Dramatic decrease in Bitcoin supply above $50,000

Quick Take

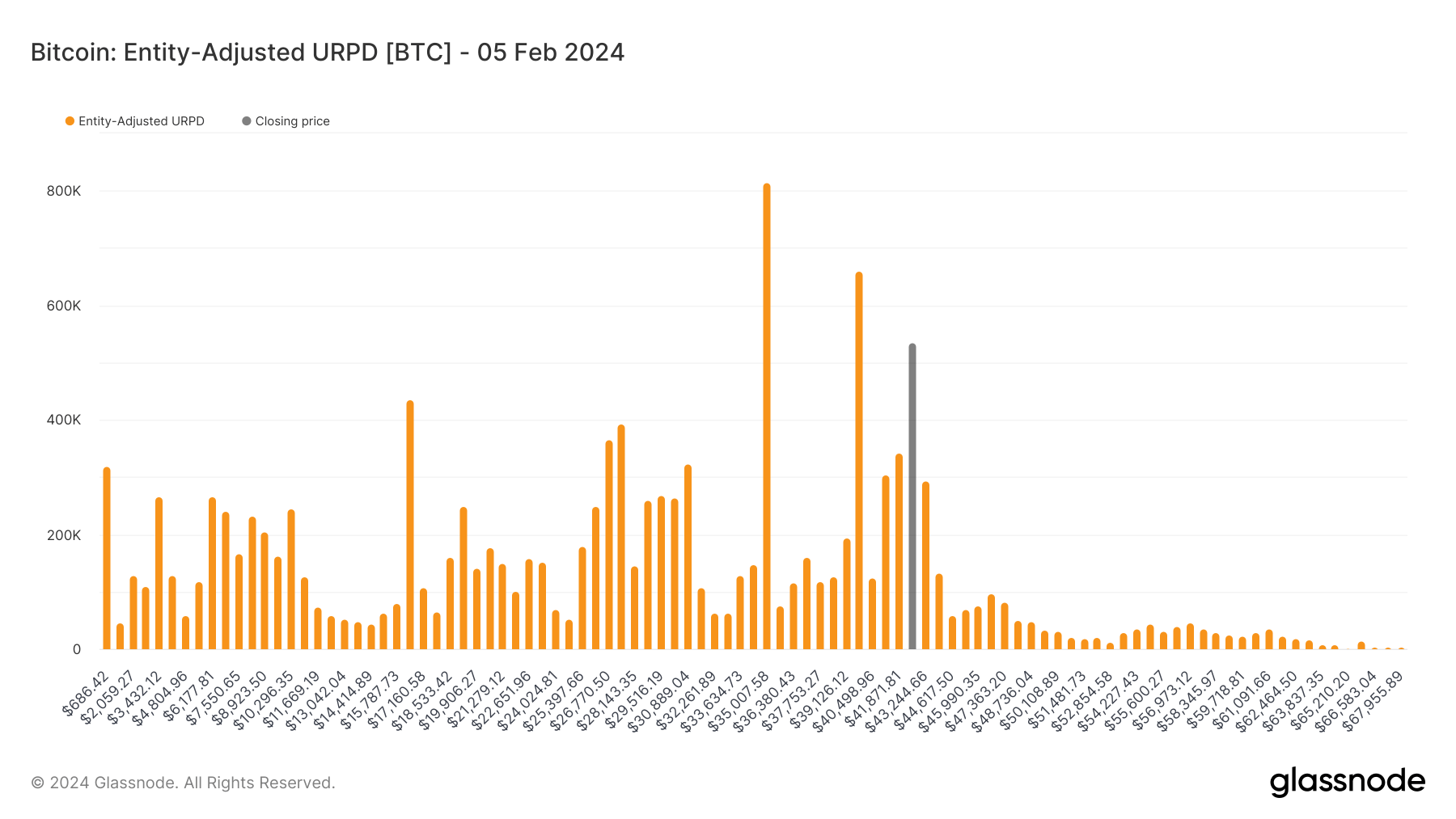

The UTXO Realized Price Distribution (URPD) metric by Glassnode offers a snapshot of the prices at which the existing Bitcoin UTXOs were established. Each bar on the graph represents the Bitcoin in circulation that was last transferred within a particular price range.

Since the bull run of 2021, when Bitcoin reached an all-time high of approximately $69,000, the percentage of total supply sitting above $50,000 has decreased dramatically. As of Feb. 5, 2024, only about 3.5% of Bitcoin’s supply sits in this price bracket, down from around 13% as of Dec. 31, 2021. This data suggests a significant sell-off over the past 24 months, as Bitcoin went as low as $15,500 during the FTX collapse.

Concurrently, a noticeable consolidation is observed around the $40,000-$44,000 price range, accounting for approximately 13% of the current total supply. This indicates an accumulation phase, where investors are holding onto Bitcoin in anticipation of a potential price surge due to the ETFs and an upcoming halving.

Glassnode

Glassnode