Contrasting currents in crypto market as Bitcoin futures plunge, crypto-margin soars

Quick Take

The recent data analysis indicates a critical shift in Bitcoin futures contracts, particularly in the wake of the Grayscale lawsuit. Bitcoin open interest, the total number of outstanding futures contracts, has suffered a significant reduction, with a rough estimate of 400,000 Bitcoin in futures contracts representing one of the lowest readings year-to-date.

The diminishing liquidity signals a potential change in investor sentiment or strategic investment decisions.

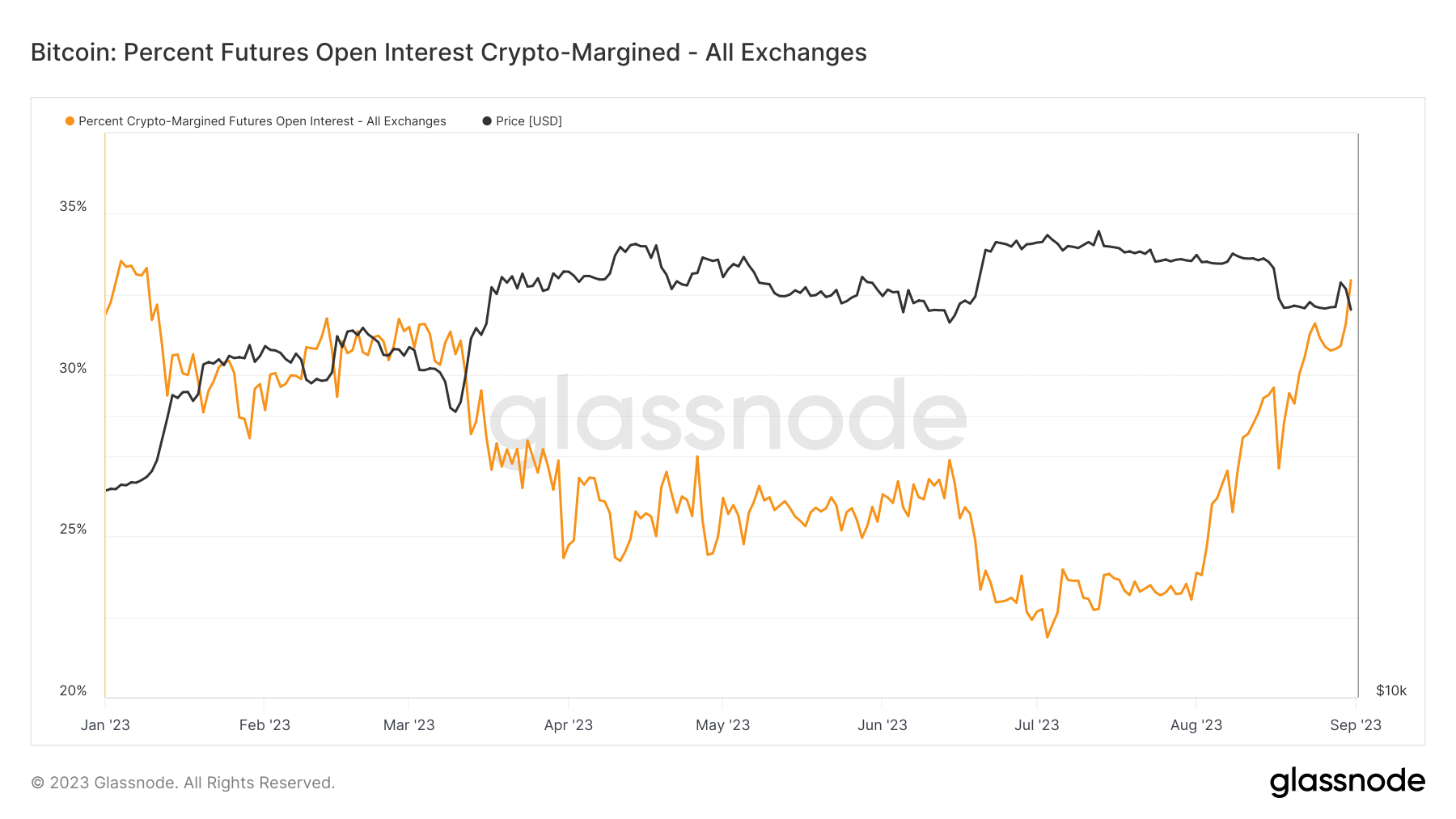

Interestingly, while overall Bitcoin futures contracts have declined, crypto-margin futures contracts assert a contrary trend. Crypto-margin refers to futures contracts with open interest margined in the native cryptocurrency (Bitcoin, in this case) rather than a traditional currency like USD or a stablecoin.

The crypto-margin is set to reach new year-to-date highs, with approximately 135,000 Bitcoin, or around 33% of all open interest contracts, being placed in the crypto margin.

Glassnode

Glassnode