Convergence in drawdowns of Bitcoin and U.S. long bonds, as TLT plunges

Quick Take

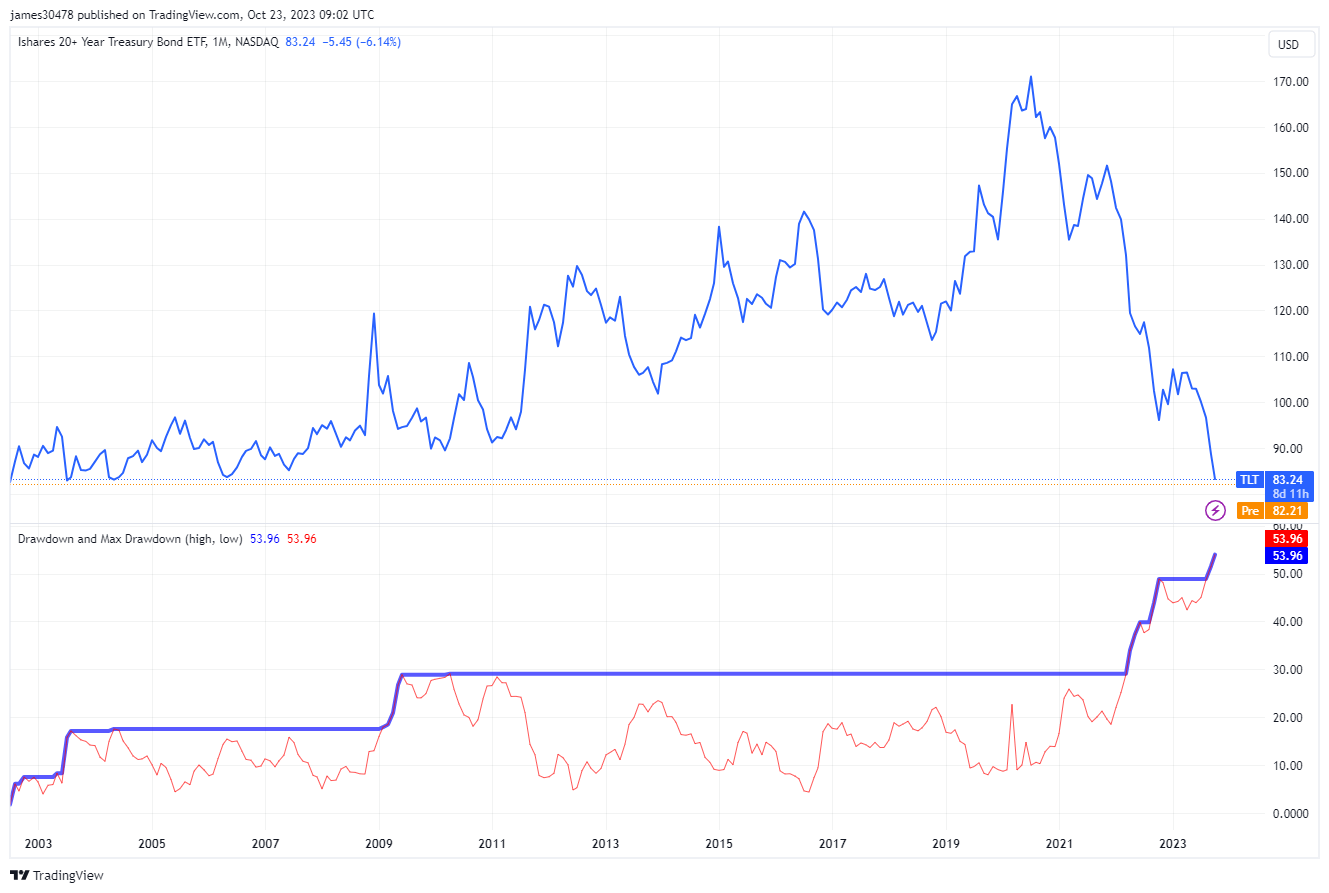

Last week, Oct. 18, analyst Dylan Leclair observed a similarity in the drawdowns of Bitcoin and TLT.

A comparison of the drawdowns of Bitcoin and TLT, the U.S. long bond, an ETF with a total asset holding of $95 billion, according to VettaFi, reveals a fascinating trend. Bitcoin, often under the scanner for its volatility, demonstrates resilience in its recovery trajectory. Following a plunge to $15,500 during the FTX collapse in Nov. 2022, Bitcoin has made a significant rebound, trading at roughly $30,000. This performance represents a drawdown of 56% from its all-time high, aligning with previous bear market behavior.

Interestingly, each successive cycle records a less severe drawdown. The maximum drawdown of this cycle for Bitcoin to date stands at 77%.

In contrast, TLT is currently witnessing its most severe drawdown ever, at 54%. This juxtaposition underscores the harsh impact felt in the bond market while simultaneously highlighting Bitcoin’s recovery. A mere few percentage points now separate the two drawdowns, adding a new dimension to the discussion on financial asset stability.

Glassnode

Glassnode