BlackRock’s Bitcoin ETF sees massive inflow while Grayscale faces second largest outflow

Quick Take

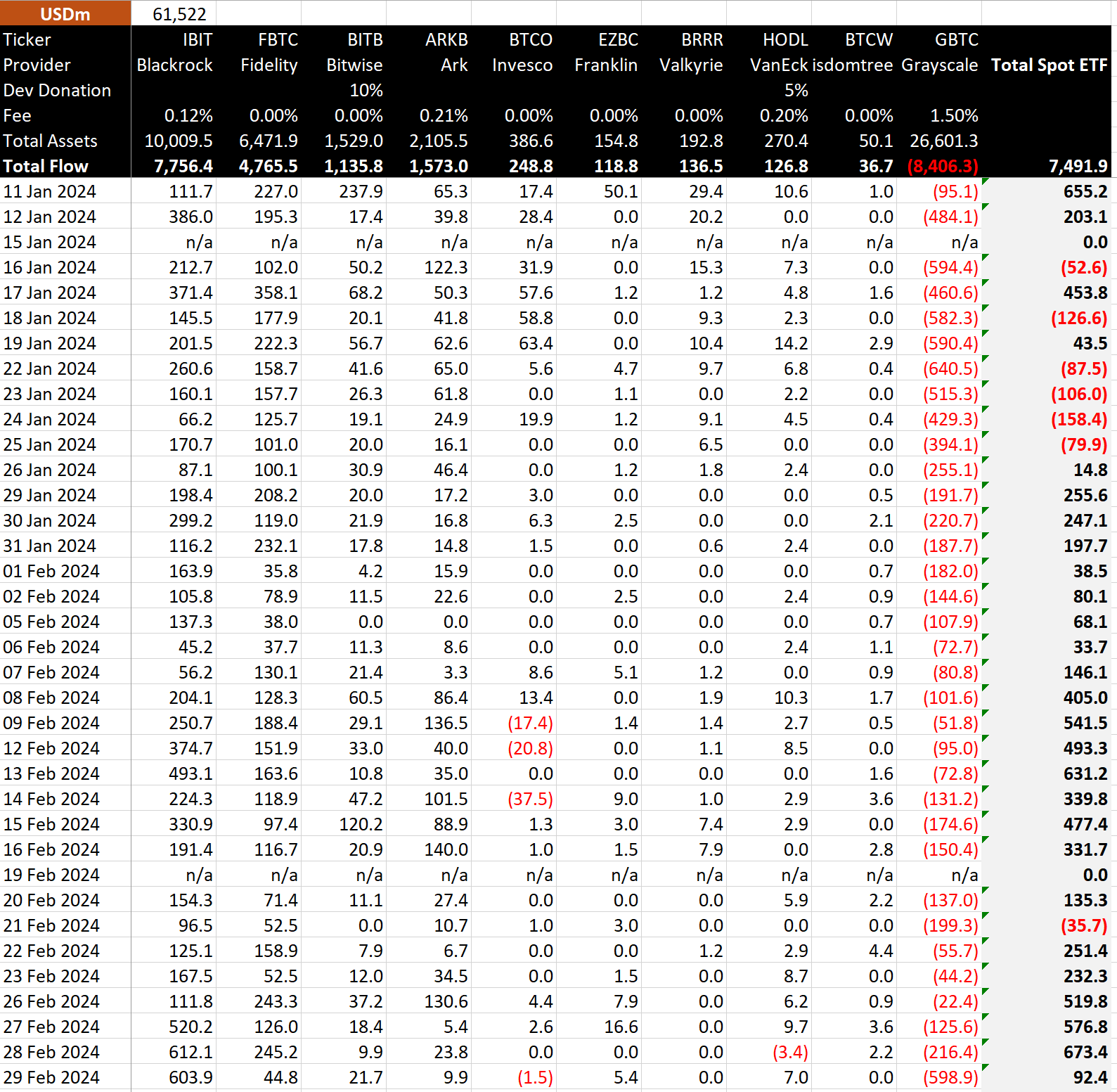

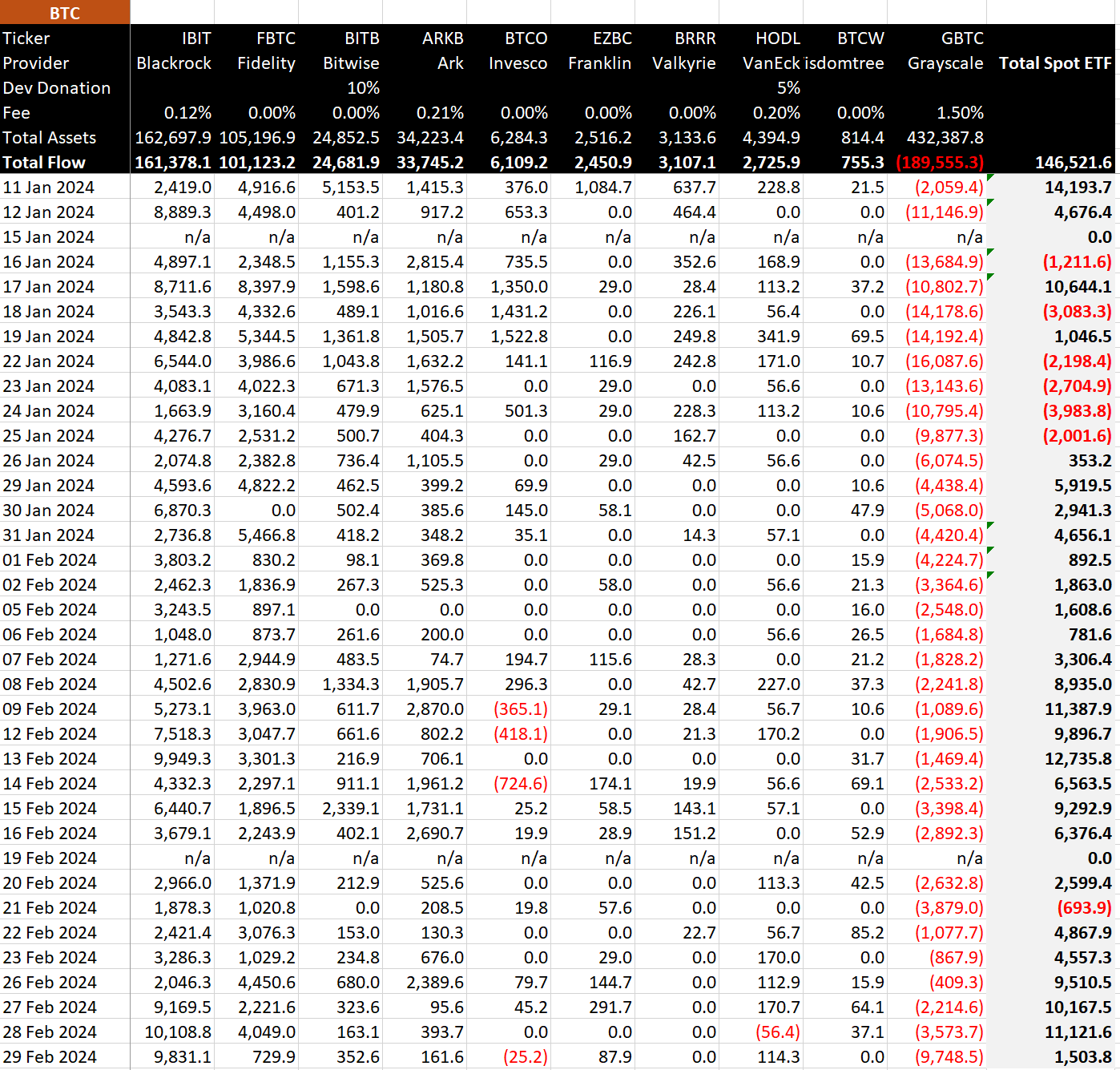

Data from BitMEX suggests that BlackRock’s IBIT had another remarkable day for the Bitcoin ETFs. It witnessed the second-largest inflow since trading started, with $604 million coming under management, equivalent to roughly 10,000 BTC. This dramatic influx escalated the cumulative total of inflows for IBIT to an impressive $7.8 billion. As a result, BlackRock’s total Bitcoin holdings have surged to 161,378 BTC.

Data from BitMEX also showed a massive outflow from the Grayscale Bitcoin Trust (GBTC), which experienced its second-largest outflow since inception, with a staggering $599 million exiting its ETF. This outflow has pushed GBTC’s total outflows to a worrying $8.4 billion.

Consequently, the total inflows on the day amounted to a mere $92 million, equivalent to roughly 1,500 BTC.

Furthermore, the total net flows for all spot Bitcoin ETFs have reached a significant benchmark of $7.5 billion, equating to roughly 146,522 BTC.

BitMEX

BitMEX