Insights

Economic woes drive Bitcoin below $63,000

Quick Take

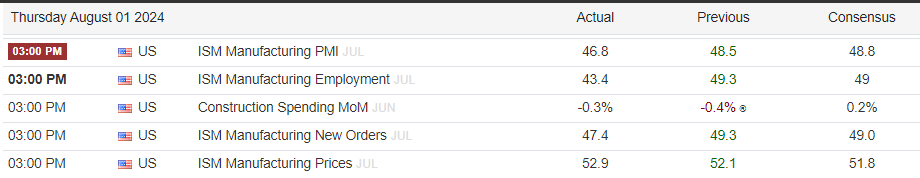

Bitcoin experienced a sharp decline to below $63,000 on Aug.1 following disappointing economic data, leading to significant liquidations in the market.

Over the past 24 hours, $300 million has been liquidated, with over $277 million of these being long positions. In just the past hour, $40 million has been liquidated, predominantly from long positions, according to Coinglass.

CoinGlass

CoinGlass