Data shows US government often sells at the local lows in the market

Quick Take

On Apr. 2, CryptoSlate reported that the US government sold 1,999 Bitcoin (BTC), valued at approximately $130 million, from a wallet associated with Silk Road to the digital assets exchange Coinbase. As per Arkham Intelligence firm, only 1,999.999 BTC were spent in the transaction, leaving the remaining 29,799.99012413 BTC unspent.

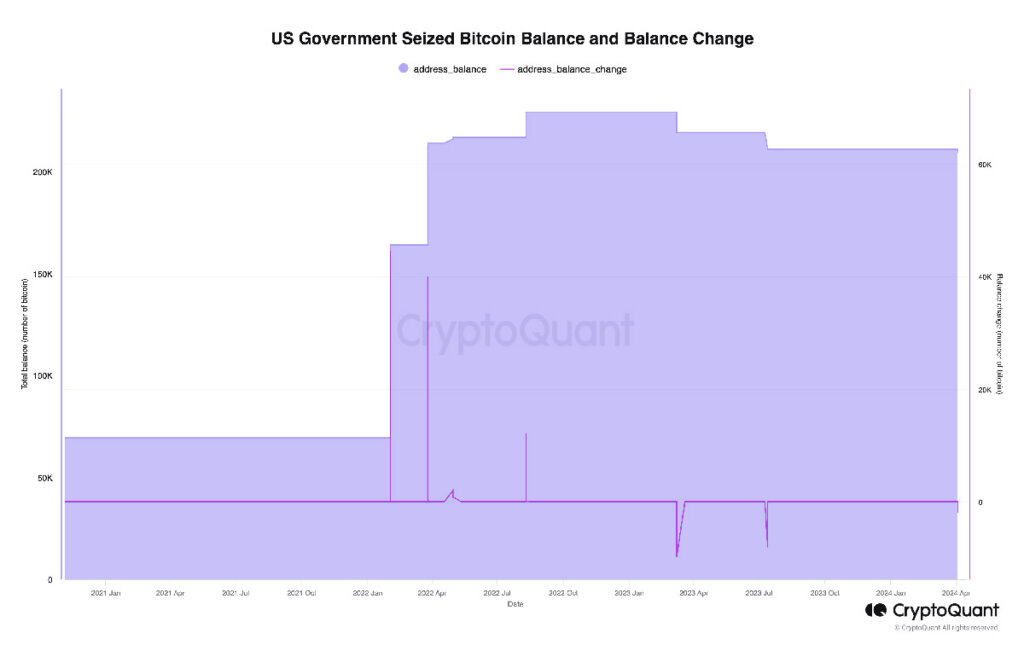

The recent transaction reduced the US government’s seized BTC balance from 210,800 BTC to 208,800 BTC, as per CryptoQuant data. Consequently, the government now holds less than 1% of the total BTC supply.

This sale aligns with the government’s ongoing strategy of gradually offloading seized BTC holdings, according to CryptoQuant data. Notably, in March 2023, approximately 10,000 BTC were sold at a time when BTC was trading at around $21,500. This sale nearly coincided with a local price bottom, which dipped to around $20,000 during the SVB collapse. Another significant sale of approximately 8,200 BTC occurred on July 12, 2023, with Bitcoin trading at around $30,000.

This development bears similarities to when the UK government sold over half of its gold reserves in 1999 at approximately $270 per ounce. This move coincided with a cyclical bottom before gold embarked on a multi-year bull run.

CryptoQuant

CryptoQuant