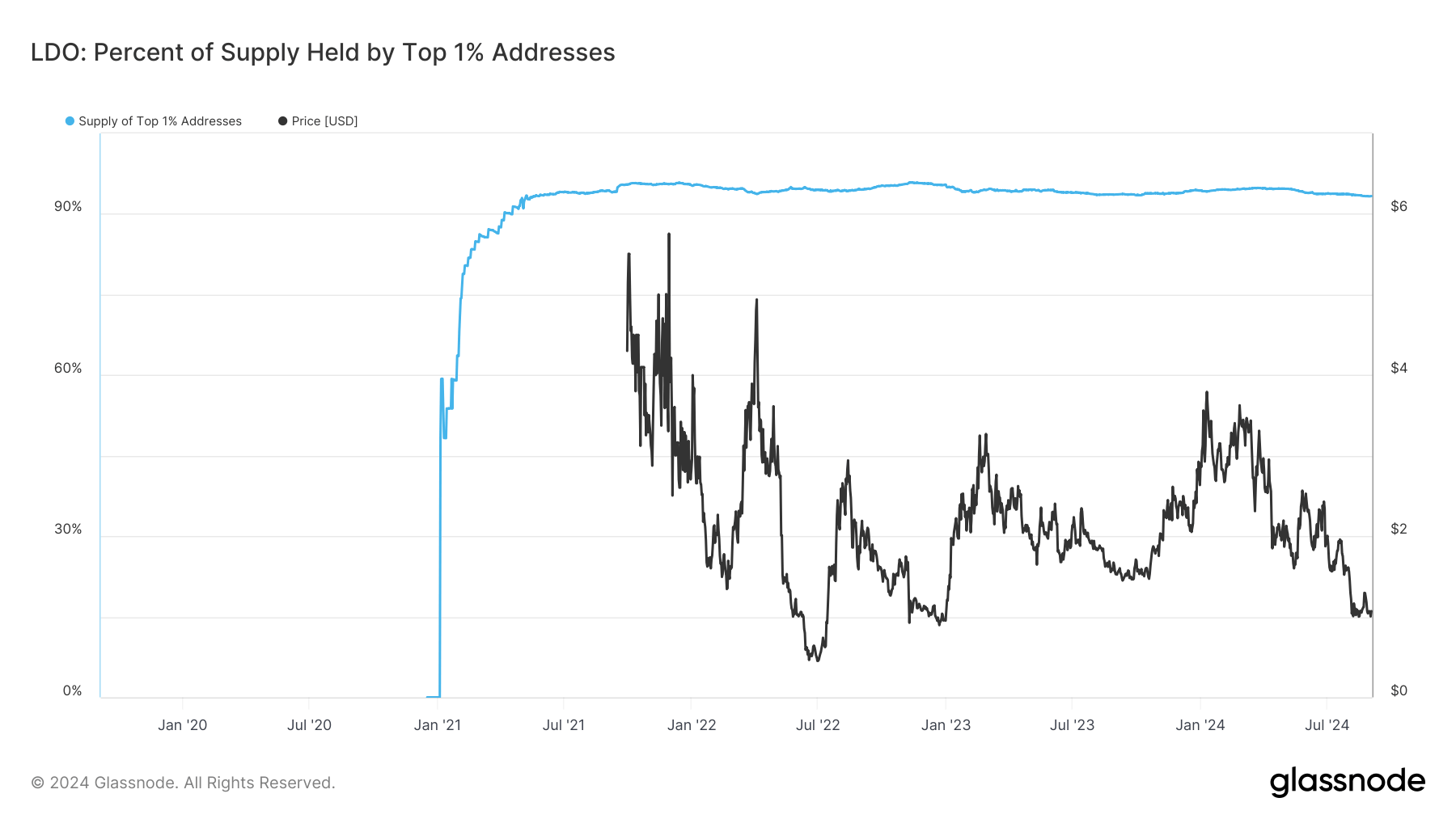

This concentration of staked ETH among 11 entities illustrates to me the challenges of staking, where technical expertise and the convenience of ETF products drive centralization. Moreover, within the Lido DAO, the top 1% of addresses control over 94% of the supply of LDO DAO tokens, giving a small group substantial influence over governance decisions.

I believe this centralization of power raises concerns about the potential for governance manipulation, which could lead to decisions that prioritize the interests of a few over the broader Ethereum community. This situation undermines the principles of decentralization and increases the risk of regulatory scrutiny, potentially impacting the Lido protocol and its users.

Additionally, CryptoSlate reported that there were no inflows or outflows for ETH ETFs on Friday, mainly because these products do not support staking as interest wanes.

Glassnode

Glassnode