Coinbase’s BTC trading premium hints at US market bullishness

Quick Take

Current data shows a marked price premium between Coinbase’s BTCUSD and Binance’s BTCUSDT. This Coinbase premium, observed by analyst Dylan LeClair, is the largest seen since the USDC depeg in March 2023, indicating a significant shift in trading patterns.

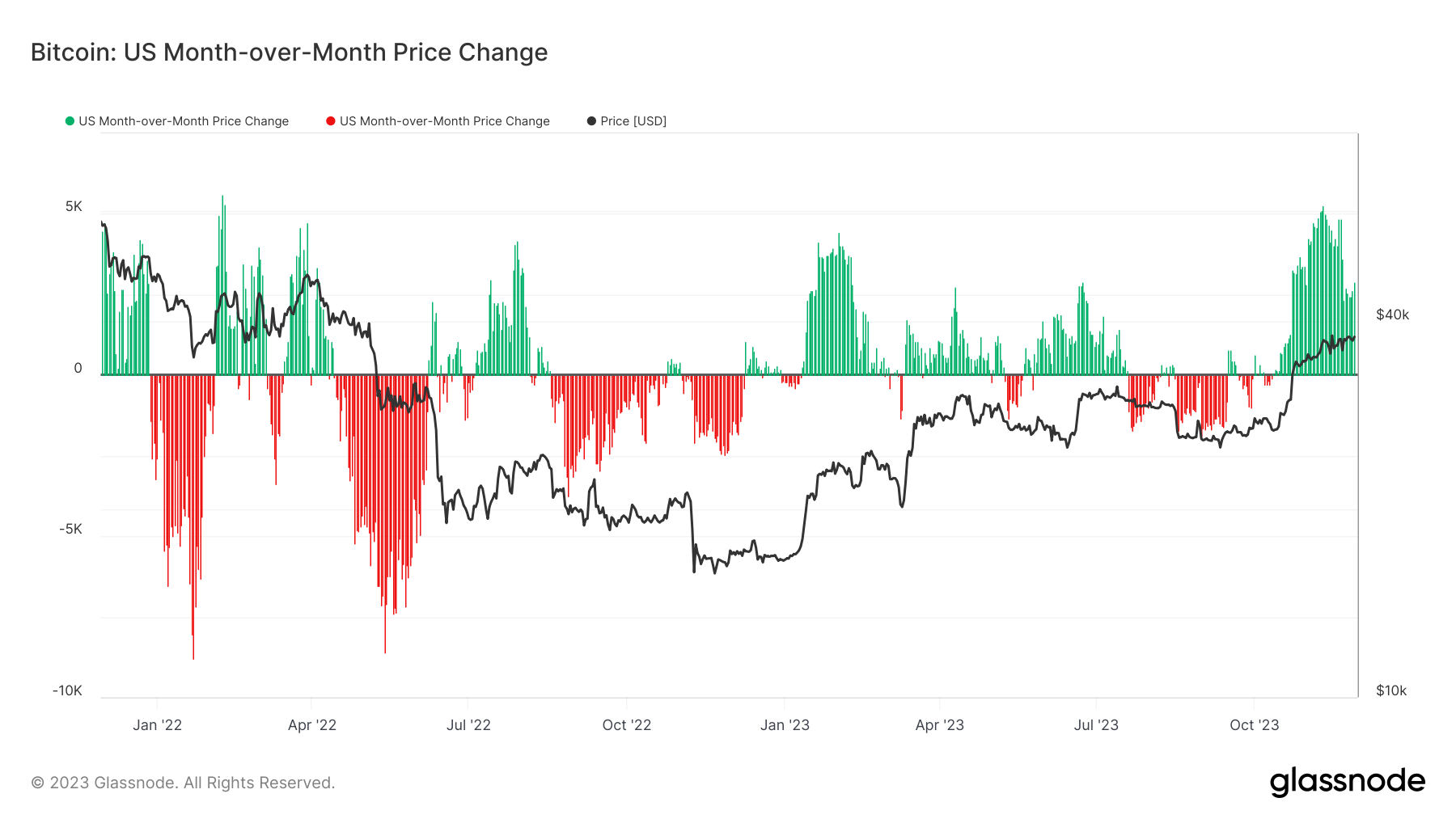

On a regional scale, recent trends show the US market leaning strongly bullish, with price changes exceeding $3,000 month over month, which tend to trade the BTCUSD pair on Coinbase.

