Drop in Bitcoin dormant supply may indicate looming rally

Quick Take

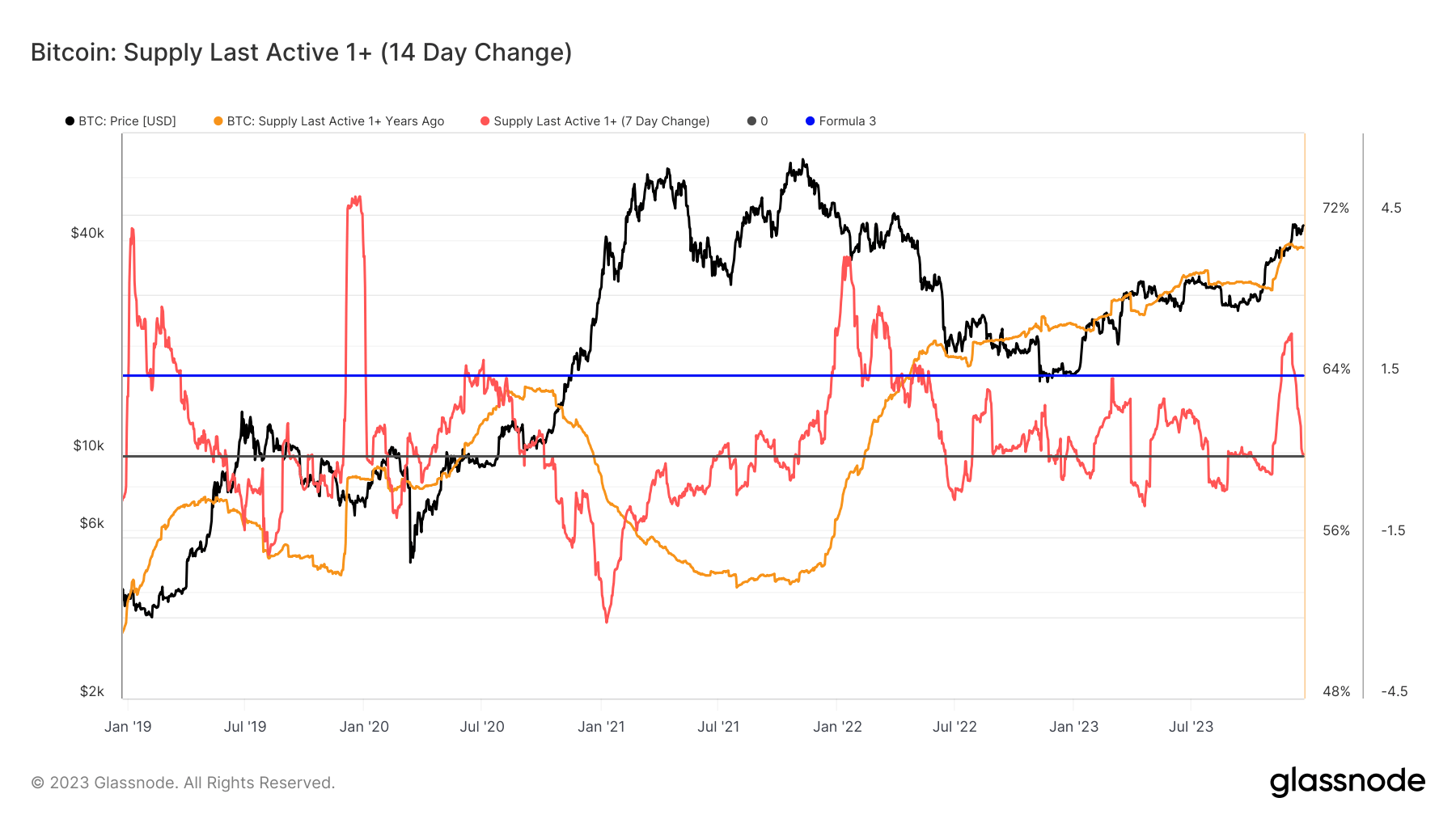

CryptoSlate’s analysis of the dormant Bitcoin supply revealed significant trends in the past few months. This supply, defined as the amount of circulating Bitcoin that has remained inactive for over a year, reached a historic 71% in November.

In its recent newsletter, Pantera Capital highlighted an interesting correlation: when this dormant supply decreases, Bitcoin often experiences major rallies.

This pattern emerges as long-term holders start to realize profits, reducing the inactive supply. This action, combined with short-term holders buying due to FOMO (Fear of Missing Out), contributes to a price surge, with ‘smart money’ capitalizing on the profits. Pantera Capital noted that these price increases invariably occur after the decline, not beforehand.

In November, a notable shift occurred in the ‘Supply Last Active 1+ Year Ago’ (SLA) metric. It spiked by over 2.0%, then dropped by a similar magnitude, marking a significant decline. This movement could indicate the beginning of a market rally, as suggested by Pantera’s findings.

Glassnode

Glassnode