Correlation observed between PBoC liquidity injections and price of Bitcoin

Quick Take

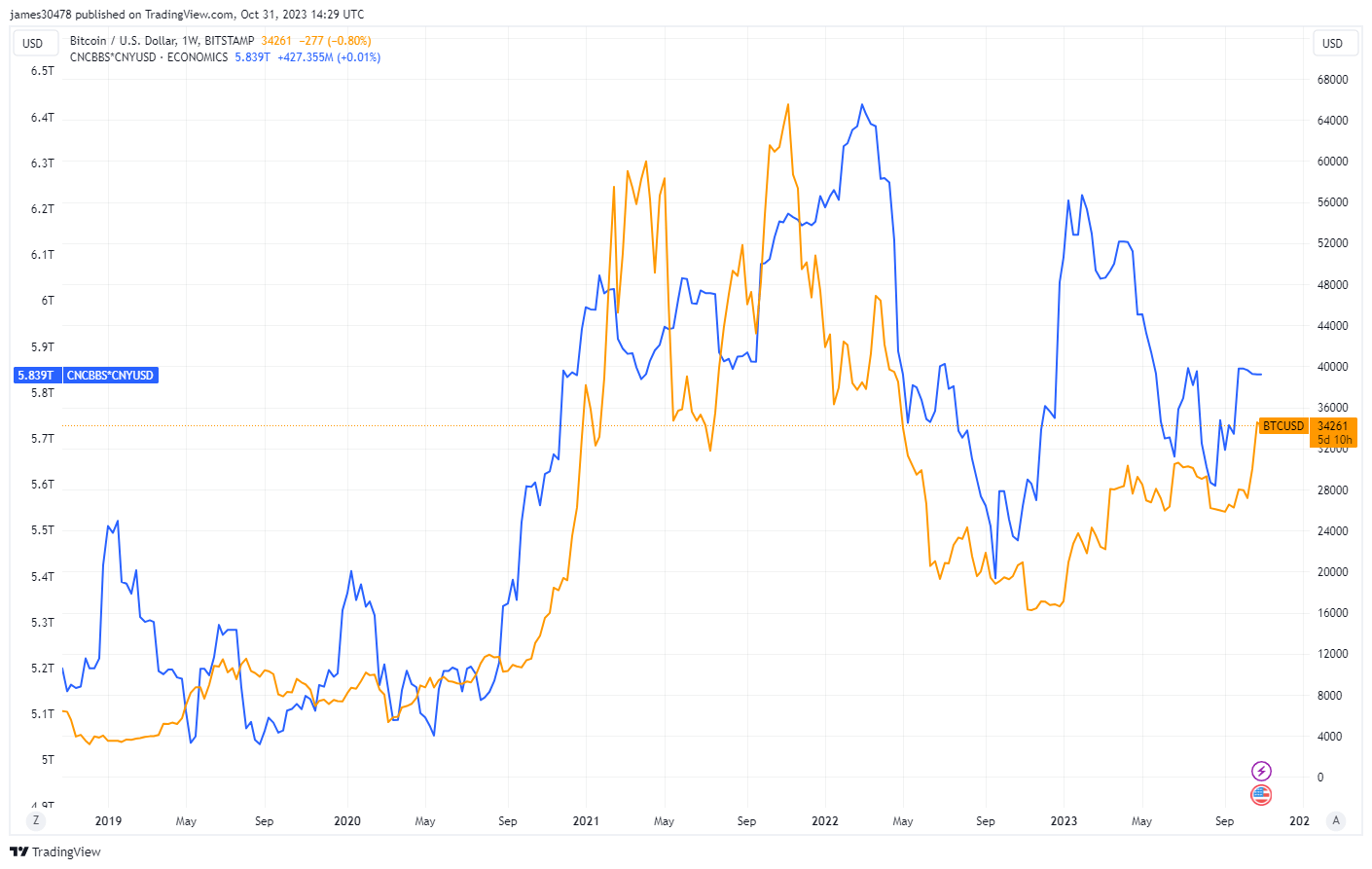

The People’s Bank of China’s (PBoC) continued liquidity injections into the market have been observed to coincide with significant movements in Bitcoin’s price.

