BlackRock’s Bitcoin ETF crosses $2 billion in inflows, with Fidelity close behind

Quick Take

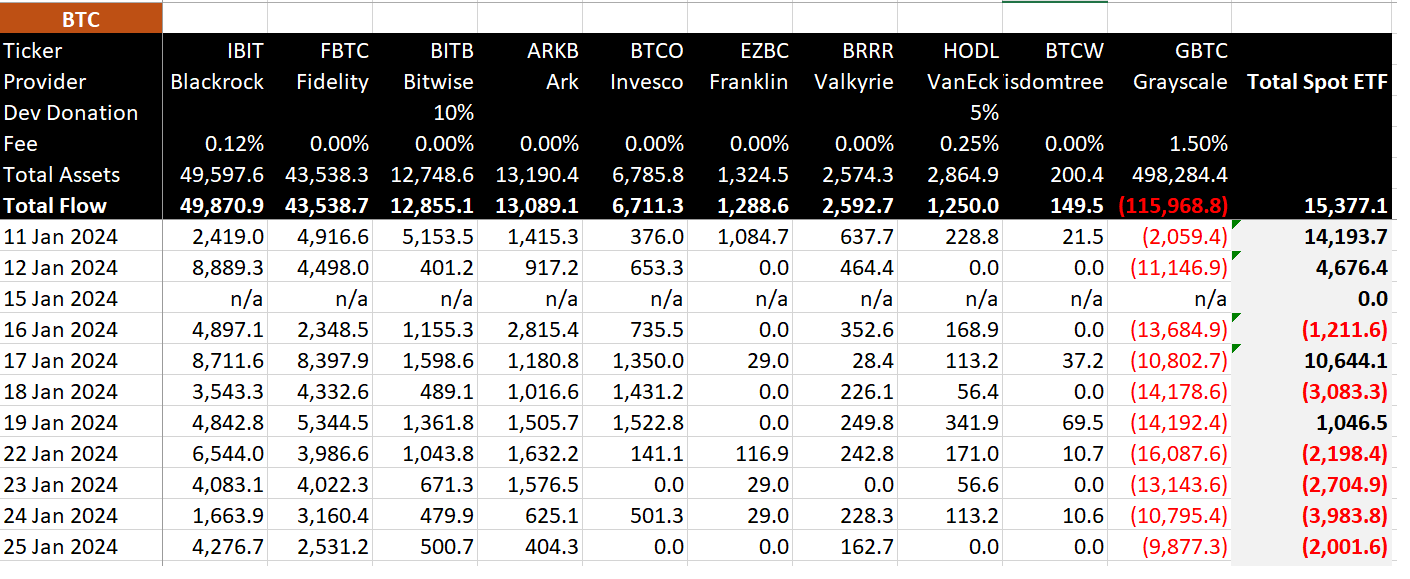

As the dust settles on the tenth trading day in the Bitcoin Spot Exchange-Traded Fund (ETF) sector, a fund flow trend has begun to emerge.

Day 10 witnessed an $80 million net outflow, according to BitMEX research, significantly impacting the overall landscape.

Grayscale GBTC, despite experiencing the lowest outflow since Day 1 at $394 million, continues to exhibit a consistent outflow trend, according to BitMEX research.

This trend is in sharp contrast to BlackRock’s IBIT Bitcoin ETF, which saw inflows jump to $170 million, a marked increase from the Jan. 24 inflow of $66 million. This surge solidifies BlackRock’s position, pushing their total inflow over the $2 billion threshold, a first among ETF providers, according to BitMEX research.

Meanwhile, Fidelity’s FBTC enjoyed another strong day, pulling in just over $100 million, thereby raising their total inflow to $1.83 billion. The combined ten-day trading inflows amounted to $744.6 million, predominantly driven by BlackRock and Fidelity’s strong performance, according to BitMEX research.

Conversely, Grayscale GBTC saw cumulative outflows reach $4.78 billion. In terms of Bitcoin accumulation, BlackRock and Fidelity lead with approximately 50,000 BTC and 43,538 BTC, respectively, while Grayscale experienced outflows of 116,000 BTC, according to BitMEX research.

The total Bitcoin held by the nine new ETFs now stands at approximately 131,340.