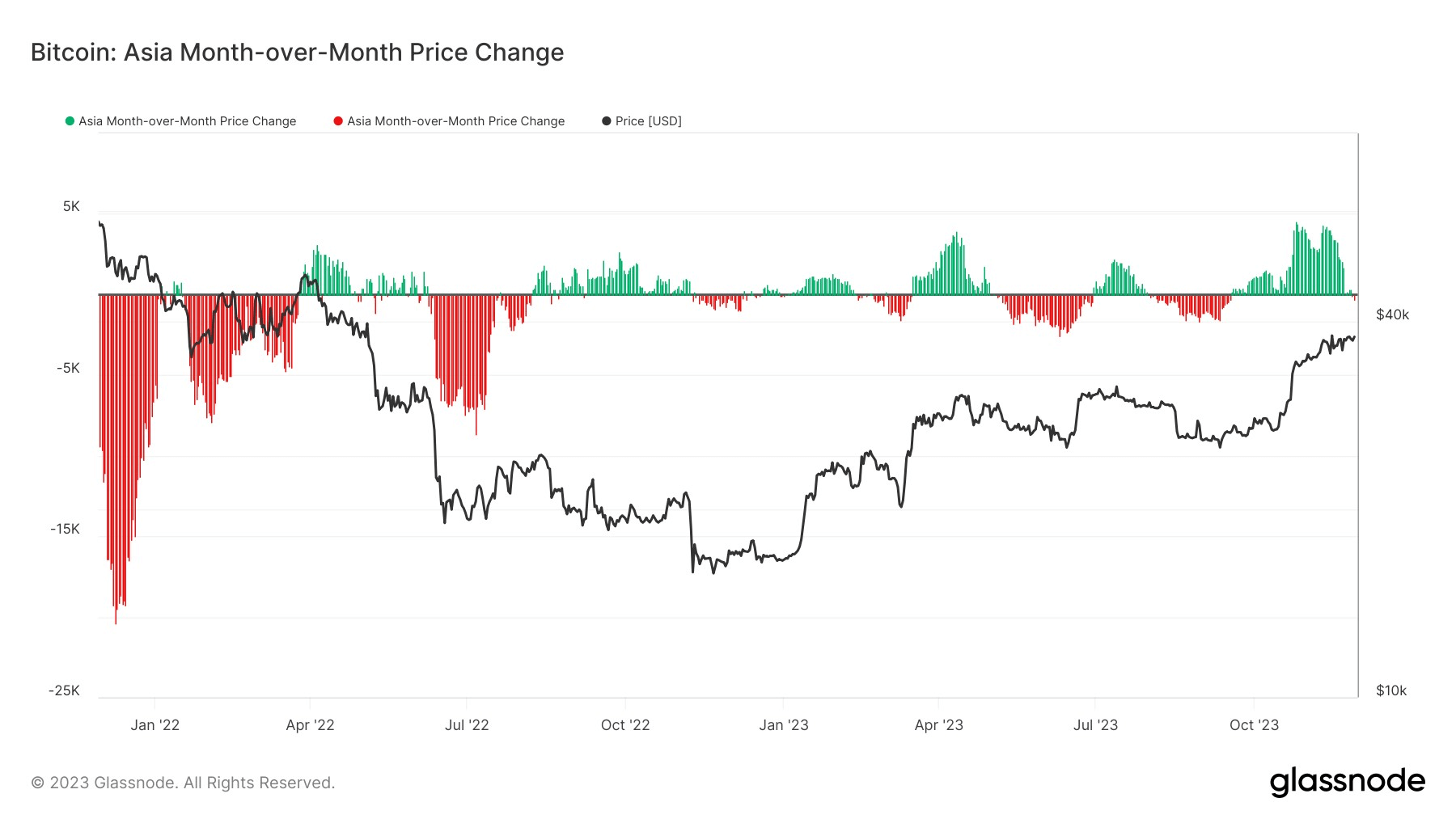

Contrarily, a significant shift occurred in Asia as the region flipped negative during its trading session – a first since September, which would tend to trade the BTCUSDT pair on Binance.

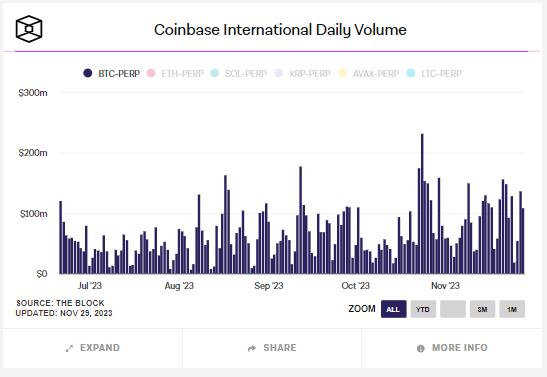

In November, there was a notable increase in the daily trading volume on Coinbase International, Coinbase’s derivatives exchange licensed in Bermuda, consistently exceeding $100 million; this could add to the premium we are seeing in the BTCUSD pair on Coinbase.

Glassnode

Glassnode