BlackRock’s IBIT overtakes Grayscale’s GBTC Bitcoin holdings amid inflow surge

Quick Take

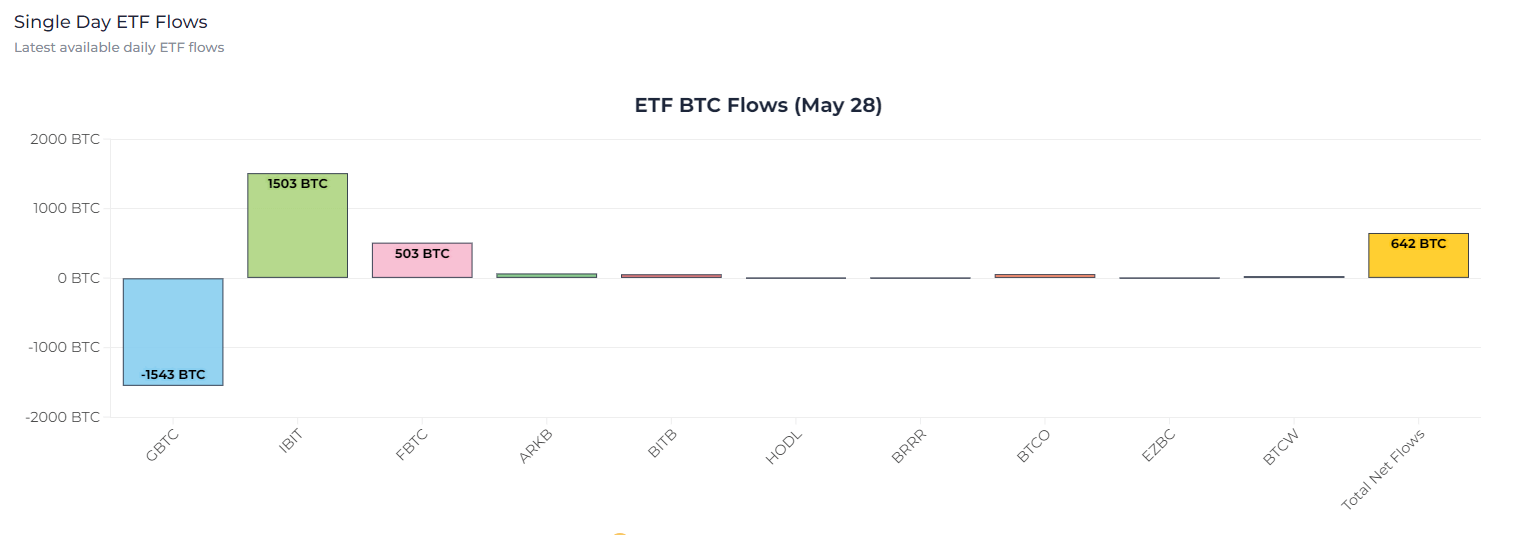

Farside data shows that Bitcoin (BTC) Exchange-traded funds (ETFs) experienced $45 million in inflows on May 28. Seven of eleven ETFs recorded positive inflows, reflecting broad interest among issuers. BlackRock’s IBIT ETF led the inflows with $102.5 million, raising its total net inflow to $16.5 billion. Fidelity’s FBTC ETF saw $34.3 million in inflows, bringing its total to $8.7 billion. Conversely, Grayscale’s GBTC ETF experienced a $105.2 million outflow, increasing its net outflows to $17.7 billion. The cumulative net inflows across all ETFs have now reached $13.7 billion.

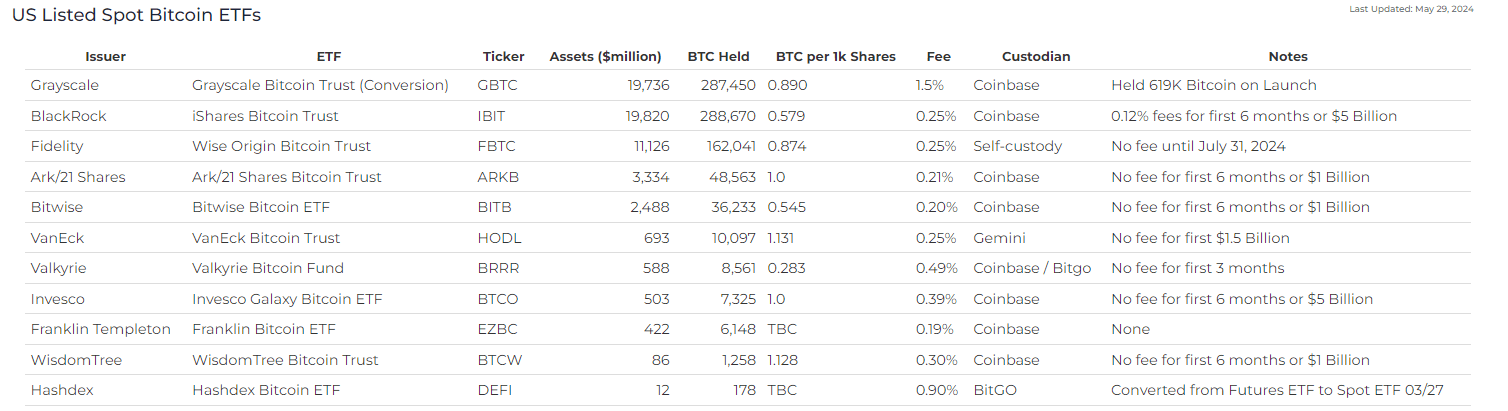

In terms of Bitcoin holdings, BlackRock’s IBIT has overtaken Grayscale’s GBTC, becoming the largest US Bitcoin ETF. HeyApollo data shows IBIT now holds 288,670 BTC, compared to GBTC’s 287,450 BTC.

The net accumulation of Bitcoin by ETFs on May 28 amounted to 642 BTC, according to heyapollo.

Farside Investors

Farside Investors