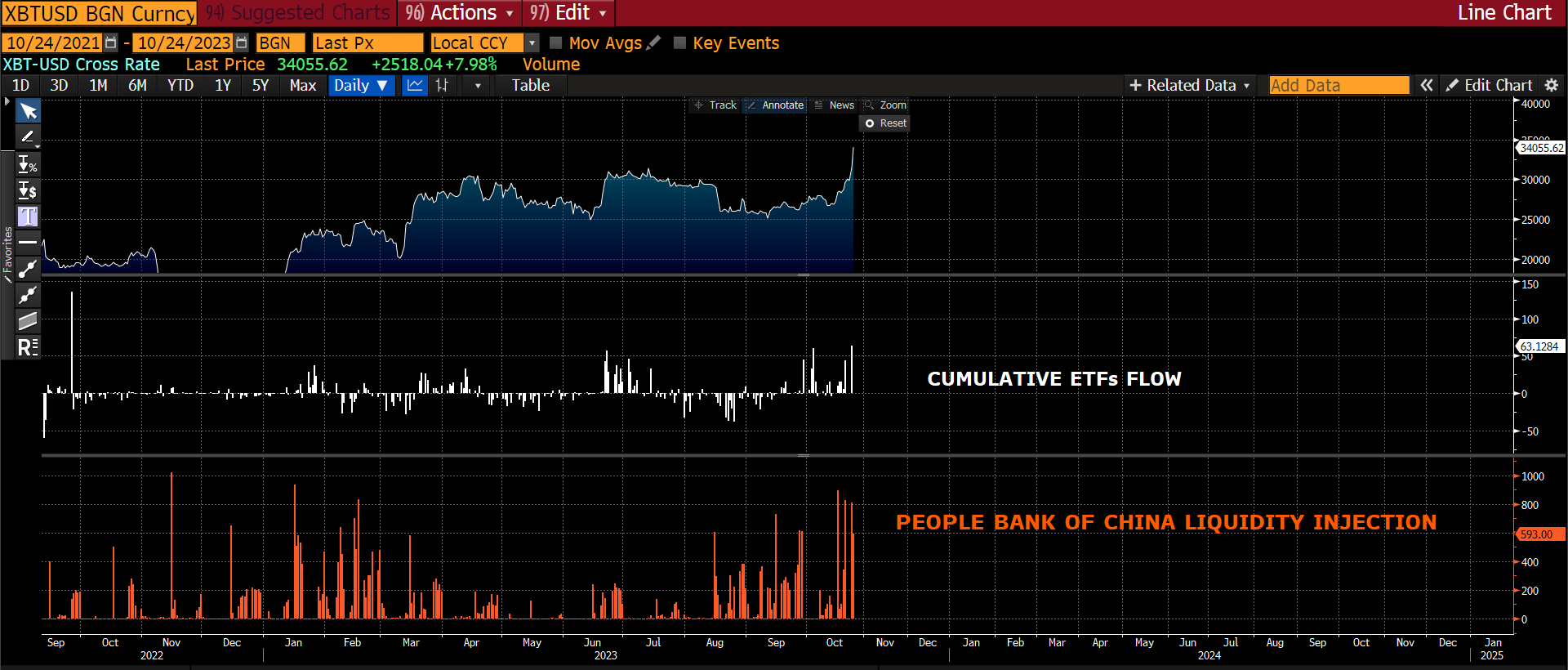

For instance, analyst Alessio Urban noted on Oct. 24 that as the PBoC’s liquidity injections surged, Bitcoin simultaneously broke above the $30,000 mark. A similar pattern was noted earlier this year, with a significant increase in PBoC’s liquidity that was followed by a rise in Bitcoin’s value. This expansion coincides with Bitcoin’s recent success, which isn’t solely attributed to liquidity injections but also to ETF inflows, as noted by Urban.

However, it’s crucial to understand that this isn’t a direct correlation but rather one of the many factors contributing to Bitcoin’s price movement, as Bitcoin is a global liquidity indicator.

In a year, the PBoC has expanded its balance sheet by over 7%; the balance sheet equates to approximately 5.84 trillion in Chinese Yuan. This multifaceted dynamic illustrates the intricate relationship between traditional financial systems and the evolving digital currency environment.